Nebraska Construction Contract for Subcontractor

Description

How to fill out Construction Contract For Subcontractor?

Have you found yourself in a scenario where you need documents for either organizational or personal tasks nearly every day.

There is a wide range of legal document templates accessible online, but finding forms you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Nebraska Construction Contract for Subcontractor, which are designed to meet federal and state requirements.

Once you find the right form, click Get now.

Choose the pricing plan you want, enter the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Nebraska Construction Contract for Subcontractor template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the appropriate city/region.

- Utilize the Review button to review the form.

- Check the details to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to discover the form that meets your requirements.

Form popularity

FAQ

An Option 2 contractor in Nebraska refers to a contractor who has obtained a specific classification for projects with a limited scope. This classification allows subcontractors to engage in certain activities without needing a full contractor's license. Being aware of these classifications through a Nebraska Construction Contract for Subcontractor can help you navigate your project requirements effectively.

States like California and New York have some of the strictest licensing requirements, including detailed examinations and proof of work experience. These states prioritize consumer protection, ensuring that only qualified individuals can perform contracting work. Utilizing a Nebraska Construction Contract for Subcontractor can guide you through local regulations, even in more stringent licensing environments.

California is often considered the hardest state to obtain a contractor's license. The process involves rigorous testing, extensive documentation, and proof of experience. For subcontractors operating in Nebraska, understanding the state’s requirements through a solid Nebraska Construction Contract for Subcontractor can significantly ease the path to compliance.

Yes, you need a license to perform roofing work in Wisconsin. The state has specific regulations that require contractors to be licensed to ensure they meet safety and quality standards. If you're considering subcontracting roofing projects, having a proper Nebraska Construction Contract for Subcontractor can help clarify your responsibilities and requirements.

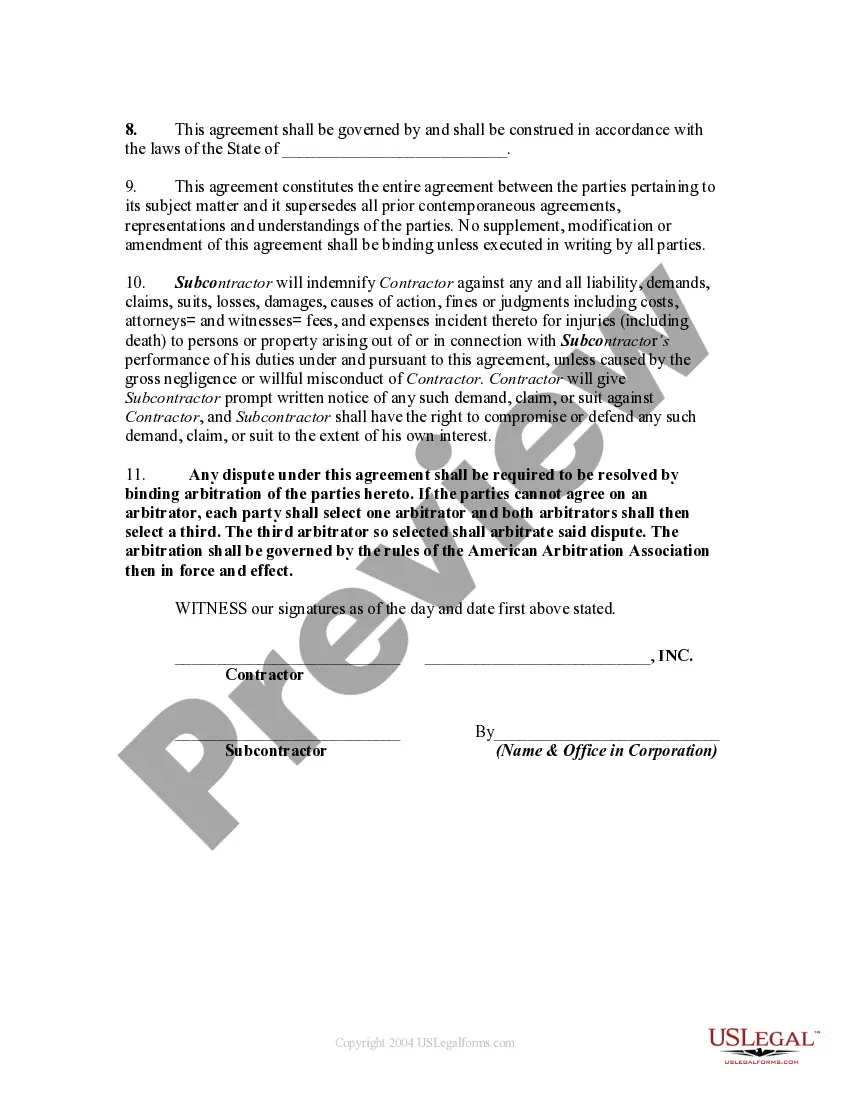

Writing a subcontractor agreement begins with defining the scope of work, payment terms, and deadlines clearly. Include legal obligations, insurance requirements, and termination clauses to protect both parties. Be specific but concise to ensure clarity and mutual understanding. For assistance and templates, check out uslegalforms, which can provide valuable resources to help create a robust subcontractor agreement.

In Nebraska, LLCs are generally treated as pass-through entities for tax purposes, meaning profits are reported on the owners' personal tax returns. However, LLCs can elect to be taxed as corporations if that aligns better with their financial strategies. Understanding your tax obligations is essential for financial planning, especially in the context of a Nebraska Construction Contract for Subcontractor. Consulting with a tax expert can provide tailored advice based on your specific situation.

To write a simple contract agreement, start by outlining the parties involved, the services provided, and the payment terms. Be clear and concise about the rights and responsibilities of each party to minimize misunderstandings. Always include a signature line where both parties can sign to indicate their acceptance of the terms. If you need more detailed templates, uslegalforms can provide various options to guide you through the process.

In Nebraska, construction services are generally exempt from sales tax when provided to real property owners. However, if you sell tangible personal property or services related to construction, different rules may apply. It is essential to clarify these tax obligations when creating a Nebraska Construction Contract for Subcontractor. Consulting tax professionals will guide you in meeting your obligations.

Nebraska has a progressive income tax system with rates ranging from 2.46% to 6.84%, depending on your income level. Understanding this tax structure is crucial for anyone working as an independent contractor in the state. Proper financial planning and awareness can help you manage your income effectively, especially when you operate under a Nebraska Construction Contract for Subcontractor.

In Nebraska, most professional services are not subject to sales tax. However, there are exceptions based on the nature of the service provided. For contractors, services directly related to construction may carry different tax implications. Always check the latest regulations to ensure compliance when drafting your Nebraska Construction Contract for Subcontractor.