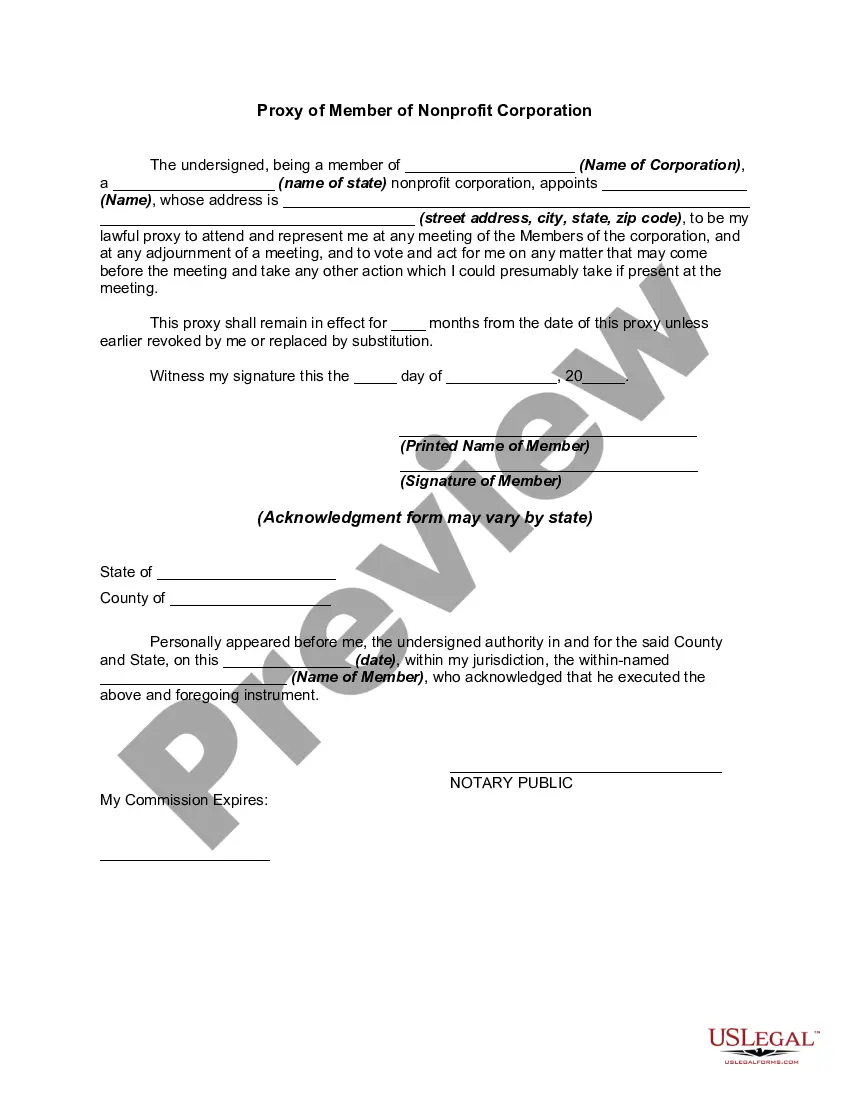

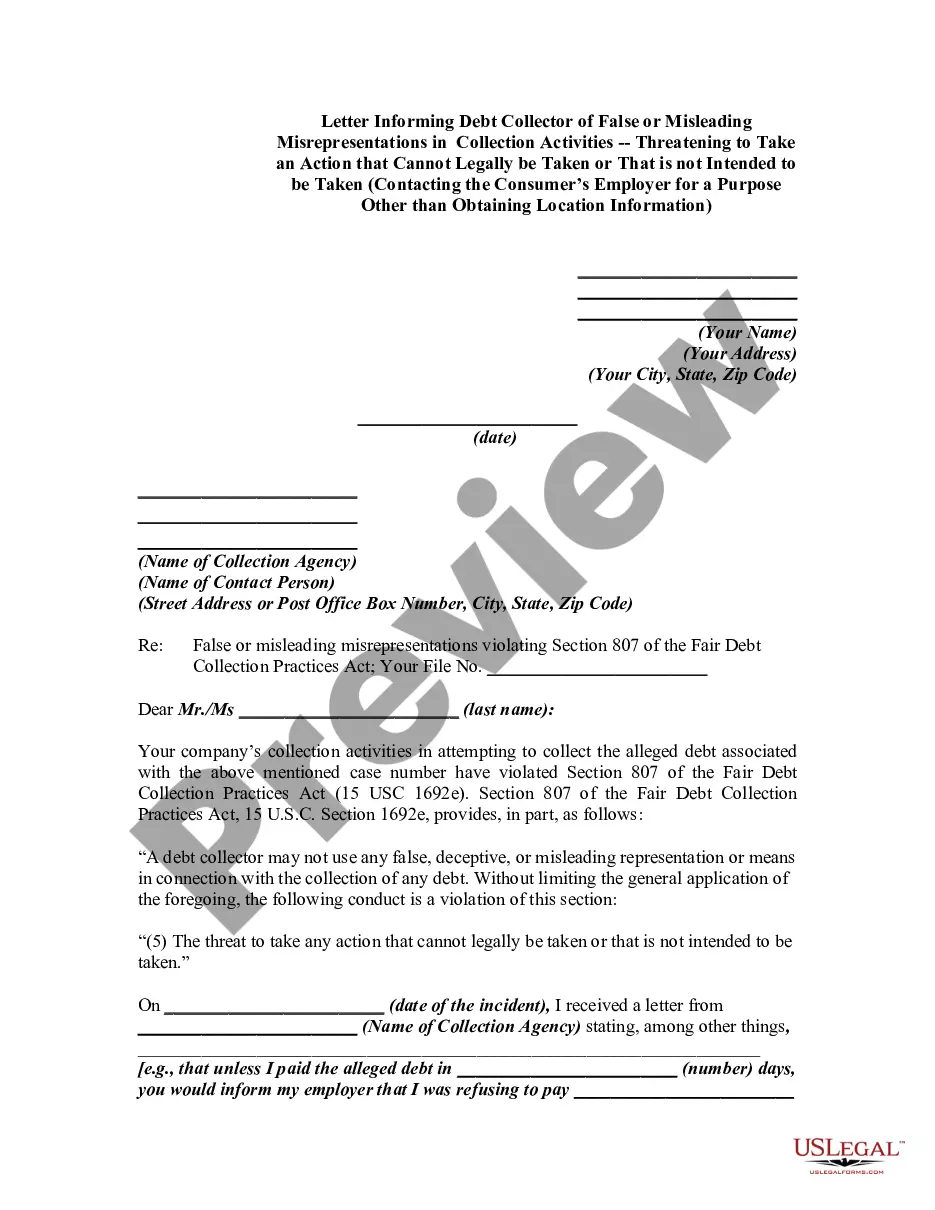

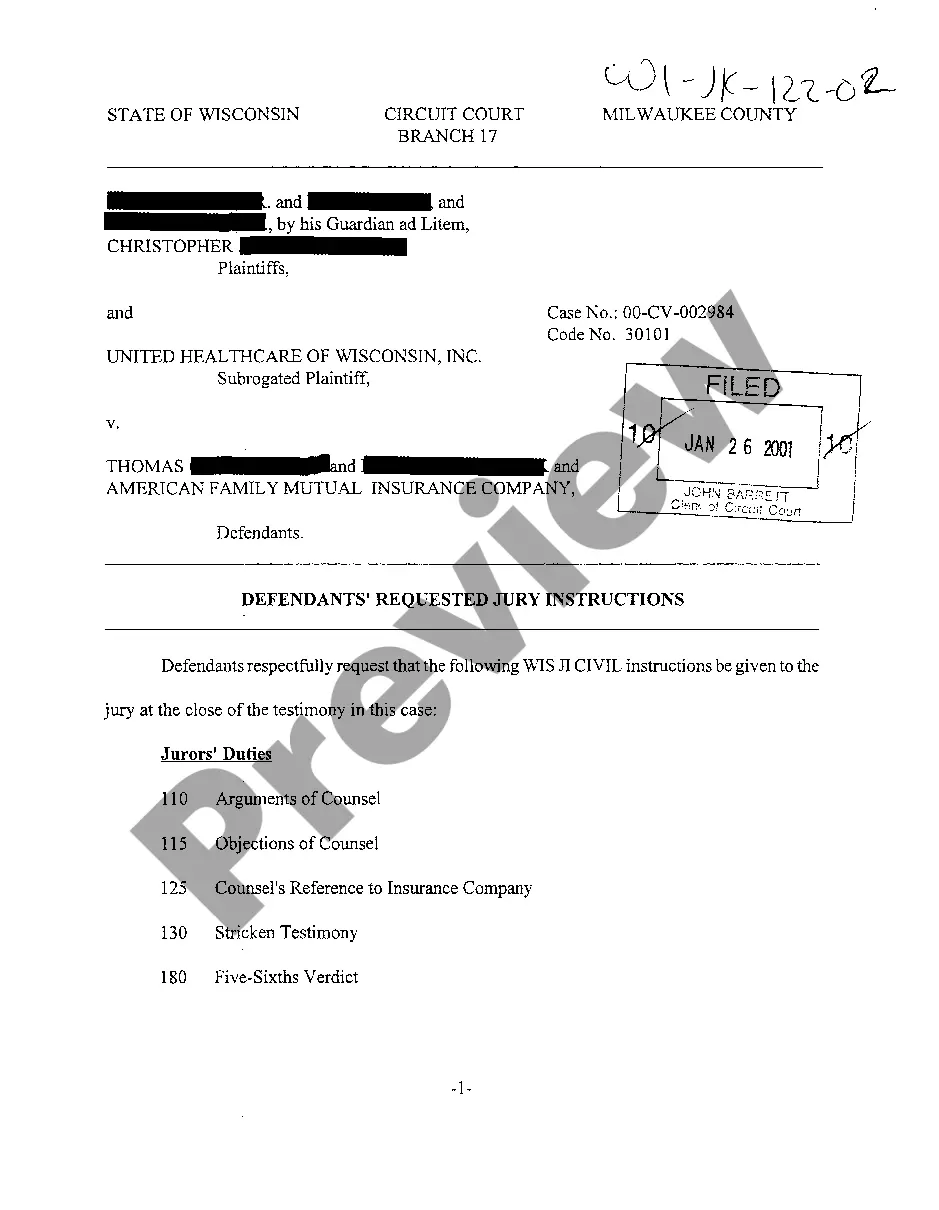

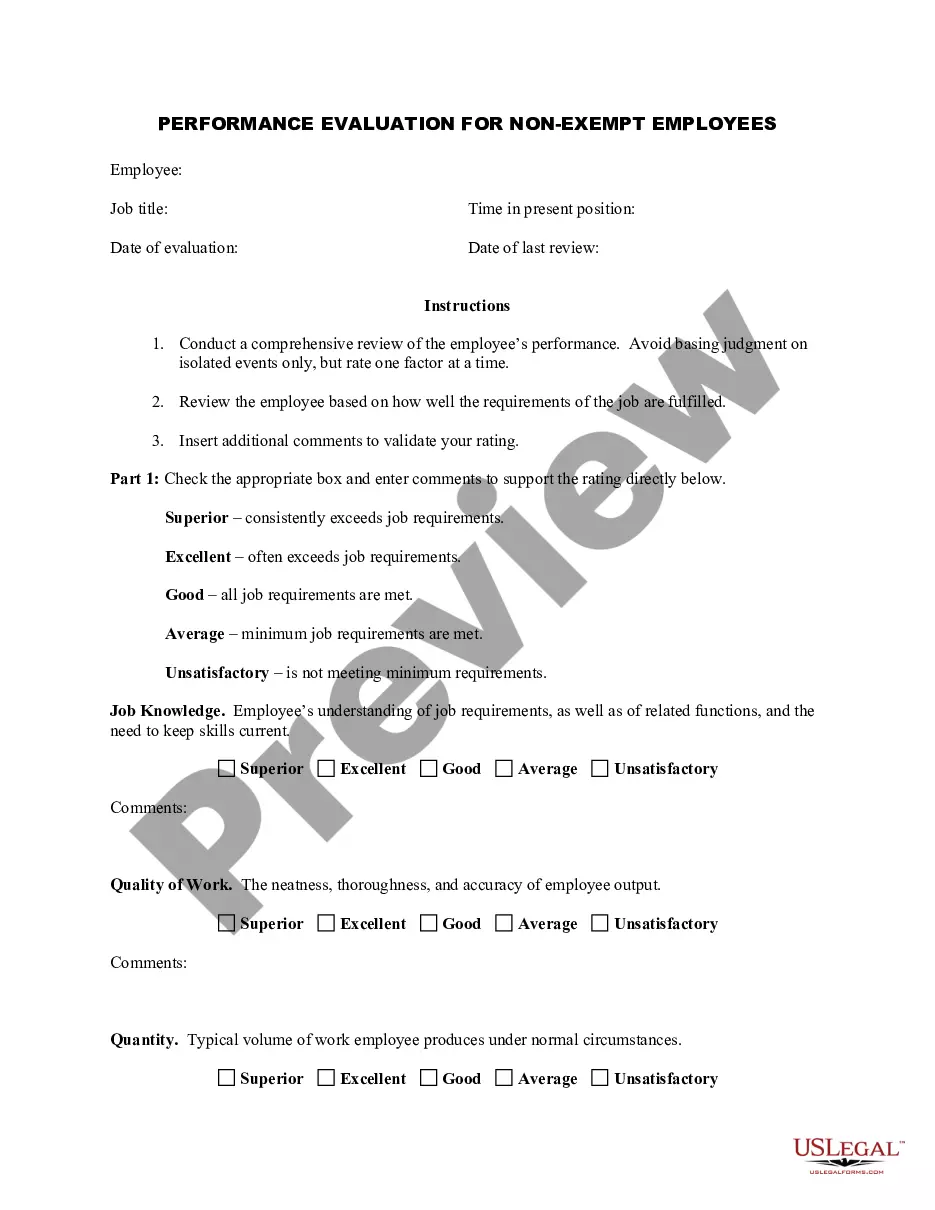

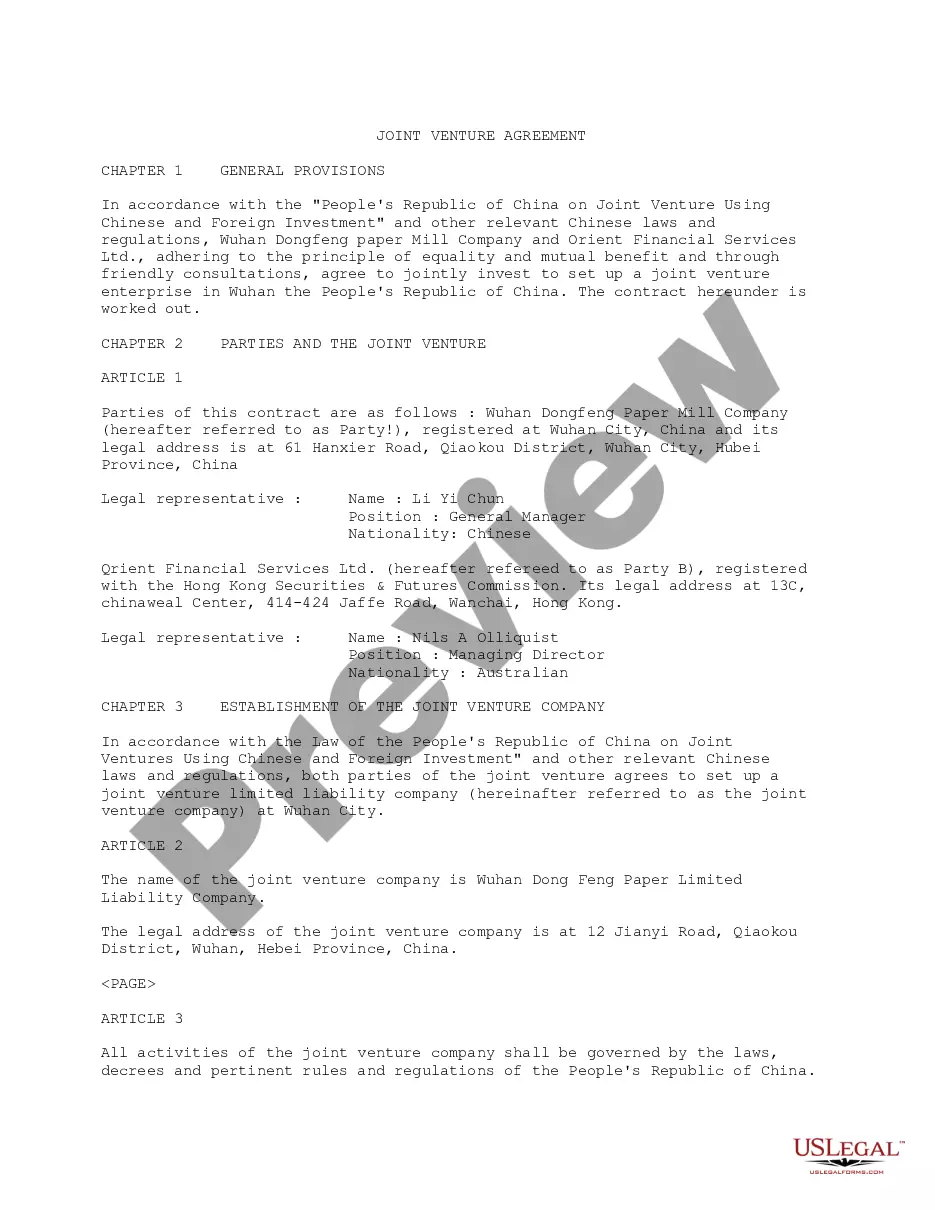

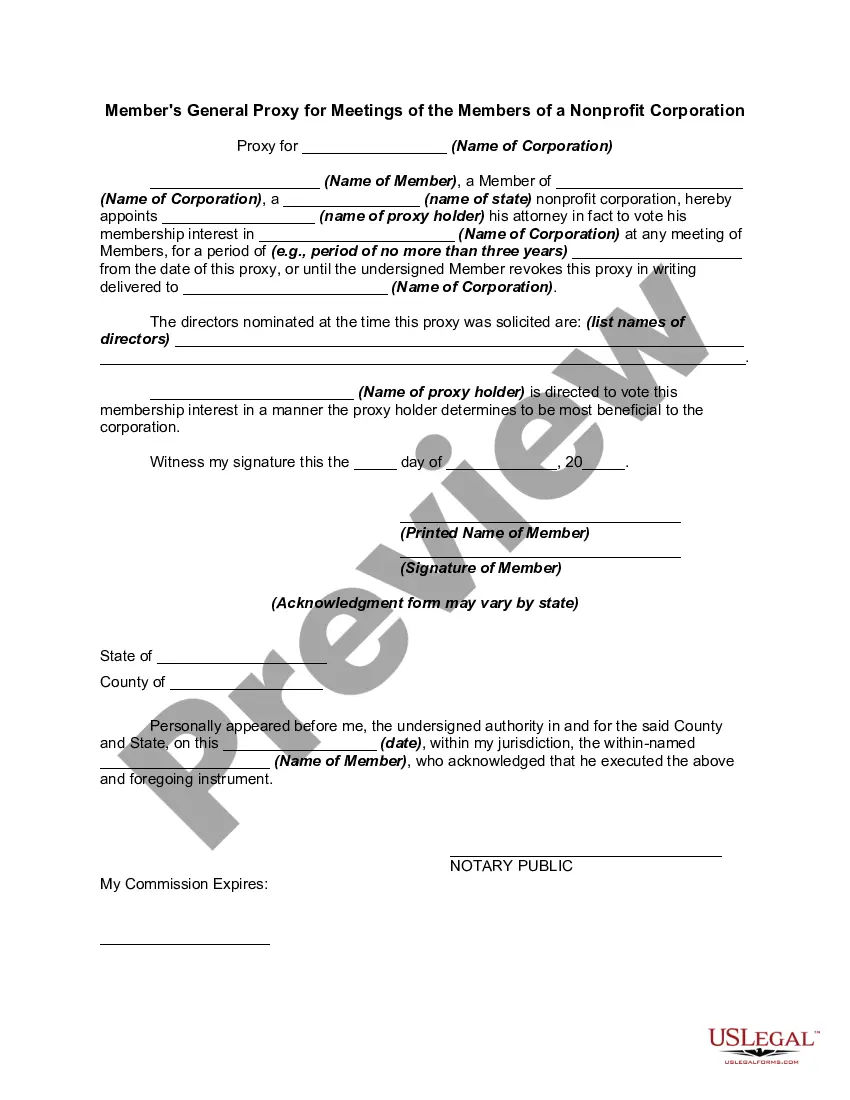

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

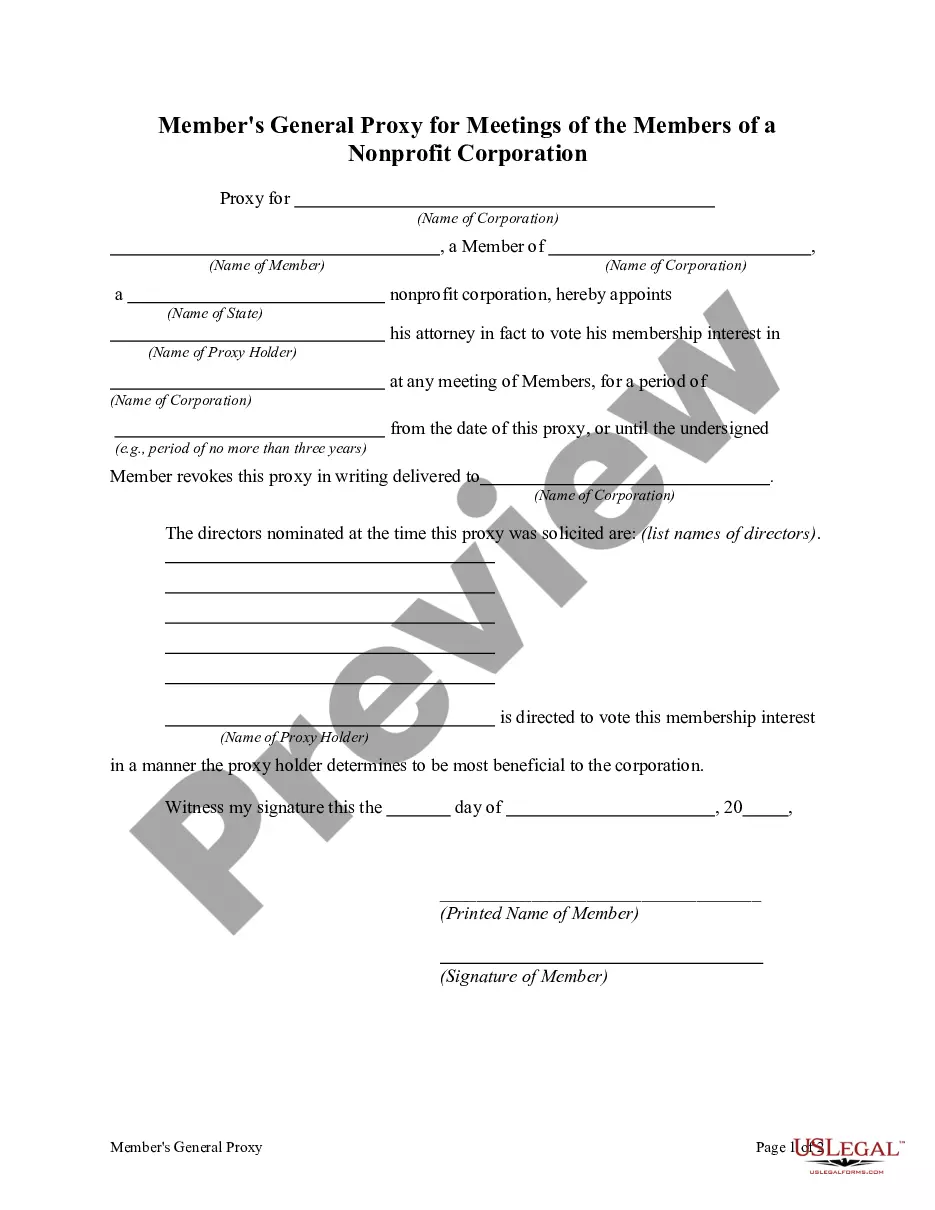

Nebraska Member's General Proxy for Meetings of the Members of a Nonprofit Corporation

Description

How to fill out Member's General Proxy For Meetings Of The Members Of A Nonprofit Corporation?

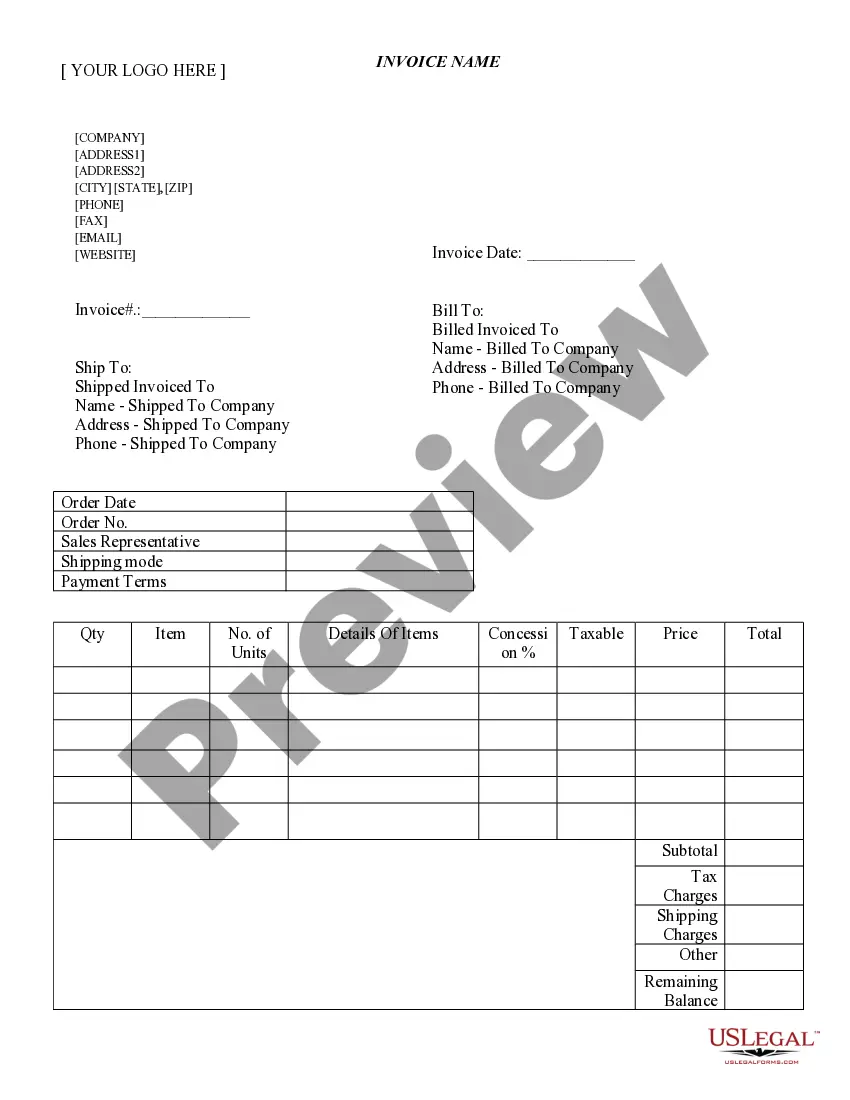

You might devote numerous hours online searching for the legal document template that meets the state and federal standards you require.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can swiftly obtain or create the Nebraska Member's General Proxy for Meetings of the Members of a Nonprofit Corporation using your service.

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Nebraska Member's General Proxy for Meetings of the Members of a Nonprofit Corporation.

- Each legal document template you receive is yours to keep indefinitely.

- To acquire an additional copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/city of choice.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

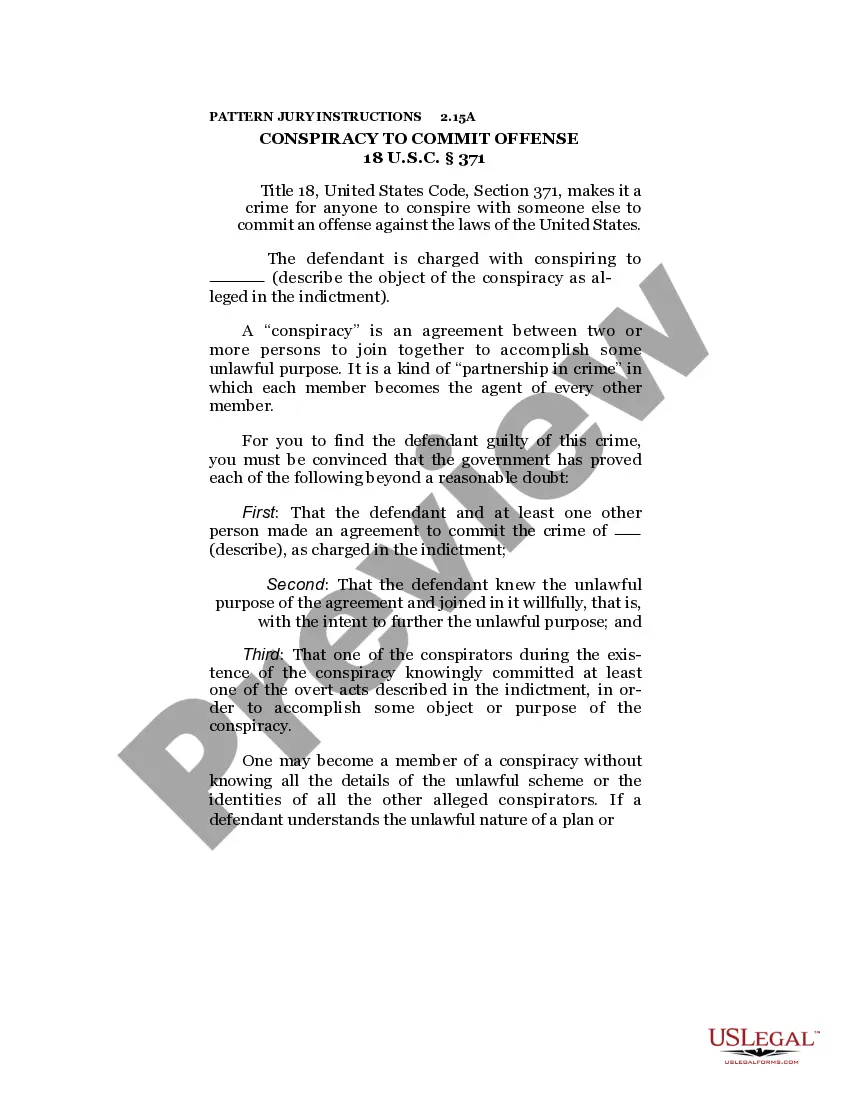

Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

According to a study by Bain Capital Private Equity, the optimal number of directors for boards to make a decision is seven. Every added board member after that decreases decision-making by 10%. Nonprofits can use that as a starting metric before considering the organization's life cycle, mission and fundraising needs.

Can my board of directors contain family members? Yes, but be aware that the IRS encourages specific governance practices for 501(c)(3) board composition. In general, having related board members is not expressly prohibited.

Yes and no. In most states it is legal for executive directors, chief executive officers, or other paid staff to serve on their organizations' governing boards. But it is not considered a good practice, because it is a natural conflict of interest for executives to serve equally on the entity that supervises them.

Choose who will be the initial directors for your nonprofit. In Nebraska, your nonprofit corporation must have three or more directors.

Can the same person be the President, Secretary and Treasurer of a corporation? Yes. A single individual may simultaneously serve as President, Secretary and Treasurer. This is common in small corporations.

A sole member structure is really appealing when an individual or corporation creates a new nonprofit and wants to retain long term control over the nonprofit's mission and activities. By making themselves the sole member, the founder can give themselves the power to appoint or remove board members.

A: While not required by federal law, many states have residency requirements for a corporation's board members. No states require that all board members live in the state of incorporation, only the registered agent is required to live in-state.