Nebraska Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Contract With Independent Contractor - Contractor Has Employees?

Have you ever found yourself in a situation where you require documents for business or personal purposes almost all the time.

There is a plethora of legal document templates accessible online, yet finding reliable ones is not easy.

US Legal Forms provides thousands of template forms, including the Nebraska Contract with Independent Contractor - Contractor has Employees, which can be tailored to meet state and federal requirements.

Once you identify the appropriate form, click on Get now.

Select the payment plan you desire, fill in the necessary information to create your account, and make the payment using PayPal or a credit/debit card. Choose a suitable file format and download your copy. Access all the document templates you've purchased in the My documents section. You can download another copy of the Nebraska Contract with Independent Contractor - Contractor has Employees at any time, if required. Just select the desired form to download or print the document template. Leverage US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service offers well-crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After logging in, you can download the Nebraska Contract with Independent Contractor - Contractor has Employees template.

- If you lack an account and wish to get started with US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

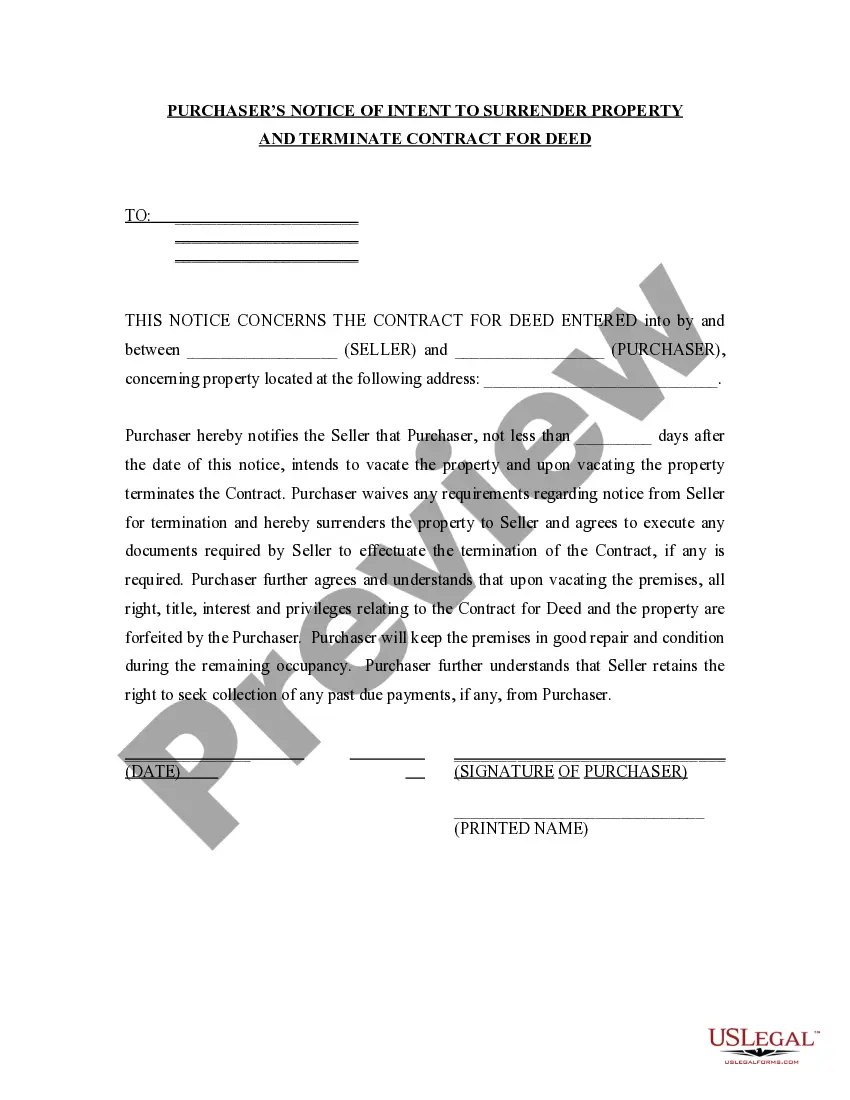

- Use the Preview button to review the form.

- Read the description to confirm that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field to locate a form that matches your requirements.

Form popularity

FAQ

A contractor is the primary party that agrees to complete a project or service, often managing their operations independently. In contrast, a subcontractor works under the contractor, handling specific tasks or portions of the overall project. Understanding the distinction is crucial, especially when drafting a Nebraska Contract with Independent Contractor - Contractor has Employees, as it sets the foundation for roles and responsibilities.

One of the main differences between a full-time employee and an independent contractor is how they file taxes with the IRS. A full-time employee uses a W-2 form, and a contractor uses a 1099.

Wage & Hour LawIndependent contractors are not considered employees under the Fair Labor Standards Act and therefore are not covered by its wage and hour provisions. Generally, an independent contractor's wages are set pursuant to his or her contract with the employer.

It is also important to note that a self-employed worker can be both employed and self-employed at the same time. For example, a worker can be an employee at a company during the day and run a business by night. Employment status may also change from contract to contract.

According to IRS guidelines, it is possible to have a W-2 employee who also performs work as a 1099 independent contractor so long as the individual is performing completely different duties that would qualify them as an independent contractor.

Yes, an employee can receive a W2 and a 1099, but it should be avoided whenever possible. That's because this type of situation is a red flag and frequently results in a response from the IRS seeking further information. It also takes unusual circumstances for this type of dual filing to be legitimate.

Independent contractors are not employees, nor are they eligible for employee benefits. They do not have taxes withheld from their paychecks but instead must pay estimated income taxes in advance through quarterly payments.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Independent contractors usually offer their services to the general public, not just to one person or company. Government auditors will be impressed if you market your services to the public. Here are some ways to do this: Obtain a business card and letterhead.

A: Typically a worker cannot be both an employee and an independent contractor for the same company. An employer can certainly have some employees and some independent contractors for different roles, and an employee for one company can perform contract work for another company.