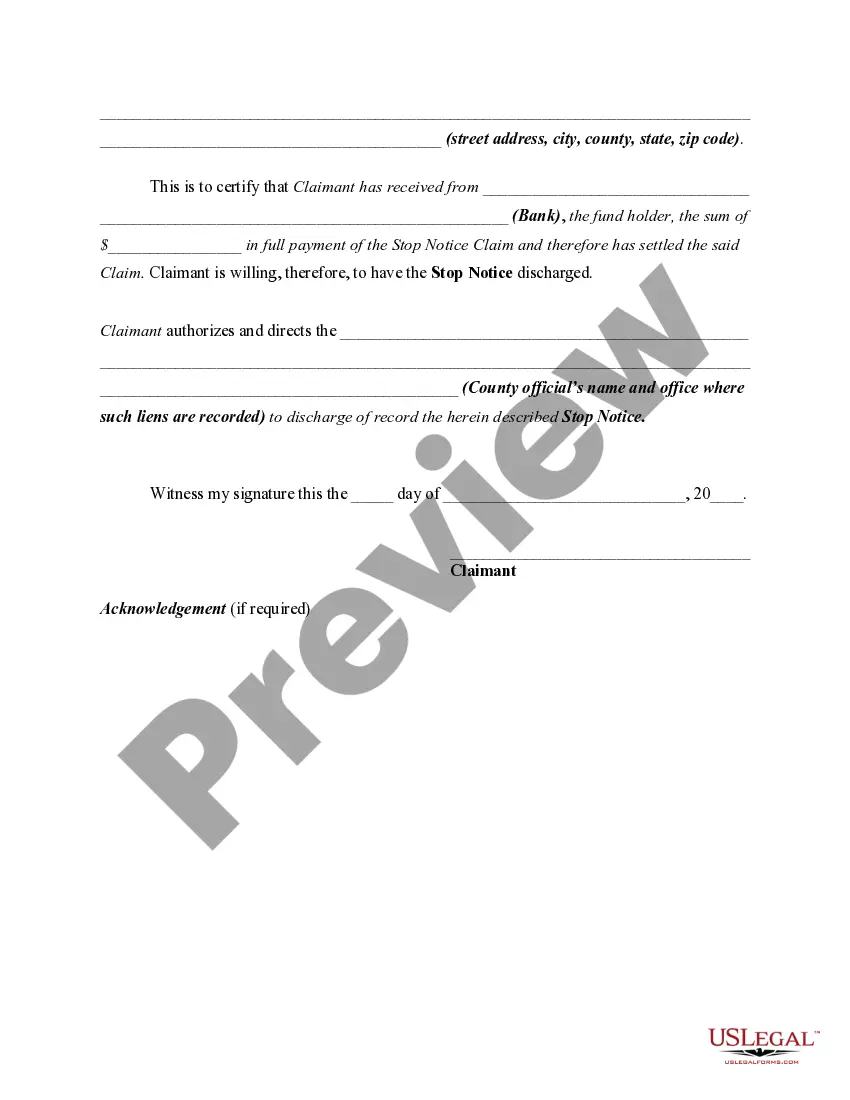

Are you presently within a place that you will need papers for either organization or person purposes almost every day time? There are tons of legal record layouts accessible on the Internet, but discovering ones you can trust isn`t straightforward. US Legal Forms gives a large number of form layouts, just like the Nebraska Certificate of Satisfaction of Stop Notice Claim or Notice to Withhold Funds, which can be written to satisfy state and federal specifications.

In case you are presently knowledgeable about US Legal Forms internet site and possess a free account, just log in. Afterward, you may down load the Nebraska Certificate of Satisfaction of Stop Notice Claim or Notice to Withhold Funds template.

Unless you offer an account and wish to begin using US Legal Forms, abide by these steps:

- Find the form you will need and make sure it is for that appropriate town/region.

- Take advantage of the Review switch to review the shape.

- Read the description to actually have selected the appropriate form.

- If the form isn`t what you are looking for, utilize the Search area to obtain the form that suits you and specifications.

- When you get the appropriate form, click Get now.

- Pick the costs strategy you want, fill out the desired information and facts to create your bank account, and purchase the order with your PayPal or credit card.

- Decide on a hassle-free data file formatting and down load your duplicate.

Locate all the record layouts you might have purchased in the My Forms menu. You can obtain a additional duplicate of Nebraska Certificate of Satisfaction of Stop Notice Claim or Notice to Withhold Funds whenever, if needed. Just go through the required form to down load or produce the record template.

Use US Legal Forms, one of the most extensive selection of legal types, to save lots of time as well as prevent faults. The assistance gives skillfully created legal record layouts which can be used for an array of purposes. Generate a free account on US Legal Forms and commence making your life easier.