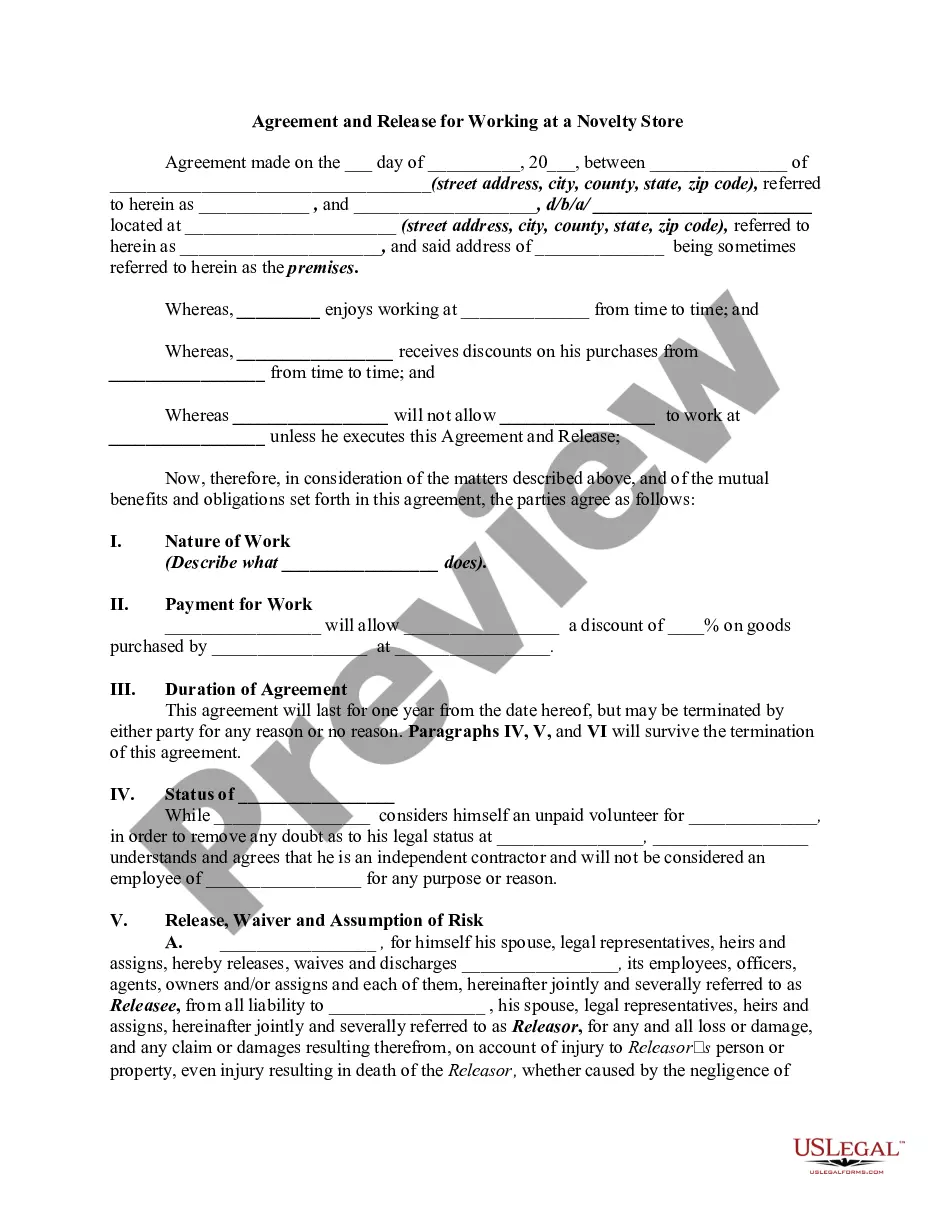

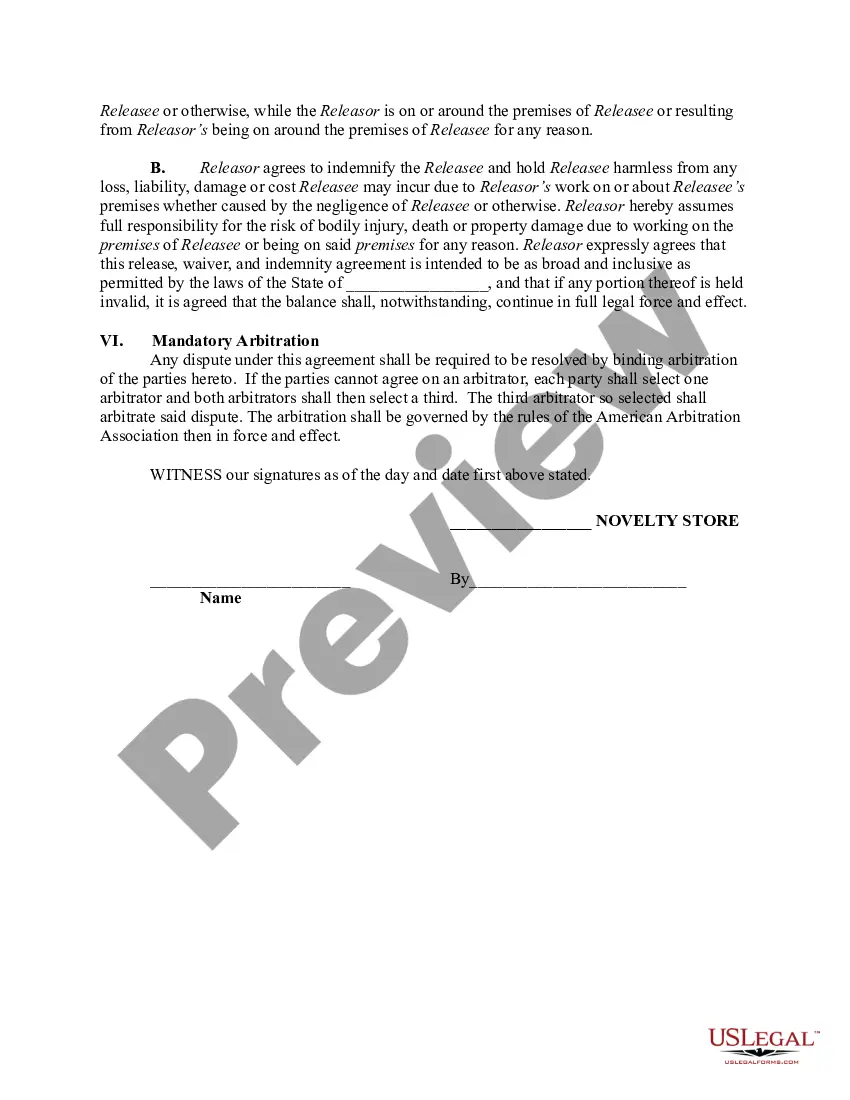

Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed

Description

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

You can spend hours online trying to locate the legal document template that fulfills the federal and state requirements you need.

US Legal Forms provides a vast collection of legal templates which are reviewed by professionals.

You can easily download or print the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed from the service.

To obtain an additional version of the form, utilize the Search field to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and click on the Acquire button.

- Then, you may complete, modify, print, or sign the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed.

- Every legal document template you obtain is your property indefinitely.

- To get another copy of the purchased form, visit the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the region/area of your choice.

- Review the form description to confirm you have picked the correct template.

Form popularity

FAQ

To obtain a seller's permit in Nebraska, you must register with the Nebraska Department of Revenue. This permit allows you to collect sales tax on taxable sales, which is crucial for running a compliant business. If you're considering the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed, securing this permit will enhance your sales operations and ensure you meet state tax obligations.

Nebraska generally requires businesses to apply for a license, with specifics depending on the county or municipality. It's important to check local regulations, as the requirements can vary. For self-employed individuals planning to utilize the Nebraska Agreement and Release for Working at a Novelty Store, securing the proper licenses is essential for smooth operations.

Yes, in most cases, you must obtain a business license to operate legally in Nebraska. This requirement varies depending on your business type and location. If you are working under the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed, familiarizing yourself with local business licensing will ensure you are compliant and avoid potential fines.

To acquire a resale certificate in Nebraska, you must fill out the appropriate application, which you can obtain from the Nebraska Department of Revenue's website. This certificate allows you to make purchases without paying sales tax when acquiring items for resale. This is especially beneficial if you’re running a novelty store under the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed.

Doing business in Nebraska typically involves engaging in any commercial activity or having a physical presence in the state. This can include establishing an office, employing residents, or selling products directly. If you are self-employed and preparing the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed, understanding this definition will help in legal compliance.

Yes, Nebraska is known as a business-friendly state with supportive regulations and economic incentives. The state's focus on fostering entrepreneurship makes it an appealing location for self-employed individuals. If you're considering the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed, you will find an environment conducive to business growth.

Yes, Nebraska requires a general contractor license to operate a construction business legally. For self-employed individuals, including those utilizing the Nebraska Agreement and Release for Working at a Novelty Store, understanding these licensing requirements is vital if your business involves any building or renovation activities.

Form 20 is the 'Nebraska Department of Revenue Tax Application.' This form facilitates the registration process for businesses collecting sales tax. For those engaged in a novelty store as outlined in the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed, this application is crucial to ensure proper tax collection and remittance.

Form 6 in Nebraska pertains to the 'Application for Certificate of Authority' which allows businesses to operate in the state. If you are self-employed, such as in the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed, this form is essential for legal compliance. It establishes your business legitimacy and helps in securing various permits.

A B2B contract in the Netherlands is a formal agreement that governs transactions and relationships between businesses. This contract outlines the expectations, obligations, and rights of the involved parties. It's crucial for mitigating risks associated with commercial relationships. If you are a self-employed individual working in a novelty store, considering similar documentation like the Nebraska Agreement and Release for Working at a Novelty Store - Self-Employed can enhance clarity and protection in your agreements.