Nebraska Guaranty by Individual - Complex

Description

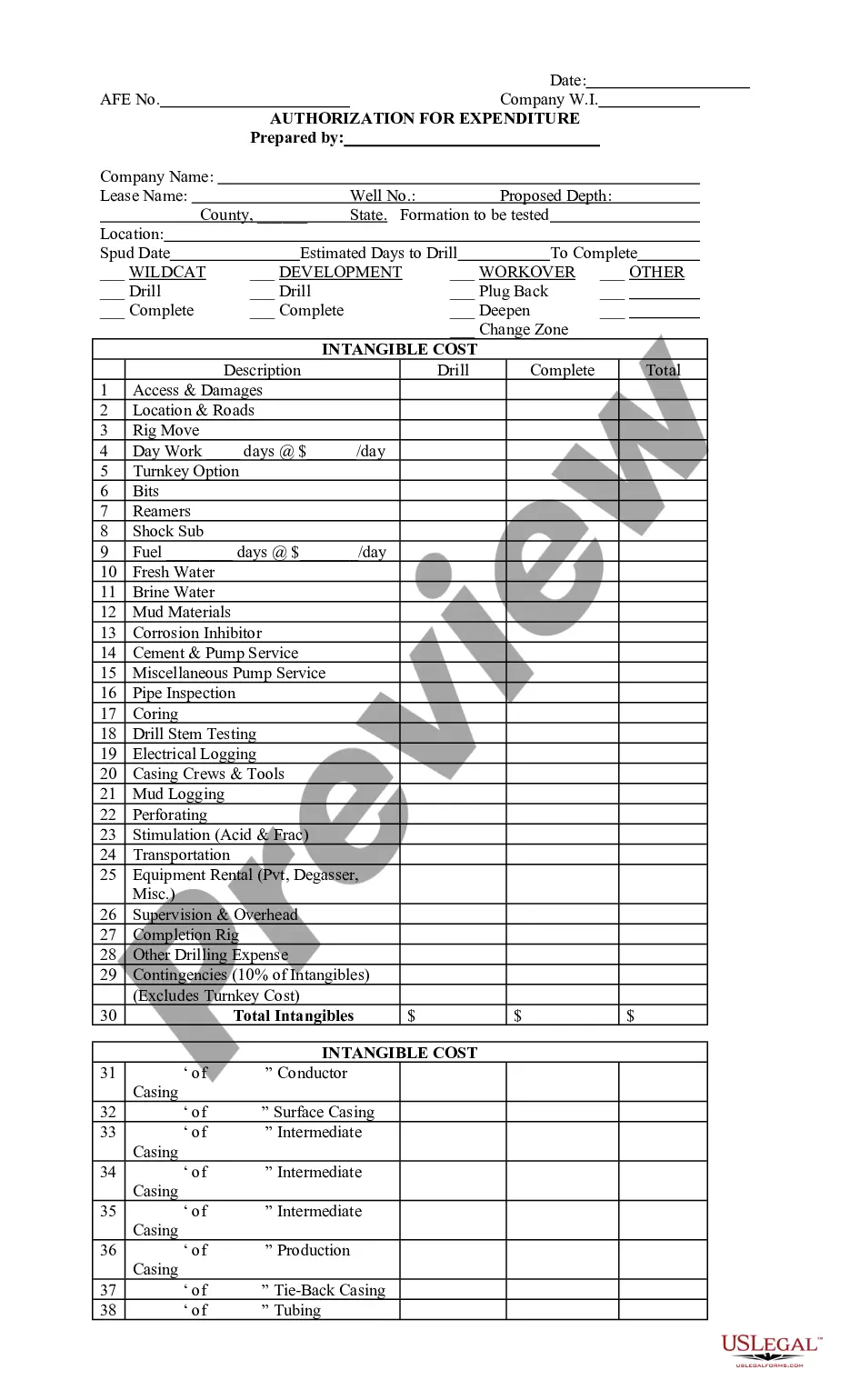

How to fill out Guaranty By Individual - Complex?

US Legal Forms - one of many greatest libraries of legitimate types in the USA - provides a wide array of legitimate document templates you can obtain or print out. Making use of the internet site, you will get a large number of types for company and personal reasons, sorted by types, states, or keywords and phrases.You can get the newest models of types much like the Nebraska Guaranty by Individual - Complex within minutes.

If you have a monthly subscription, log in and obtain Nebraska Guaranty by Individual - Complex from the US Legal Forms collection. The Acquire button will show up on every single develop you perspective. You have accessibility to all formerly delivered electronically types in the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, listed below are straightforward directions to get you began:

- Ensure you have picked out the correct develop for the metropolis/state. Click on the Preview button to check the form`s information. Browse the develop outline to ensure that you have chosen the correct develop.

- In the event the develop does not match your requirements, make use of the Search area near the top of the monitor to find the one that does.

- When you are content with the shape, validate your choice by simply clicking the Purchase now button. Then, select the costs program you prefer and provide your accreditations to register for an profile.

- Process the deal. Utilize your bank card or PayPal profile to finish the deal.

- Choose the file format and obtain the shape on your own product.

- Make changes. Fill up, change and print out and signal the delivered electronically Nebraska Guaranty by Individual - Complex.

Each template you included in your account does not have an expiration day which is the one you have permanently. So, in order to obtain or print out an additional version, just check out the My Forms section and then click on the develop you want.

Obtain access to the Nebraska Guaranty by Individual - Complex with US Legal Forms, by far the most considerable collection of legitimate document templates. Use a large number of expert and status-specific templates that satisfy your business or personal requirements and requirements.

Form popularity

FAQ

State guaranty funds guarantee payment for insurance policyholders should the insurance company default. The fund only covers beneficiaries of insurance companies where the insurer is licensed to sell products in that state.

Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

The maximum total amount the Guarantee Association will provide for any one individual for life insurance and annuity coverage is $300,000, even if that individual is covered by multiple life insurance policies and annuities. Is my claim against the insolvent insurer affected by the Guarantee Association? Yes.

What is the difference between state guaranty associations and FDIC insurance? The FDIC is an independent federal agency that provides deposit insurance for bank deposits. State guaranty associations are nonprofit organizations that operate at the state level to protect insurance policyholders.

The health insurance protection for which the Guarantee Association may become liable shall be the contractual obligations for which the insurer is liable or would have been liable if it were not an insolvent insurer, up to a maximum benefit of $200,000.

StateMax liability for present value of an annuity contractMax aggregate benefits for all lines of insuranceCalifornia80% not to exceed $250,00080% not to exceed $300,000Colorado$250,000$300,000Connecticut$500,000$500,000Delaware$250,000$300,00047 more rows

If you own an annuity policy, the state guaranty fund for the state where you reside protects your benefits up to set limits. The most common limits are between $250,000 - $300,000, but can be as much as $500,000 in select states.

While annuities don't have federal government insurance, guaranty associations in all 50 states cover at least $250,000 in annuity benefits for customers. This is specifically for if the insurance company that issued the contract goes belly up.