Nebraska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

If you need to finalize, obtain, or print official document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Take advantage of the site’s user-friendly and straightforward search to get the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the payment.

Step 6. Select the format of the legal document and download it to your device.

- Use US Legal Forms to obtain the Nebraska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain option to find the Nebraska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/region.

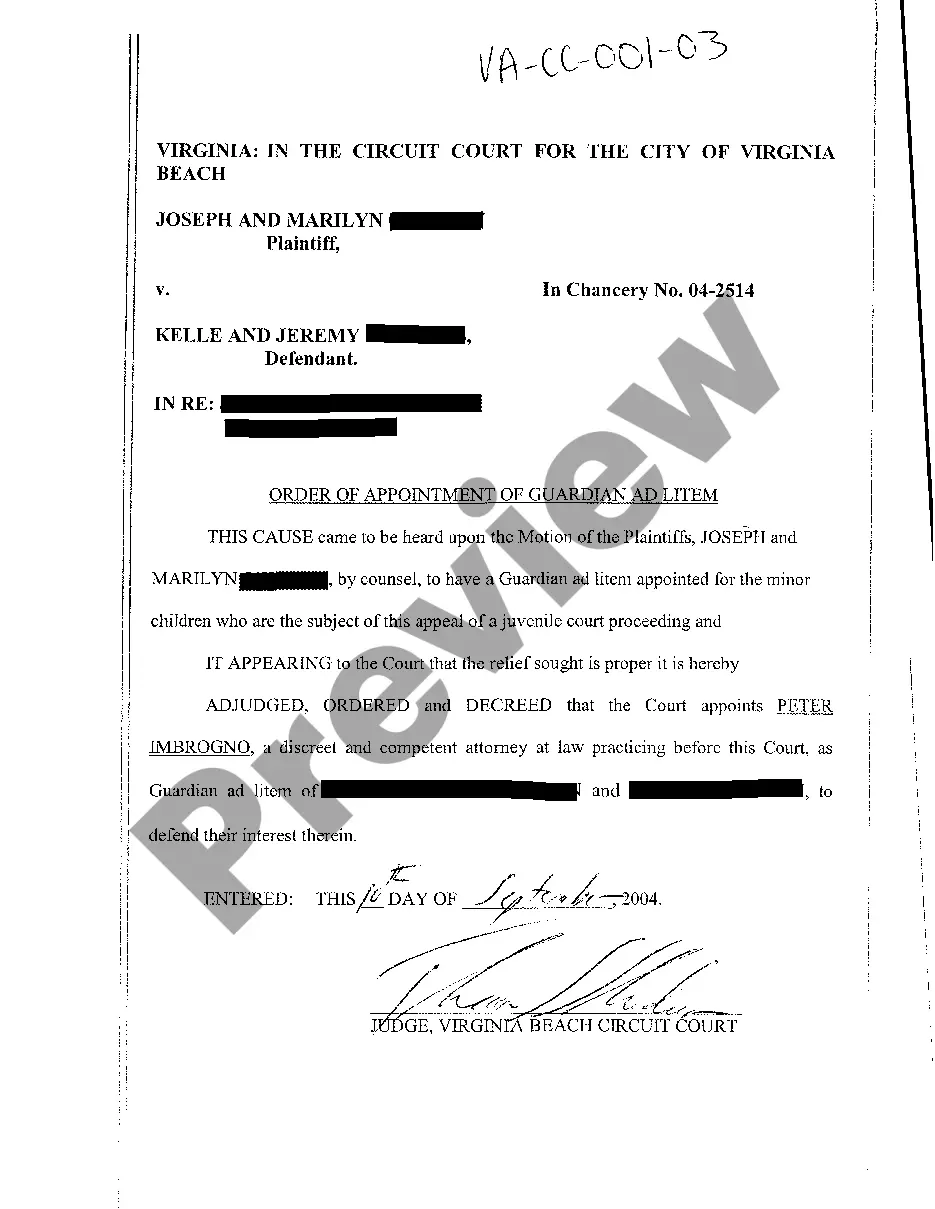

- Step 2. Use the Preview option to view the form’s content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click the Buy now option. Choose the pricing plan you prefer and enter your credentials to register for the account.

Form popularity

FAQ

To secure your homestead exemption, you typically need to present proof of identity, your residential information, and any pertinent documents related to your income and property. Gathering these items in advance will streamline the application process. By utilizing resources on platforms like USLegalForms, you can ensure you have everything necessary to successfully claim your Nebraska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

6. Form. Amended Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales.

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

What Is a Certificate of Tax Exemption? Certificate of Tax Exemption or CTE is issued to individuals or organizations who are exempt from tax. Exemption from taxation, as the name suggests, is when certain individuals, organizations, or institutions are free from taxes due to privileges granted by legislative grace.

If you already have a Nebraska Identification Number, you can find it on previous correspondence from the Nebraska Department of Revenue, by contacting the agency at 800-742-7474, or by visiting their Contact Us page for email.

Traditional Goods or Services Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.

If audited, the Nebraska Department of Revenue requires the seller to have a correctly filled out Form 13 Resale Certificate. Without it correctly filled out, the seller could end up owing sales taxes that should have been collected from the buyer in addition to penalties and interest.

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the