Nebraska Estate Planning Data Letter and Employment Agreement with Client

Description

How to fill out Estate Planning Data Letter And Employment Agreement With Client?

Are you presently in an environment where you require documents for both business or particular activities nearly every day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers an extensive selection of form templates, such as the Nebraska Estate Planning Data Letter and Employment Agreement with Client, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click Buy now.

Select the pricing plan you want, enter the necessary details to create your account, and complete the purchase using your PayPal or credit card. Choose a suitable file format and download your copy. Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Nebraska Estate Planning Data Letter and Employment Agreement with Client at any time if needed. Just select the required form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service provides professionally drafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Estate Planning Data Letter and Employment Agreement with Client template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/region.

- Utilize the Review button to examine the form.

- Go through the details to ensure that you have selected the correct form.

- If the form isn't what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

You fill out an agreement by first reviewing the entire document to understand what information is needed, as seen in agreements like the Nebraska Estate Planning Data Letter and Employment Agreement with Client. Enter the required information accurately and ensure that all sections are complete. After filling it out, confirm with the other party that both of you agree with the details before signing.

Filling out an agreement requires careful attention to detail. Begin by entering names, dates, and specific obligations related to the agreement, such as those found in the Nebraska Estate Planning Data Letter and Employment Agreement with Client. It's essential to follow the provided structure to avoid confusion, ensuring both parties' responsibilities are clear.

Writing up a simple agreement involves clearly stating the purpose of the agreement, like the Nebraska Estate Planning Data Letter and Employment Agreement with Client, and outlining key terms. Use simple language to describe expectations, responsibilities, and payment terms. Make sure to include spaces for both parties to sign, ensuring the document is legally binding.

To complete an agreement like the Nebraska Estate Planning Data Letter and Employment Agreement with Client, start by accurately filling in all required details such as names, dates, and specific terms. Review the agreement to confirm that it aligns with your intentions and legal standards. Once all necessary information is included, both parties should sign the document to validate it.

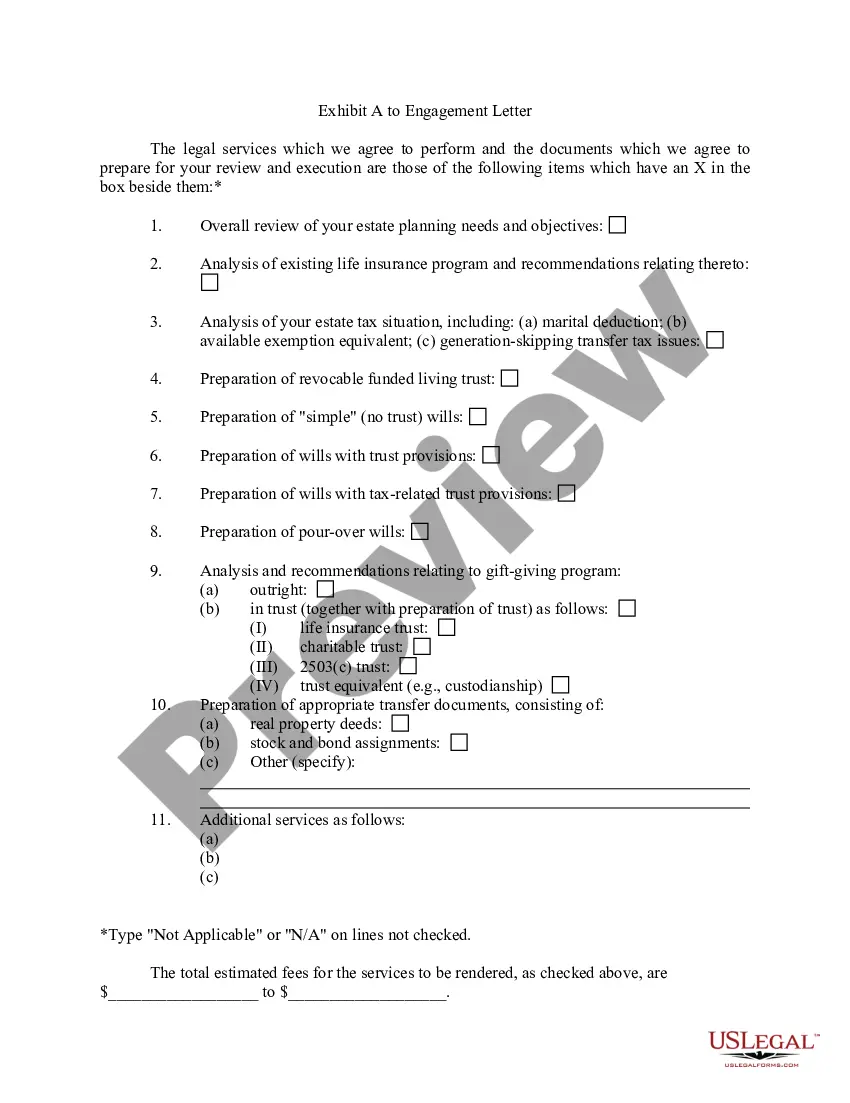

An example of an agreement is the Nebraska Estate Planning Data Letter and Employment Agreement with Client. This document outlines the terms between a client and an estate planner, detailing responsibilities, expectations, and compensation. It serves as a guide for the working relationship, ensuring clarity and mutual understanding, which is essential for effective estate planning.

Yes, form 1041 can be filed electronically. Filing electronically is often faster and more convenient than mailing paper forms. Many tax software programs support e-filing for form 1041, ensuring you meet deadlines efficiently. Consider leveraging resources like US Legal Forms to help structure your Nebraska Estate Planning Data Letter and Employment Agreement with Client properly.

In Nebraska, you generally have about a year to settle an estate. However, some complex estates may take longer due to various factors such as disputes or asset management. It’s important to stay organized and keep clear records throughout the process. You can enhance your understanding of timelines by utilizing the Nebraska Estate Planning Data Letter and Employment Agreement with Client for guidance.

Yes, estate tax returns can be filed electronically in many cases. Electronic filing helps to speed up the processing time and minimizes errors that can occur with paper forms. Utilizing an online service can guide you through completing the required documents. Explore how the Nebraska Estate Planning Data Letter and Employment Agreement with Client can stand out during your electronic filings.

The perfection period in Nebraska typically refers to the timeline for a creditor's claim against an estate. Generally, this period lasts for several months from the date of the notice of probate. It is crucial for estate administration, as it dictates how long creditors have to present their claims. When working with the Nebraska Estate Planning Data Letter and Employment Agreement with Client, be aware of these timelines to properly manage debts.

Yes, a fiduciary is required to file a tax return if the estate earns income during its administration. This requirement helps ensure that the estate’s financial obligations are met. By filing on time, you can avoid penalties and facilitate a smoother estate settlement. Understanding the Nebraska Estate Planning Data Letter and Employment Agreement with Client can further clarify the fiduciary's responsibilities.