Nebraska Invoice Template for Baker

Description

How to fill out Invoice Template For Baker?

You can spend hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can easily download or print the Nebraska Invoice Template for Baker from our service.

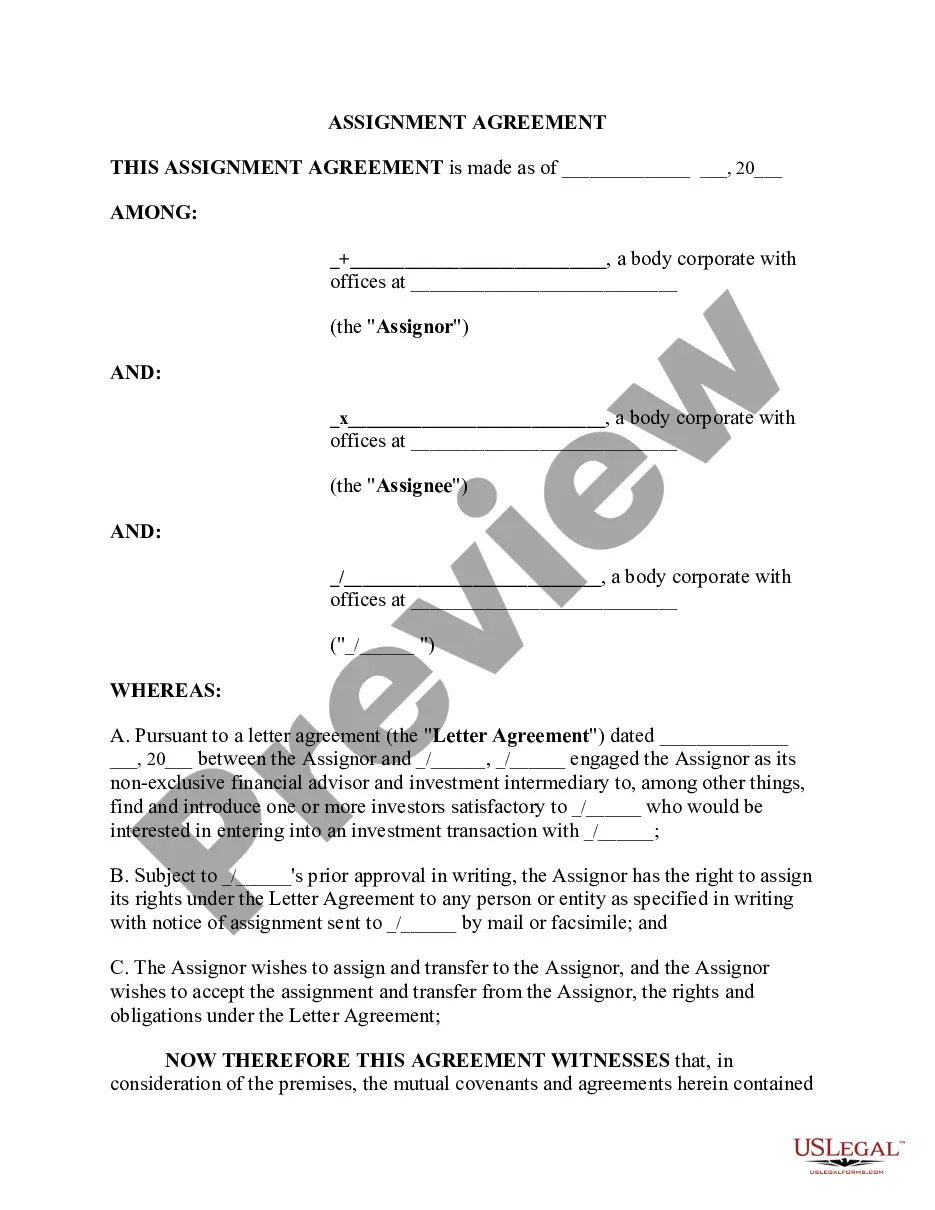

If available, utilize the Preview button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Nebraska Invoice Template for Baker.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Check the form description to confirm you have chosen the correct type.

Form popularity

FAQ

Regulation 1 007 provides guidelines regarding the collection of sales tax in Nebraska, including specific rules for different types of sales. Understanding this regulation is essential for compliance with state laws. A Nebraska Invoice Template for Baker can help incorporate necessary information as outlined in Reg 1 007, making your business operations not only compliant but also more professional.

Nebraska's tax rule primarily mandates that sales tax is applied to all retail sales of tangible personal property, unless exempted. Additionally, different local jurisdictions may impose additional local taxes. To effectively manage your invoices while adhering to tax regulations, a Nebraska Invoice Template for Baker can provide clarity and organization.

Any retailer engaged in the business of selling tangible personal property for use or consumption in Nebraska must collect sales tax. This includes businesses that sell both in-person and online. By utilizing a Nebraska Invoice Template for Baker, you can ensure that your invoices meet the state's requirements, making your tax collection process more efficient.

Yes, remote sellers must collect sales tax in Nebraska if their sales exceed a certain threshold. This law, aiming to level the playing field between local and out-of-state sellers, ensures that all businesses contribute fairly. A Nebraska Invoice Template for Baker can streamline your invoicing process, making compliance with state tax regulations simpler.

Yes, if you make taxable sales in Nebraska, you are required to collect sales tax. This requirement applies to both physical and digital goods sold. Using a Nebraska Invoice Template for Baker can help you clearly itemize your products and easily apply the correct sales tax to your customers' invoices.

Yes, it is legal to make your own invoice, provided you follow guidelines relevant to your state. A Nebraska Invoice Template for Baker can aid in ensuring that you include required information like your business name and tax ID number. By using this template, you can create an invoice that is not only legal but also enhances your credibility with clients.

To make a homemade invoice, consider using a Nebraska Invoice Template for Baker as your guide. Begin by gathering your business information, customer details, and list of services provided. This structure will help ensure that your homemade invoice is professional and includes all necessary components, such as subtotal, taxes, and total due.

Creating your own invoice is straightforward with a Nebraska Invoice Template for Baker. Start by downloading the template and customize it with your branding and contact details. Make sure to detail the products or services rendered, including prices and due dates, so clients have a clear understanding of what they are being billed for.

Yes, you can generate an invoice from yourself using a Nebraska Invoice Template for Baker. This template allows you to easily input your business details, client information, and itemized services. By employing this template, you ensure that your invoice meets all necessary requirements, thus simplifying the billing process for both you and your clients.

Making a contractor invoice involves similar steps as creating a bakery invoice. A Nebraska Invoice Template for Baker can guide you through this process. While the specifics may differ, ensuring clear itemization and transparent payment terms are crucial. Uslegalforms offers templates that cater to various needs, including contractor invoices.