The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Nebraska Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records

Description

How to fill out Complaint Objecting To Discharge Or Debtor In Bankruptcy Proceeding For Failure To Keep Books And Records?

US Legal Forms - one of the largest libraries of legal forms in the United States - delivers a wide array of legal papers layouts it is possible to acquire or print out. Making use of the website, you may get a huge number of forms for business and individual functions, sorted by categories, suggests, or key phrases.You will find the latest variations of forms such as the Nebraska Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records in seconds.

If you already possess a monthly subscription, log in and acquire Nebraska Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records from the US Legal Forms catalogue. The Obtain switch will show up on every single kind you perspective. You gain access to all earlier acquired forms inside the My Forms tab of your account.

In order to use US Legal Forms initially, here are straightforward directions to help you started:

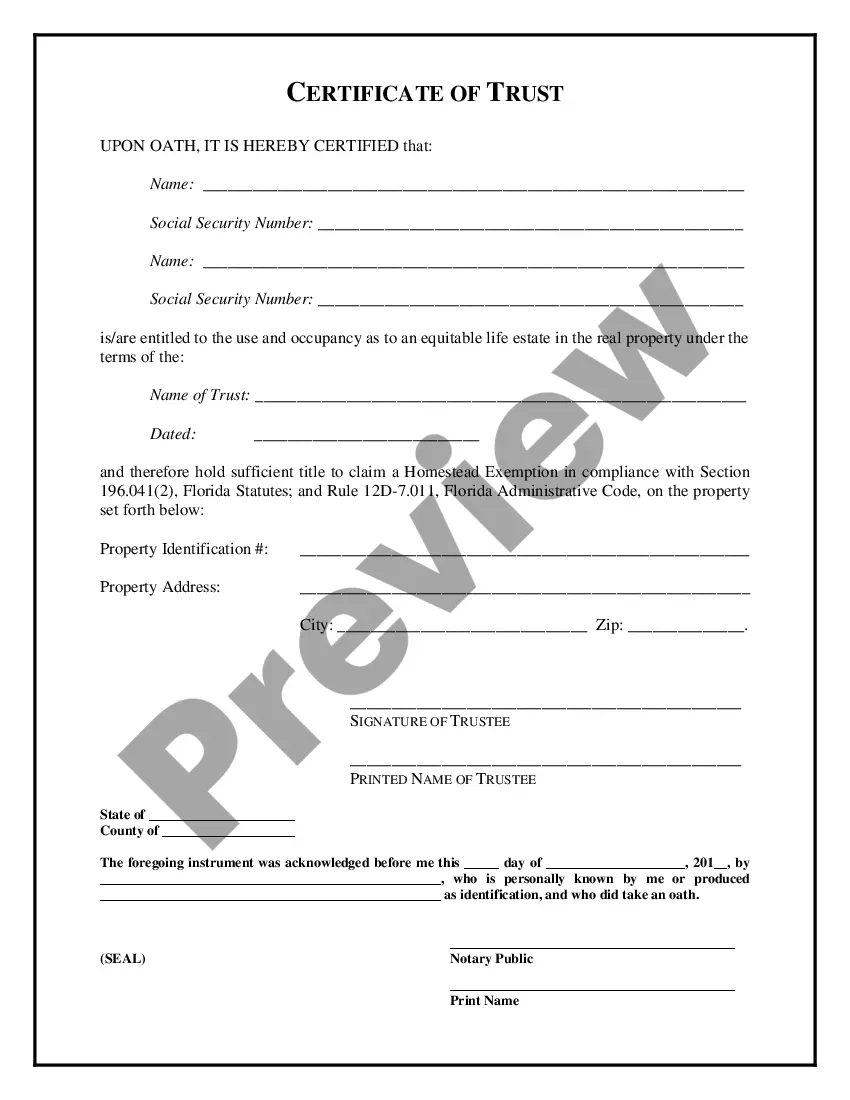

- Make sure you have selected the best kind for your area/county. Go through the Review switch to analyze the form`s articles. See the kind explanation to actually have chosen the proper kind.

- If the kind does not suit your needs, utilize the Lookup field towards the top of the screen to obtain the one that does.

- Should you be content with the form, validate your option by clicking the Purchase now switch. Then, opt for the pricing strategy you like and give your references to sign up on an account.

- Method the purchase. Utilize your credit card or PayPal account to perform the purchase.

- Select the formatting and acquire the form on your system.

- Make alterations. Fill up, modify and print out and sign the acquired Nebraska Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records.

Each and every template you put into your money lacks an expiration time which is your own eternally. So, if you want to acquire or print out an additional duplicate, just go to the My Forms segment and then click about the kind you require.

Obtain access to the Nebraska Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records with US Legal Forms, probably the most extensive catalogue of legal papers layouts. Use a huge number of specialist and condition-specific layouts that meet your organization or individual demands and needs.

Form popularity

FAQ

178Power to disclaim onerous property (2)Subject as follows, the liquidator may, by the giving of the prescribed notice, disclaim any onerous property and may do so notwithstanding that he has taken possession of it, endeavoured to sell it, or otherwise exercised rights of ownership in relation to it.

Subsection 153A(6) specifically states that the ?bankrupt's debts? means all debts that have been proved in the bankruptcy and includes interest payable on those debts where the creditor was entitled to charge interest in ance with the terms of the credit agreement, together with all of the costs, charges and ...

You'll still be required to keep up all payments on secured debts for assets you plan to keep, like payments on your mortgage or car loan. Bankruptcy does not eliminate spousal or child support payments. Bankruptcy also won't get rid of court fines or debts due to fraud.

A PIA, also known as a Part X (10), is a legally binding agreement between you and your creditors. A PIA can be a flexible way to come to an arrangement to settle debts without becoming bankrupt.

(e) a transaction that, by virtue of section 120, 121, 122, 128B or 128C, is void as against the trustee in the earlier bankruptcy continues to be void as against that trustee.

Subsection 178(1) of the BIA lists eight classes of debts that are not released by an order of discharge. These exceptions are based on an overriding social policy. Subject to these eight exceptions, an order of discharge releases the bankrupt from all claims provable in bankruptcy.

A debtor may apply to the Court to challenge (oppose) a bankruptcy notice before the time for compliance with the notice has finished. The debtor can apply to challenge a bankruptcy notice if: there is a defect in the bankruptcy notice. the debt on which the bankruptcy notice is based does not exist.

No one can prevent a person from filing bankruptcy but a bankrupt's discharge can be opposed by the Office of the Superintendent of bankruptcy, a creditor or the trustee.