Nebraska Letter of Intent to Form a Limited Partnership

Description

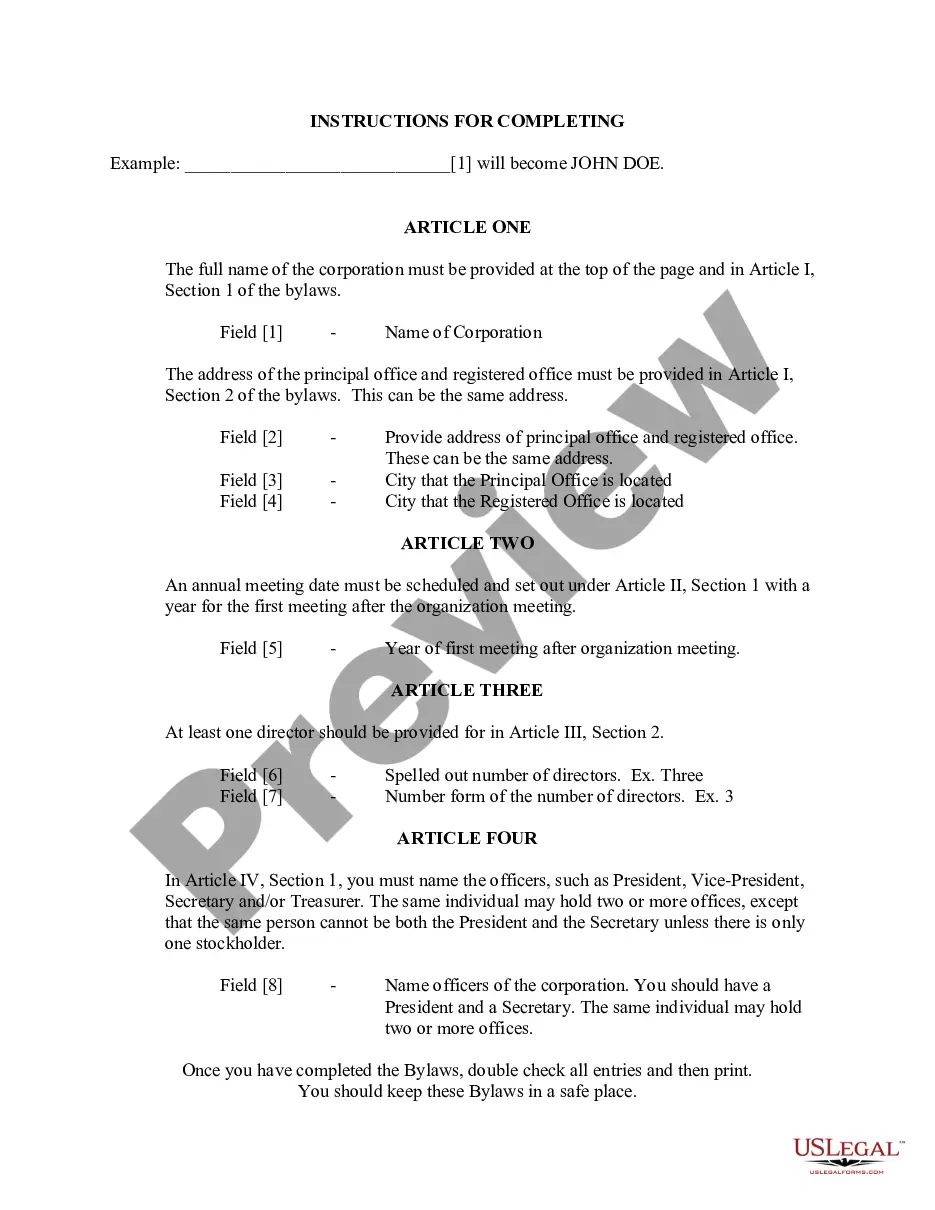

How to fill out Letter Of Intent To Form A Limited Partnership?

You can devote hours online searching for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers a multitude of legal documents that have been vetted by experts.

It is easy to download or print the Nebraska Letter of Intent to Establish a Limited Partnership from my service.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Acquire button.

- Afterwards, you can complete, modify, print, or sign the Nebraska Letter of Intent to Establish a Limited Partnership.

- Every legal document template you purchase is yours forever.

- To obtain another copy of the purchased document, navigate to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the county/city that you select.

- Review the form description to verify you have chosen the right template.

Form popularity

FAQ

Business Partnership agreement This is a vital document for a partnership. A business partnership agreement sets out what is expected from each of the partners, how key decisions are made, and how profits (and liabilities) are divided.

Starting an LLC in Nebraska is EasySTEP 1: Name your Nebraska LLC.STEP 2: Choose a Nebraska Registered Agent.STEP 3: File the Nebraska LLC Certificate of Organization.STEP 4: Complete Nebraska LLC Publication Requirements.STEP 5: Create a Nebraska LLC Operating Agreement.STEP 6: Get an EIN.

A legal name is the official name of the entity that owns a business. A sole proprietorship's legal name is the owner's full name. If a general partnership has given a name to itself in a written partnership agreement, then that name is the general partnership's legal name.

The State of Nebraska does not provide an official Certificate of Organization. Instead, they want you to make your own (meeting the statutory requirements of Nebraska Revised Statute 21-117), or hire a lawyer and have them create one for you.

In the words of the Uniform Partnership Act, a partnership is "an association of two or more persons to carry on as Co-owners of a business for profit." The essential characteristics of this business form, then, are the collaboration of two or more owners, the conduct of business for profit (a nonprofit cannot be

Within the narrow sense of a for-profit venture undertaken by two or more individuals, there are three main categories of partnership: general partnership, limited partnership, and limited liability partnership. In a general partnership, all parties share legal and financial liability equally.

Partnerships are relatively easy to establish. With more than one owner, the ability to raise funds may be increased, both because two or more partners may be able to contribute more funds and because their borrowing capacity may be greater.

If you decide to create a partnership in Nebraska, there are a few steps to go through in order to properly establish the business.Step 1: Select a name for your partnership.Step 2: Register business name.Step 3: File organizational documents with the Secretary of State.More items...?

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

Based on ContractsCounsel's marketplace data, the average cost of a project involving a partnership agreement is $603.89 . Partnership agreement cost depends on many variables, which includes the service requested, number of partners, and the number of custom terms needed to be included in the document.