This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nebraska Agreement to Renew Trust Agreement

Description

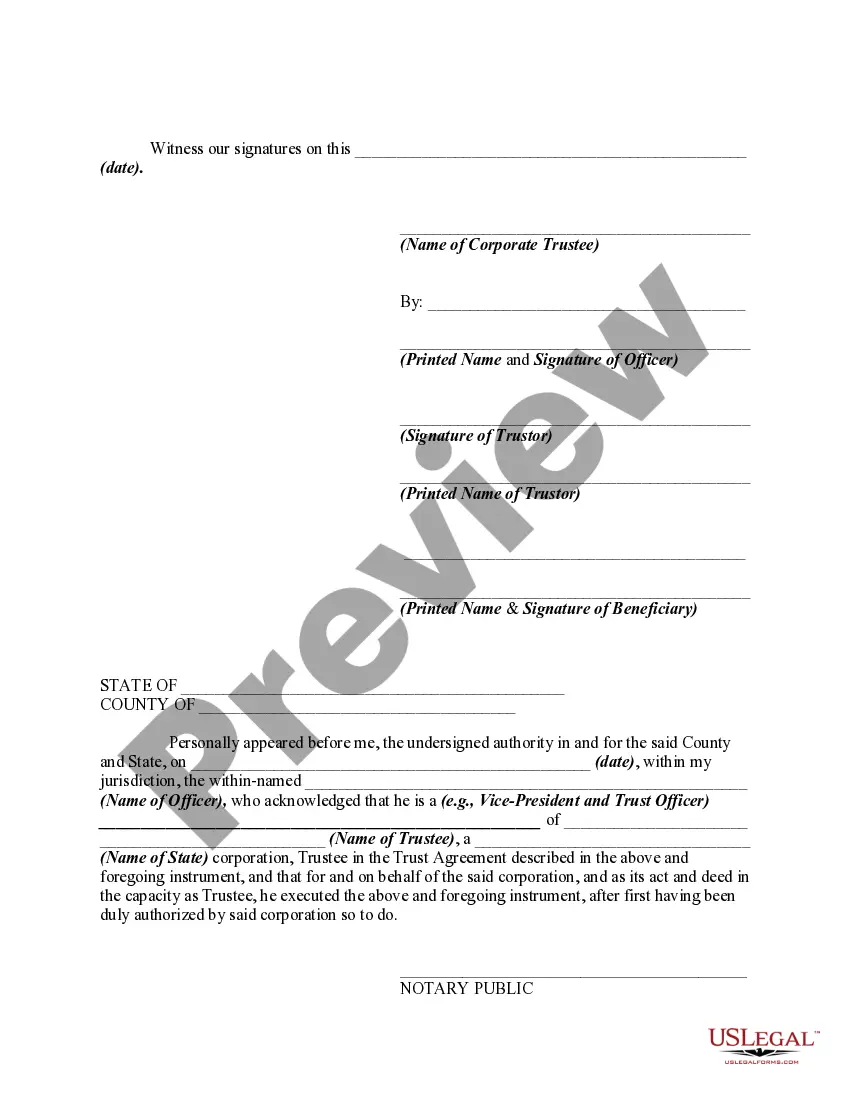

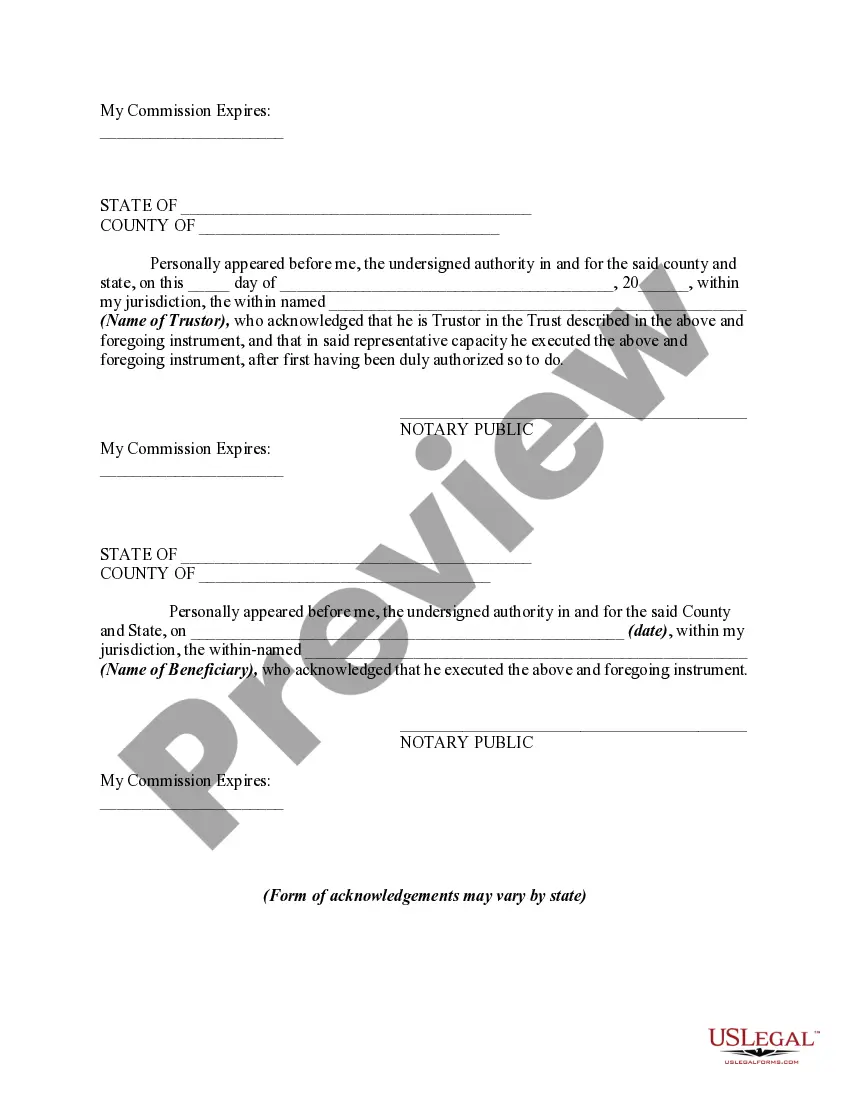

How to fill out Agreement To Renew Trust Agreement?

It is feasible to spend hours online searching for the valid document template that fulfills the federal and state requirements you need.

US Legal Forms offers numerous valid templates which can be reviewed by professionals.

You can easily obtain or generate the Nebraska Agreement to Renew Trust Agreement from this service.

If available, utilize the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and then select the Download option.

- After that, you can complete, modify, print, or sign the Nebraska Agreement to Renew Trust Agreement.

- Every valid document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred county/city.

- Review the template description to make certain you have chosen the appropriate form.

Form popularity

FAQ

A trust certificate serves as a summary of the trust's terms and is often used for third-party transactions. Conversely, a trust agreement details all provisions, management instructions, and beneficiary designations. Understanding this distinction is crucial when working with a Nebraska Agreement to Renew Trust Agreement, as it impacts how you present your trust to others.

In Nebraska, a trust operates based on the terms outlined in the trust document. A Nebraska Agreement to Renew Trust Agreement allows you to manage assets and dictate how they are distributed after your passing. Trusts provide flexibility and can help avoid probate, making them an attractive option for many individuals.

Amending an irrevocable trust can be complex, but it is sometimes possible. If you have a Nebraska Agreement to Renew Trust Agreement, certain provisions may allow for amendments under specific circumstances. Consulting a trust attorney can clarify your options while ensuring adherence to Nebraska laws.

Generally, you do not have to file a trust with the state. Trusts, including those established under a Nebraska Agreement to Renew Trust Agreement, typically do not require state filing unless you are dealing with specific property or tax implications. Always consider seeking legal advice to understand your obligations.

Currently, not all states require trust registration. In fact, each state has its own laws governing trusts, including Nebraska. If you are using a Nebraska Agreement to Renew Trust Agreement, it's important to consult with a qualified attorney to determine whether registration is necessary in your specific situation.

Wealthy individuals often place their homes in a trust to enhance asset protection and facilitate easier distribution upon death. Trusts can shield assets from creditors and can help in tax efficiency. Utilizing the Nebraska Agreement to Renew Trust Agreement makes navigating these benefits clearer for anyone looking to protect their estate.

Typically, a trust agreement is prepared by an attorney specializing in estate planning. This professional ensures that the document adheres to state laws and meets your family's needs effectively. Using the Nebraska Agreement to Renew Trust Agreement as a base can simplify this process with legal precision.

Deciding whether to gift a house or place it in a trust depends on your specific financial goals and family dynamics. A trust provides control over how and when your heirs receive the property, while gifting might lead to immediate tax implications. The Nebraska Agreement to Renew Trust Agreement can help clarify your intentions in either case.

The negative side of a trust often includes the complexity of setup and potential for high administration fees. Additionally, the process of transferring assets into the trust can be time-consuming. By leveraging the Nebraska Agreement to Renew Trust Agreement, you can streamline the process and minimize complications.

Placing assets in a trust can offer several advantages, such as avoiding probate and providing privacy for asset distribution. However, it can also come with disadvantages, like initial setup costs and ongoing management fees. Understanding the Nebraska Agreement to Renew Trust Agreement helps you weigh these pros and cons clearly.