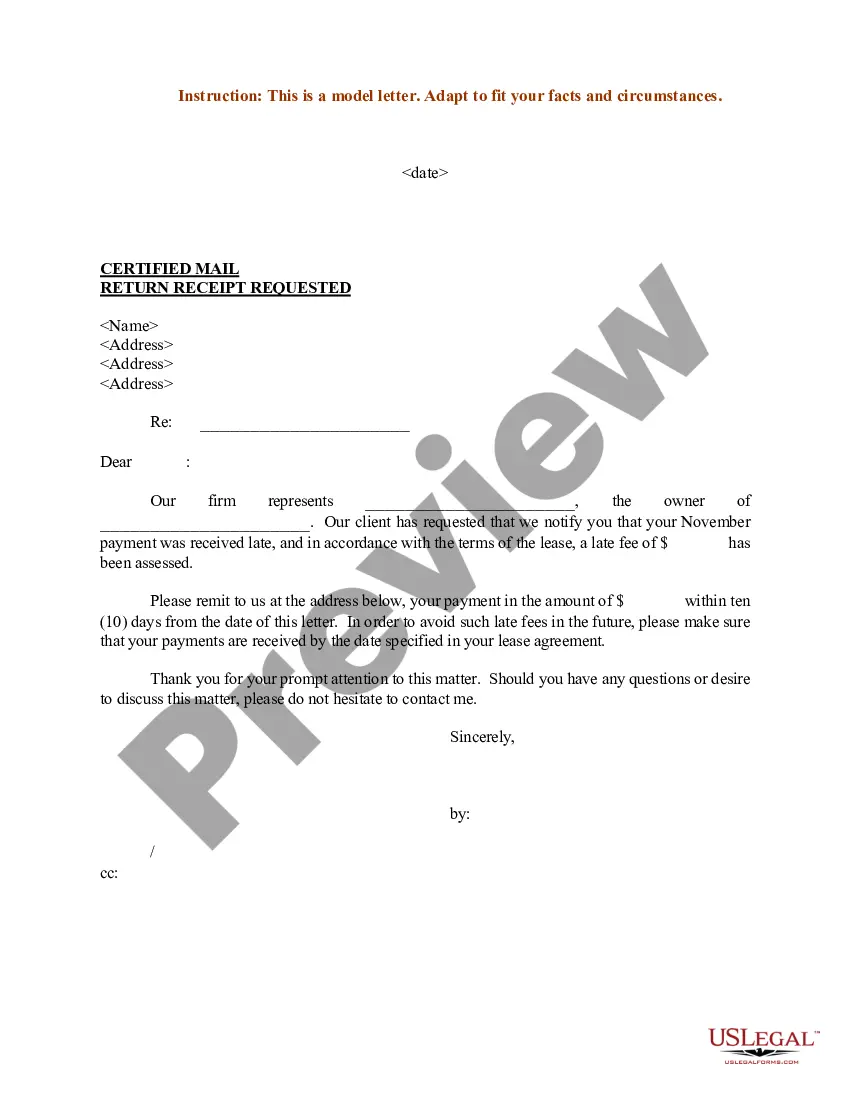

Nebraska Sample Letter for Late Fees

Description

How to fill out Sample Letter For Late Fees?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates you can acquire or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the most recent forms such as the Nebraska Sample Letter for Late Fees in just a few minutes.

If you already have a monthly subscription, Log In and download the Nebraska Sample Letter for Late Fees from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms from the My documents tab of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Choose the file format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Nebraska Sample Letter for Late Fees. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nebraska Sample Letter for Late Fees with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview option to review the form’s content.

- Read the form description to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- If you're satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

30+ days late If your client hasn't made payment (or meaningful contact) within 30 days of the invoice becoming due, it may be time to issue a letter before action (LBA), or to pass over the matter to a debt collection agency. An LBA gives your client formal notice that legal action is imminent.

Credit card issuers don't report payments that are less than 30 days late to the credit bureaus. If your payment is 30 or more days late, then the penalties can add up. Common results of paying late include: Late payment fee: In most cases, you'll be hit with a late payment fee.

Your late fees should also be fair. In most cases, they are expressed as a small percentage of the invoice total (less than 10%), but you are also able to charge a fixed amount as an administrative fee.

How to get customers to pay past due invoices Send a gentle reminder. ... Send an updated invoice. ... Ask why the client isn't paying. ... Demand payment more firmly. ... Escalate the situation. ... Hire a factoring service. ... Hire a debt collection service.

Dear [Name], We require your immediate attention to resolve this issue. Invoice [invoice number] is now overdue by [number of days overdue]. If we do not receive payment within 10 working days, we will refer the matter to a collection agency.

Contact your credit card issuer Apologize for the late fee, and explain why it happened. Make sure to highlight your history as a good customer and ask if they'll be willing to waive the fee.

What Is a Late Fee? The term late fee refers to a charge that lenders and other companies often impose on consumers when they fail to make an on-time payment on a debt, such as a loan or credit card, or any other type of financial agreement, such as an insurance or rental contract.

Charge a percentage of the owing balance each day, week, or month after the payment deadline. Example: For a $500 invoice with a monthly interest rate of 2%, the customer will owe you $502.50 after the first week and $510 after 30 days.