Nebraska Installment Payment and Purchase Agreement

Description

How to fill out Installment Payment And Purchase Agreement?

Are you in a situation where you require documents for potential business or specific purposes virtually all the time? There are countless legitimate document templates available online, but finding ones you can trust isn’t easy.

US Legal Forms offers a wide array of document templates, including the Nebraska Installment Payment and Purchase Agreement, which can be customized to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Nebraska Installment Payment and Purchase Agreement template.

- Locate the document you need and ensure it is for the correct jurisdiction.

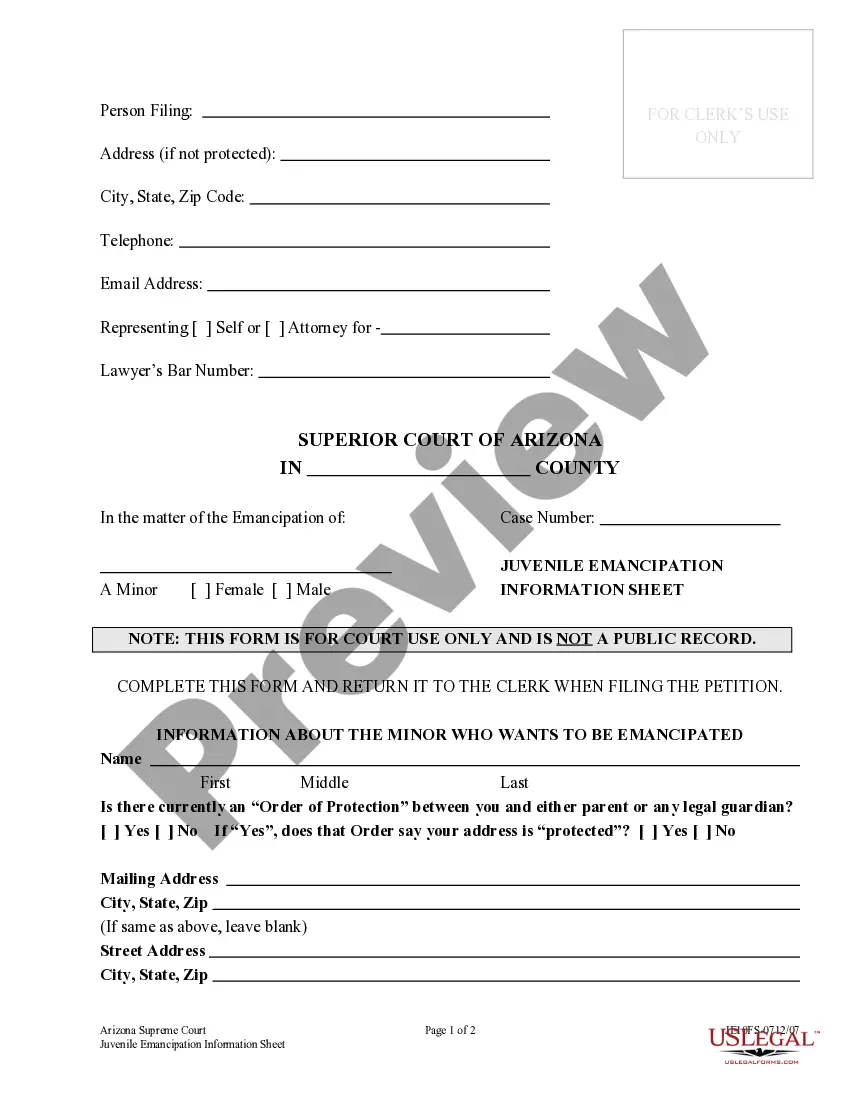

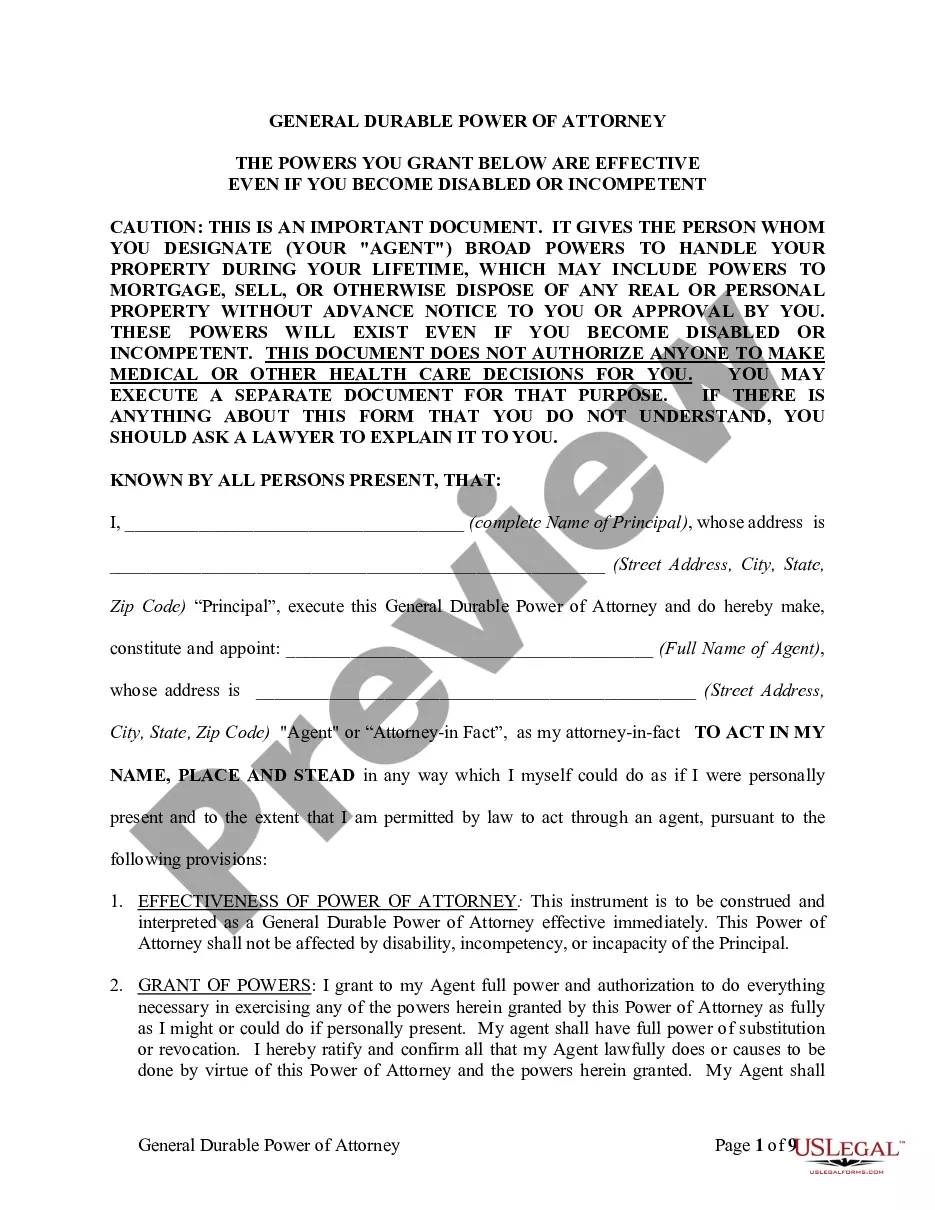

- Utilize the Review option to examine the document.

- Check the description to confirm you have chosen the right document.

- If the document isn’t what you are looking for, use the Lookup field to find the template that meets your needs and requirements.

- When you find the appropriate document, click Purchase now.

- Select the pricing plan you desire, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

By using an installment sale, the seller may benefit by: Partially deferring taxes while simultaneously improving cash flow. Keeping income within a desired tax bracket by spreading that income across a longer period of time. Restrict capital gains to a lower tax bracket.

Buy now, pay later, or BNPL, is a type of installment loan. It divides your purchase into multiple equal payments, with the first due at checkout. The remaining payments are billed to your debit or credit card until your purchase is paid in full.

An installment plan is a way of buying goods gradually. You make regular payments to the seller until, after some time, you have paid the full price and the goods belong to you.

Bill and hold agreements represent a sales arrangement in which the buyer pays for the item or items a seller is offering, but the seller does not ship or deliver them right away but at a later date.

In hire purchase, both ownership and purchase are delayed till the complete payment, whereas, in installment purchase, purchase and ownership take place before the complete payment.

A retail installment sales contract agreement is slightly different from a loan. Both are ways for you to obtain a vehicle by agreeing to make payments over time. In both, you are generally bound to the agreement after signing.

Qualifying as an Installment Sale Note: installment sales do not require multiple payments over multiple years. For example, a sale by a calendar year taxpayer that is closed on 12/31/2021 and paid for on 1/1/2022 is considered an installment sale because at least one payment is made in a year after the year of sale.

An installment purchase agreement is a contract used to finance the acquisition of assets. Under the terms of such an agreement, the buyer pays the seller the full purchase price by making a series of partial payments over time. The payments include stated or imputed interest.

A payment plan agreement, also known as an installment agreement, is a written legal document that allows one party to make smaller payments over time to payoff a larger debt.

Also known as a conditional sales contract, the seller allows the purchaser to take delivery of the items outlined in the contract and pay for them later. Rightful ownership of the property belongs to the seller until the full price is paid by the buyer.