US Legal Forms - one of many greatest libraries of lawful forms in the USA - offers a wide range of lawful document themes you may acquire or printing. Using the internet site, you can find a large number of forms for organization and specific purposes, sorted by categories, states, or keywords and phrases.You can find the latest versions of forms such as the Nebraska Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company in seconds.

If you have a monthly subscription, log in and acquire Nebraska Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company from your US Legal Forms collection. The Download key will appear on every single type you perspective. You have access to all in the past delivered electronically forms in the My Forms tab of your account.

If you want to use US Legal Forms the very first time, listed below are simple directions to help you get started off:

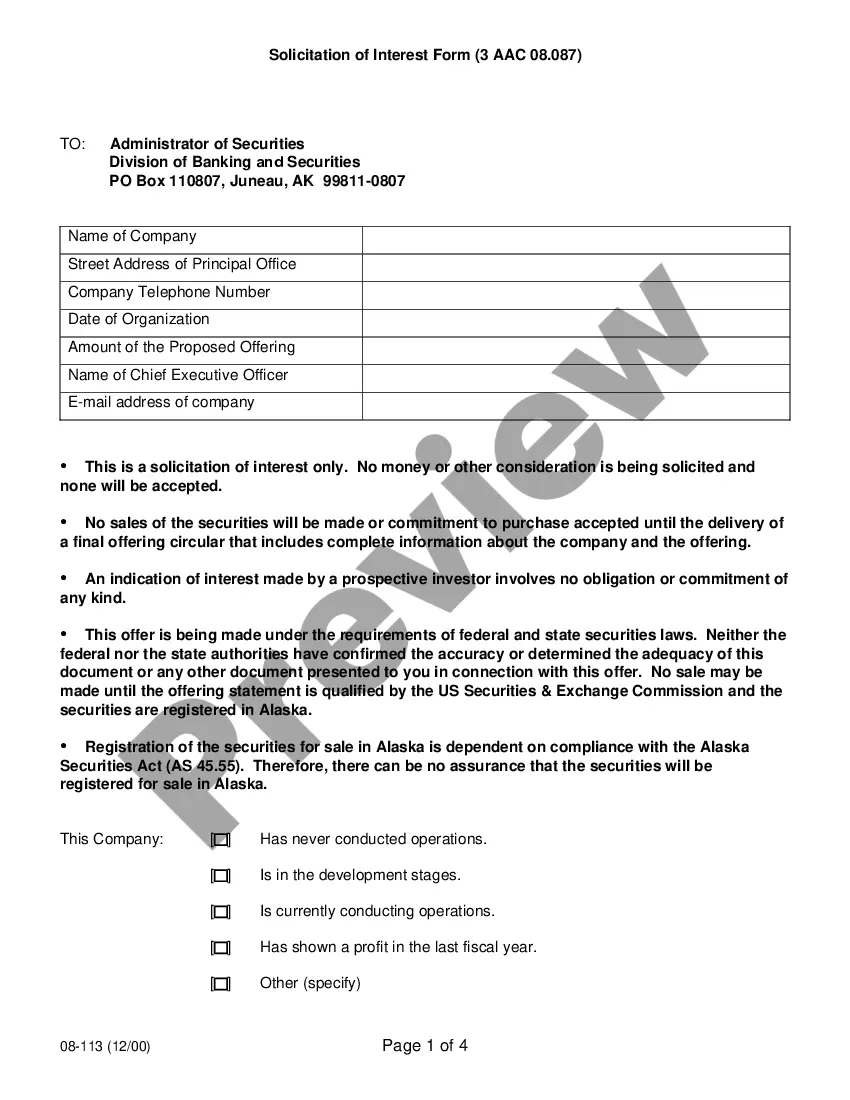

- Make sure you have picked the correct type for your city/area. Click on the Review key to examine the form`s information. Browse the type outline to ensure that you have selected the appropriate type.

- In the event the type does not match your demands, make use of the Search field near the top of the display to obtain the the one that does.

- When you are happy with the shape, verify your selection by visiting the Get now key. Then, choose the rates plan you prefer and give your accreditations to register to have an account.

- Process the financial transaction. Make use of your credit card or PayPal account to accomplish the financial transaction.

- Choose the structure and acquire the shape on your device.

- Make alterations. Complete, change and printing and sign the delivered electronically Nebraska Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company.

Every single web template you included with your bank account lacks an expiration date and is also your own property permanently. So, if you wish to acquire or printing another copy, just proceed to the My Forms segment and then click about the type you will need.

Obtain access to the Nebraska Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company with US Legal Forms, the most substantial collection of lawful document themes. Use a large number of specialist and condition-particular themes that meet up with your company or specific needs and demands.