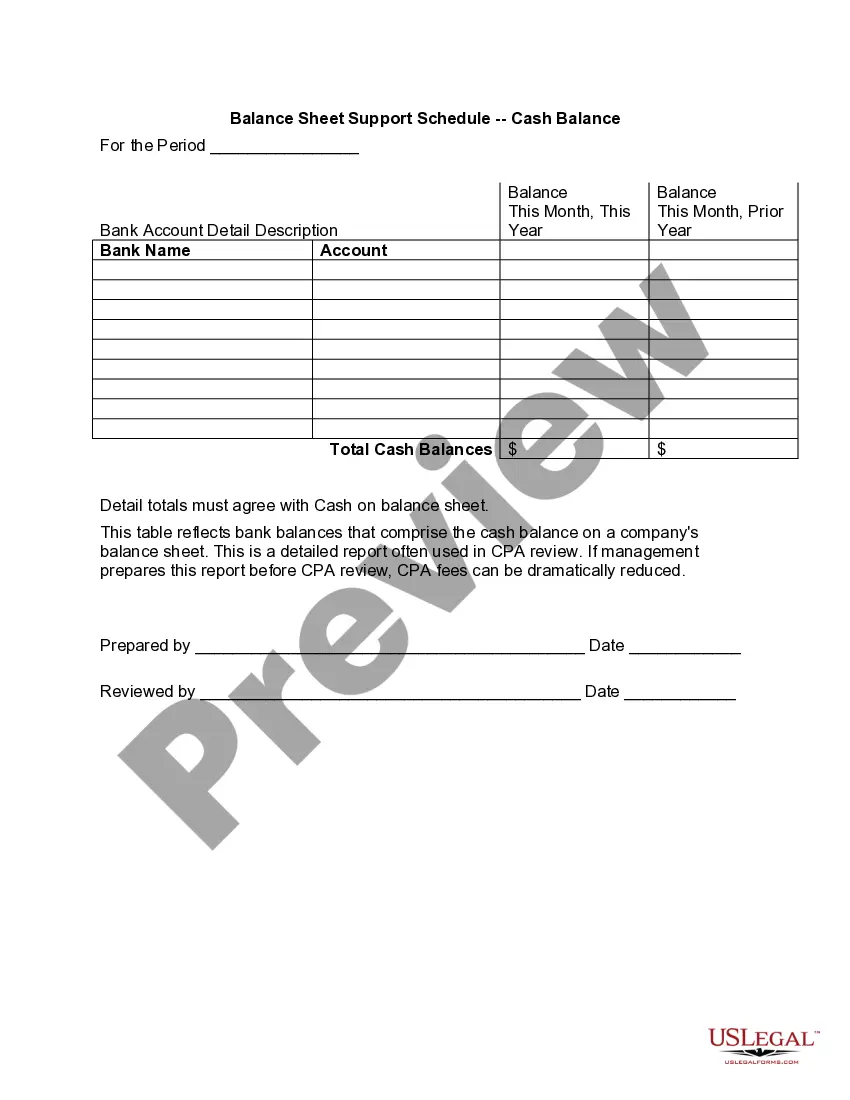

This schedule is tailored for small businesses.

Nebraska Balance Sheet Support Schedule - Inventory

Description

How to fill out Balance Sheet Support Schedule - Inventory?

Are you in a circumstance where you require documents for either business or personal purposes nearly every day.

There are numerous trustworthy document templates available online, but finding ones you can trust isn't simple.

US Legal Forms offers a vast selection of form templates, such as the Nebraska Balance Sheet Support Schedule - Inventory, which are designed to meet state and federal regulations.

Once you find the appropriate form, click on Acquire now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for the order using PayPal or Visa or Mastercard. Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can obtain another copy of the Nebraska Balance Sheet Support Schedule - Inventory anytime, if needed. Just click on the required form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Balance Sheet Support Schedule - Inventory template.

- If you don’t have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct town/state.

- Use the Review button to preview the form.

- Check the information to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

Preparing a balance sheet schedule starts with identifying all financial components of your business. List your assets, followed by your liabilities and owners' equity. Incorporating a Nebraska Balance Sheet Support Schedule - Inventory ensures that your inventory is accurately represented, allowing for precise calculations that reflect your business's financial status.

Filling out a balance sheet involves several steps. First, gather your company’s financial data, including assets and liabilities. Next, list your total assets, followed by your total liabilities. Finally, calculate the owners' equity. Consider integrating a Nebraska Balance Sheet Support Schedule - Inventory into your process for a thorough understanding of your inventory’s impact on your finances.

Yes, if you are filing Form 1065 for a partnership, you generally need to complete Schedule L. This schedule provides a snapshot of the partnership's financial condition at year-end. Utilizing a Nebraska Balance Sheet Support Schedule - Inventory can ease the process by ensuring that your inventory figures are accurate and compliant with state requirements.

Nebraska does not impose a franchise tax on businesses like some other states do. However, understanding the requirements for filing your business taxes is crucial. Using a Nebraska Balance Sheet Support Schedule - Inventory can assist in organizing your financials efficiently, helping you prepare for any potential tax-related processes.

The Schedule L balance sheet per book reports the company's financial position at the end of the tax year. It includes assets, liabilities, and owners’ equity. By using a Nebraska Balance Sheet Support Schedule - Inventory, you ensure that your inventory levels and related financials are accurately documented, reflecting your business’s true health.

The Nebraska corporate tax rate varies based on the taxable income of the corporation. For taxable income up to $100,000, the rate is 5.58%. For income between $100,000 and $1 million, the rate is 7.81%. Understanding these rates is essential when preparing your Nebraska Balance Sheet Support Schedule - Inventory, as it helps in effective financial planning and tax compliance.

The financial position of Nebraska reflects its economic stability and growth potential. It combines various financial statements, including the Nebraska Balance Sheet Support Schedule - Inventory, to showcase the state's assets and liabilities. By analyzing these figures, investors and stakeholders can gain valuable insights into Nebraska's fiscal health, guiding them in making sound financial decisions.

A balance sheet schedule provides a detailed breakdown of a company's assets, liabilities, and equity at a specific point in time. This document plays a crucial role in the overall Nebraska Balance Sheet Support Schedule - Inventory, offering transparency and insight into inventory values. By maintaining this schedule, businesses can assess their financial health and make informed decisions based on accurate inventory reporting.