A common-law lien is the right of one person to retain in his possession property that belongs to another until a debt or claim secured by that property is satisfied. It pertains exclusively to personal property. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nebraska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien

Description

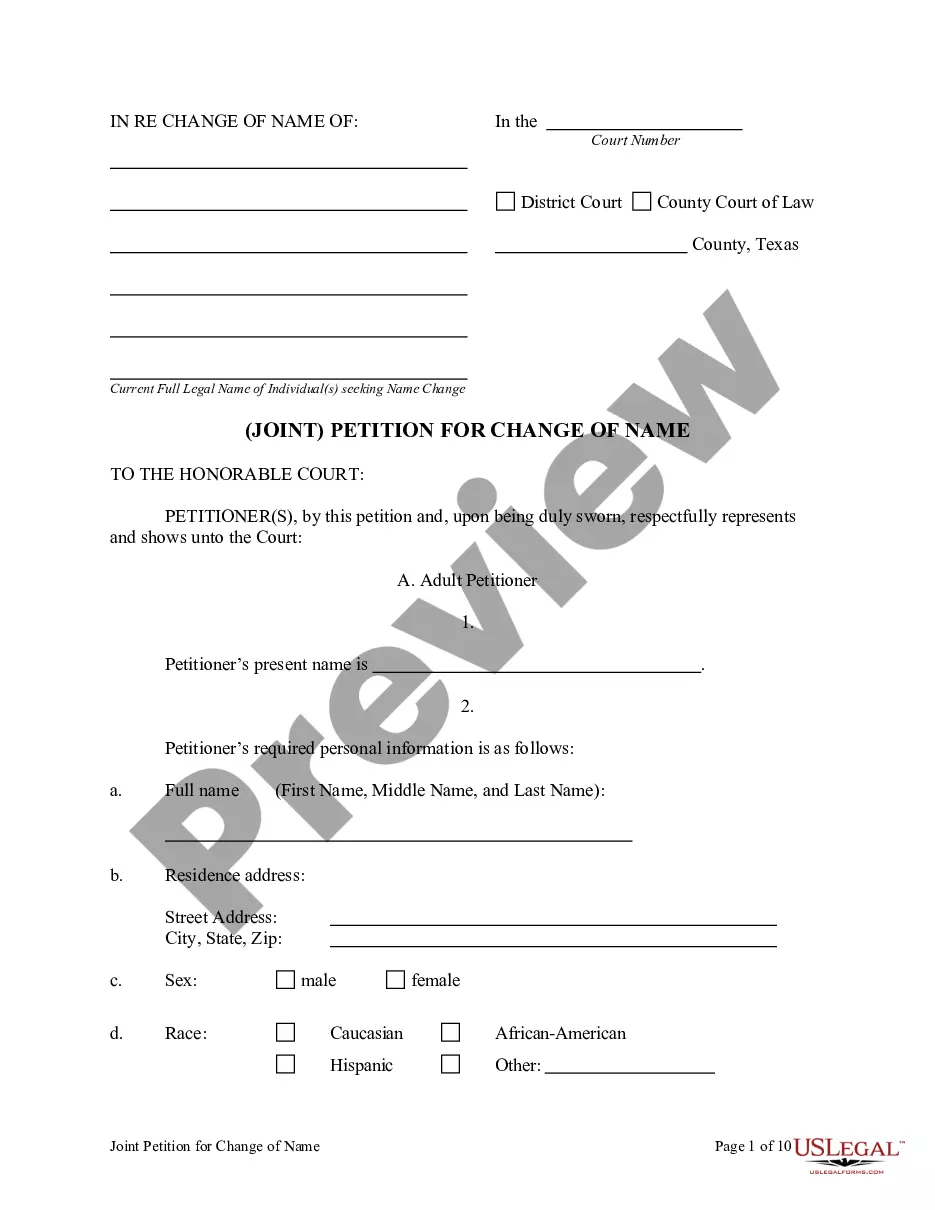

How to fill out Notice Of Lien And Of Sale Of Personal Property Pursuant To Non-Statutory Lien?

Are you in the situation the place you need to have paperwork for sometimes company or personal purposes almost every day? There are a variety of authorized file templates accessible on the Internet, but locating versions you can rely on isn`t simple. US Legal Forms gives a huge number of type templates, like the Nebraska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien, which can be written to meet state and federal specifications.

If you are already knowledgeable about US Legal Forms website and have a merchant account, simply log in. Next, you may down load the Nebraska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien format.

If you do not offer an account and wish to start using US Legal Forms, abide by these steps:

- Obtain the type you require and ensure it is for your appropriate area/area.

- Take advantage of the Preview option to examine the shape.

- See the outline to actually have selected the right type.

- In case the type isn`t what you`re trying to find, use the Research industry to get the type that fits your needs and specifications.

- When you discover the appropriate type, click on Get now.

- Select the rates program you want, fill out the necessary information and facts to create your bank account, and pay money for the transaction utilizing your PayPal or charge card.

- Select a convenient data file format and down load your duplicate.

Find all of the file templates you might have purchased in the My Forms food list. You may get a more duplicate of Nebraska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien at any time, if possible. Just go through the necessary type to down load or printing the file format.

Use US Legal Forms, the most comprehensive assortment of authorized types, to save lots of time and steer clear of faults. The service gives skillfully created authorized file templates that can be used for a range of purposes. Create a merchant account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

For Non-Participating members of electric titles, a release of lien is available by filing a Nebraska Electronic Lien and Title Non-Participating Lender Lien Release application. A lender completes and submits to any County Treasurer or the Department of Motor Vehicles.

Non-Participating Lenders: Lienholder must, within fifteen (15) days after receiving the final payment, submit a Non-Participating Lender Lien Release form to any Motor Vehicle Office. The title is then printed and mailed as instructed by the lienholder.

Items required for issuance of a Nebraska title: Lien Contract (If Financed) Title fee of $10.00. Lien fee of $7.00 (If Financed)

77-1831. Real property taxes; issuance of treasurer's tax deed; notice given by purchaser; contents.

(1) A person commits theft if he or she obtains services, which he or she knows are available only for compensation, by deception or threat or by false or other means to avoid payment for the service.

007.01 At any time within three years after any amount of tax to be collected is assessed, or within ten years after the last recording of the state tax lien or continuation statement, the Tax Commissioner may bring an action in the District Court of Lancaster County, or in the courts of any other state, or the United ...

Any seller who willfully understates the amount upon which the sales tax is due shall be subject to a penalty of one thousand dollars.

77-1818. Real property taxes; certificate of purchase; lien of purchaser; subsequent taxes; purchaser provide notice; contents; prove service of notice; administrative fee.