Nebraska Agreement for the Use of Property of a Named Church

Description

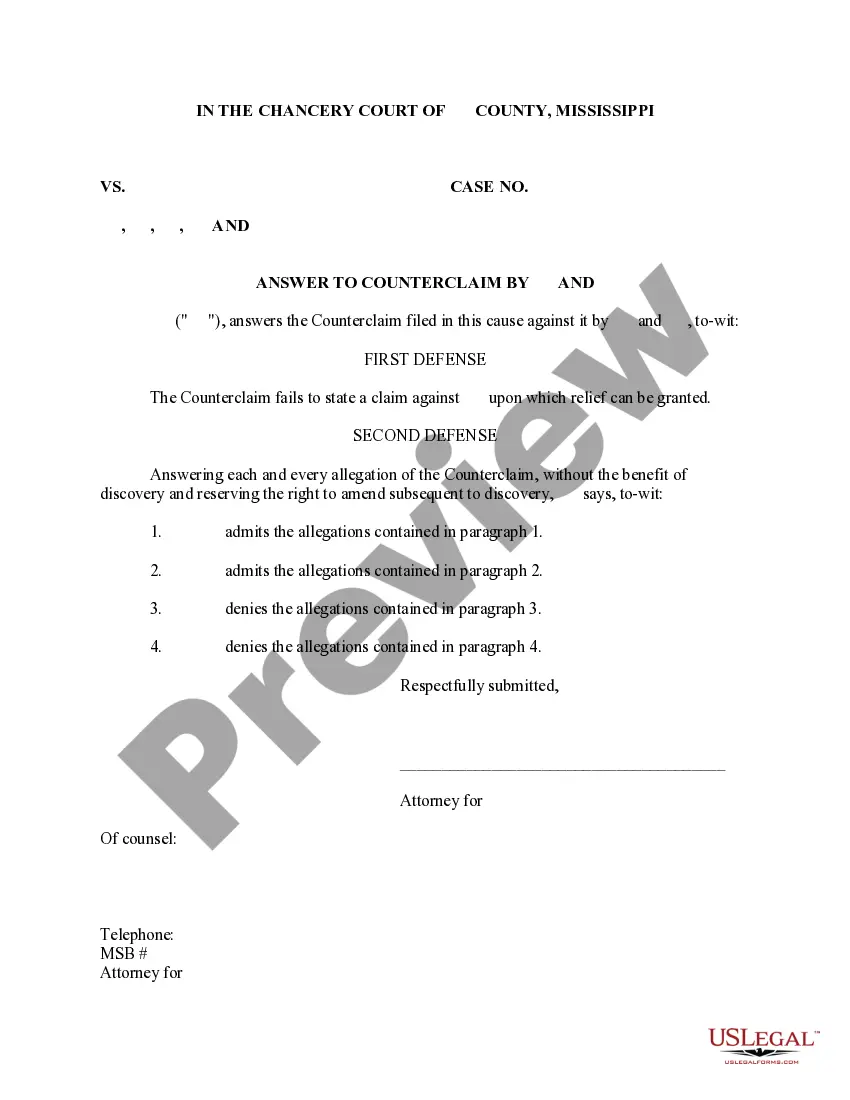

How to fill out Agreement For The Use Of Property Of A Named Church?

Locating the appropriate legitimate document format may be a challenge.

Clearly, there are numerous web templates accessible online, but how can you secure the genuine form you require.

Utilize the US Legal Forms platform. The service offers a vast selection of templates, such as the Nebraska Agreement for the Use of Property of a Named Church, that are available for business and personal purposes.

If you are a first-time user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your locality. You can preview the form using the Preview button and read the form description to verify it is the right one for you.

- All of the forms are reviewed by professionals and comply with state and federal standards.

- If you are already registered, Log In to your account and click the Obtain button to retrieve the Nebraska Agreement for the Use of Property of a Named Church.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents tab of your account to get another copy of the document you need.

Form popularity

FAQ

Yes, churches in Nebraska generally qualify for tax-exempt status under state law. This exemption is significant, as it allows churches to avoid property taxes, thus allocating more resources to their community programs. Under the Nebraska Agreement for the Use of Property of a Named Church, congregations can formalize agreements that support their tax-exempt status. If you need assistance navigating these regulations, consider using the uslegalforms platform to find tailored legal forms to ensure compliance with local laws.

A church can allow a business to use their property, but it's essential to formalize this arrangement through a clear agreement. The Nebraska Agreement for the Use of Property of a Named Church can help specify the conditions and terms of use. Such documentation protects both parties and ensures compliance with all regulations. For assistance in drafting these agreements, check out uslegalforms for reliable resources.

Yes, many churches own rental properties as a source of income to support their operations. However, managing rental properties requires adherence to local laws and financial guidelines. Utilizing the Nebraska Agreement for the Use of Property of a Named Church is effective in outlining responsibilities and expectations. If you're considering this option, uslegalforms can provide invaluable guidance.

Running a business through a church is possible, but it usually requires strict adherence to regulations and guidelines. The Nebraska Agreement for the Use of Property of a Named Church can help define how the church property is used for this purpose, ensuring compliance with tax laws and nonprofit status. To navigate this process smoothly, consider using resources like uslegalforms for practical advice.

The ownership of church property typically rests with the church organization itself. This can be a group of trustees, a diocese, or another governing body depending on the church's structure. The Nebraska Agreement for the Use of Property of a Named Church can help clarify ownership rights and responsibilities. If you have questions about ownership, look into uslegalforms for more detailed information.

Yes, a church can rent space to a for-profit business, but this often depends on the church's policies and local laws. It is essential to have a well-structured agreement, such as the Nebraska Agreement for the Use of Property of a Named Church, to outline the terms of the arrangement. Such agreements help ensure compliance with zoning laws and protect the church's interests. For specific guidance, uslegalforms can assist you.

Yes, church property is generally considered private property. This means the church organization has the right to determine how the property is used. The Nebraska Agreement for the Use of Property of a Named Church can provide clarity on these usage rights. If you need more information, consider exploring resources on this topic through uslegalforms.

Yes, you can turn your house into a place of worship, following applicable laws and regulations. It is advisable to establish a Nebraska Agreement for the Use of Property of a Named Church to clarify your church's intentions. Make sure to comply with local zoning regulations and consider any necessary permits. This thorough approach can help you create a space that serves your community effectively.

Form 13 in Nebraska is used to apply for a tax exemption for religious, charitable, or educational purposes. By completing this form, you provide necessary information to demonstrate your organization's eligibility. If you are establishing your house as a church, submitting a Form 13 in conjunction with the Nebraska Agreement for the Use of Property of a Named Church can be beneficial. This combination ensures you meet all legal requirements.

Reg 1 007 in Nebraska pertains to the tax-exempt status for certain religious organizations. It outlines the specific criteria that a church must meet to qualify for tax exemptions. Understanding this regulation is crucial if you're planning to establish your residence as a church. With the Nebraska Agreement for the Use of Property of a Named Church, you can secure your tax-exempt status while complying with local laws.