This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

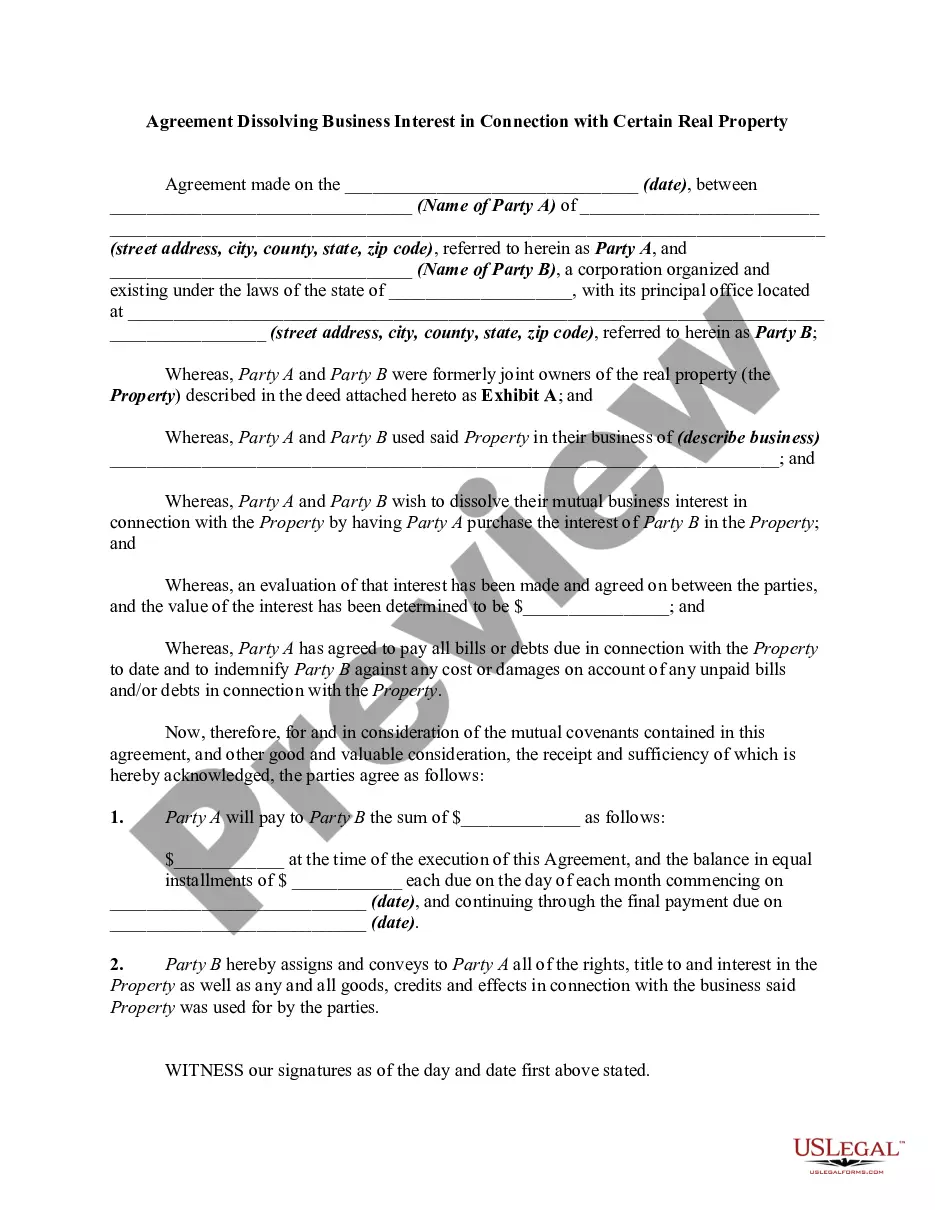

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

You can allocate time on the web searching for the legal document template that fulfills the federal and state requirements you will have.

US Legal Forms provides a vast selection of legal forms that are verified by professionals.

You can conveniently obtain or create the Nebraska Agreement Terminating Business Interest Relating to Specific Real Estate from the services.

First, ensure you have chosen the appropriate document template for your county/region of selection. Review the form description to guarantee you have selected the correct form. If possible, utilize the Preview button to examine the document template simultaneously.

- If you already possess a US Legal Forms account, you may sign in and click the Get button.

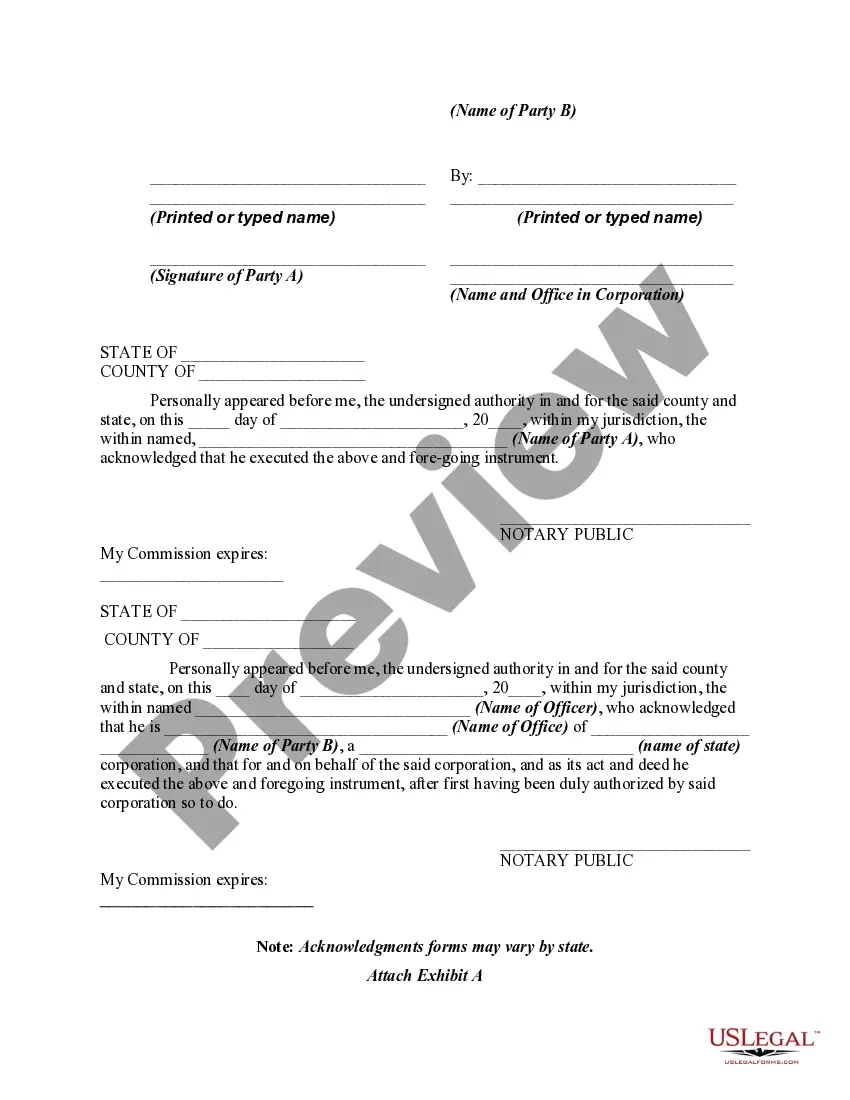

- Subsequently, you can complete, edit, create, or sign the Nebraska Agreement Terminating Business Interest Relating to Specific Real Estate.

- Each legal document template you obtain is yours indefinitely.

- To retrieve another copy of the acquired form, go to the My documents section and click the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, adhere to the straightforward instructions below.

Form popularity

FAQ

The duties and powers of the Nebraska Real Estate Commission encompass regulating the real estate industry and protecting property buyers and sellers. They review and investigate any violations, provide educational resources for agents, and offer guidance on important legal documents like the Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property. Ultimately, the commission works to uphold high standards within the real estate market.

One significant duty of the real estate commissioner is to facilitate the licensing process for real estate professionals in Nebraska. This role includes maintaining standards and ensuring that all licensed agents comply with relevant laws. Additionally, the commissioner provides guidance on documents, including the Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property, to help agents serve their clients effectively.

The Nebraska Real Estate Commission oversees real estate practices within the state. Its main responsibilities include enforcing regulations, protecting consumer interests, and ensuring compliance with state laws. This commission also plays a vital role in managing licenses for real estate professionals and addressing any complaints related to agreements, like the Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property.

A real estate agent has several duties that include assisting clients in buying or selling properties. They provide valuable market insight, help clients negotiate deals, and ensure all necessary paperwork, including a Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property, is completed accurately. Additionally, agents market properties effectively and work to understand their clients' needs throughout the transaction.

Yes, Nebraska is considered a full disclosure state, meaning sellers must reveal significant issues with the property. This requirement aims to protect buyers from potential surprises post-transaction. When drafting a Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property, being aware of these full disclosure obligations is vital for a fair and successful sale.

A property condition disclosure statement is a document that sellers provide to potential buyers, detailing the condition of the property. It includes information about known defects, repairs, and other important factors that could affect a buyer's decision. This statement is essential in a Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property, as it fosters transparency in the transaction.

The convenience rule in Nebraska allows taxpayers to allocate their income based on where they conduct business activities. This rule can impact how income and deductions are reported, especially for those involved in real estate transactions. Thus, when crafting a Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property, be aware of how your business activities affect tax reporting.

In general, residential properties sold in Nebraska typically require a property condition disclosure. This includes single-family homes, townhouses, and condominiums. If you're navigating a Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property, make sure you understand which disclosures apply to your situation.

In Nebraska, sellers of residential real estate are required to complete the seller property condition disclosure statement. This statement provides buyers with crucial information about the property's condition and any known issues. If you are involved in a Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property, ensuring compliance with this requirement helps facilitate a smooth transaction.

Nebraska source income includes any income that you earn from activities within the state. This encompasses wages, business income, and rental income derived from real property situated in Nebraska. Understanding this is important when preparing a Nebraska Agreement Dissolving Business Interest in Connection with Certain Real Property, as it affects your tax obligations.