Nebraska Corporate Resolution Authorizing a Charitable Contribution

Description

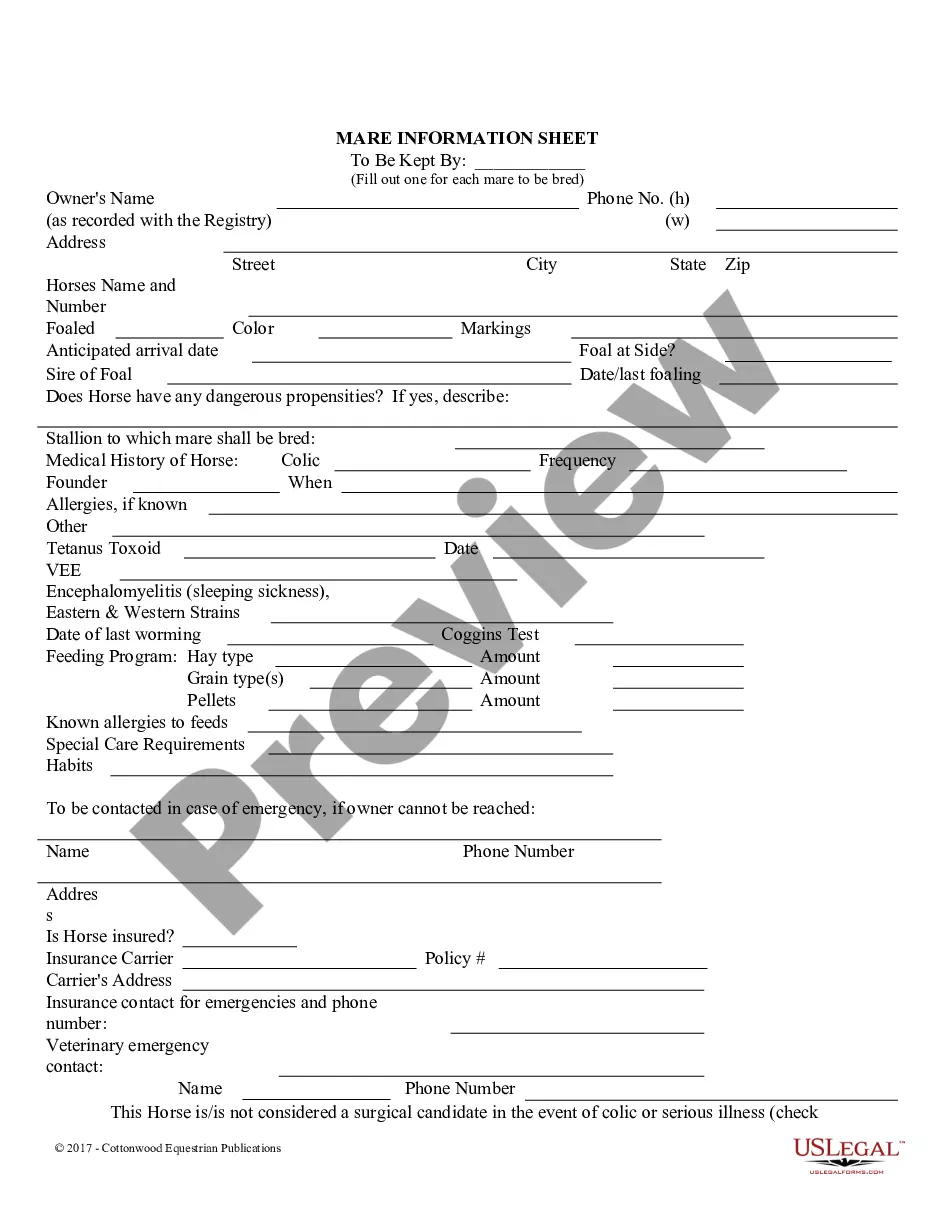

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

You might spend numerous hours online looking for the legitimate document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by experts.

You can download or print the Nebraska Corporate Resolution Authorizing a Charitable Contribution from my services.

If available, use the Review button to examine the document template as well. If you wish to obtain another version of the form, utilize the Search section to find the template that aligns with your preferences and requirements. Once you have located the template you desire, click Purchase now to proceed. Select the pricing plan you prefer, enter your information, and register for an account on US Legal Forms. Complete the transaction using your Visa or Mastercard or PayPal account to purchase the legal document. Select the format of the document and download it to your device. You may edit your document if possible. You can fill out, modify, and sign the Nebraska Corporate Resolution Authorizing a Charitable Contribution. Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, edit, print, or sign the Nebraska Corporate Resolution Authorizing a Charitable Contribution.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

Starting a 501c3 in Nebraska requires completing several steps, including choosing a name, drafting your articles of incorporation, and filing them with the state. It’s also essential to apply for an Employer Identification Number (EIN) from the IRS. Additionally, creating a Nebraska Corporate Resolution Authorizing a Charitable Contribution can facilitate fundraising and operational governance as you move forward with your mission.

To write a resolution for a nonprofit, begin with a clear title that summarizes the main focus, such as a Nebraska Corporate Resolution Authorizing a Charitable Contribution. Next, include a preamble that states the background of the decision being made and the necessity for the resolution. Finally, outline the specific decisions and actions in numbered sections, ensuring clarity and legality for future reference.

Creating a corporate resolution involves drafting a formal document that outlines key decisions made by your board or governing body. Start by clearly stating the purpose of the resolution and including details such as the date and the names of the members voting. It’s vital to keep a record of these resolutions, especially when they involve significant contributions, such as in a Nebraska Corporate Resolution Authorizing a Charitable Contribution.

In Nebraska, a nonprofit organization must have at least three board members. This requirement ensures that governance is balanced and fosters effective decision-making. Remember, diverse perspectives can enhance your nonprofit's sustainability and community impact. Additionally, having a Nebraska Corporate Resolution Authorizing a Charitable Contribution can empower your board to make impactful financial decisions.

Yes, 501c3 organizations can be exempt from sales tax in Nebraska, but they must apply for the exemption through the Nebraska Department of Revenue. This process often involves submitting a valid exemption certificate and ensuring compliance with the federal guidelines for tax-exempt organizations. If your organization plans to make charitable contributions, a Nebraska Corporate Resolution Authorizing a Charitable Contribution can support your exemption status.

Choosing the best state to start a 501c3 depends on various factors, including taxation and legal requirements. Wyoming and Nevada are popular choices due to their favorable tax structures. However, if you are located in Nebraska, starting your organization there can simplify compliance with local laws. Additionally, a Nebraska Corporate Resolution Authorizing a Charitable Contribution can help streamline your operational decisions.

A corporate resolution for authorized signers is a document that designates individuals who have the authority to act on behalf of the company. In the case of a Nebraska Corporate Resolution Authorizing a Charitable Contribution, it would specify which officers can sign checks or agreements related to the donation. This clarity helps ensure proper governance and simplifies the donation process.

A board resolution letter is an official document that reflects decisions made by a company's board. For instance, a letter for a Nebraska Corporate Resolution Authorizing a Charitable Contribution would detail the approval of the contribution, including the amount and recipient. This letter acts as a formal confirmation that the board has agreed to the terms laid out in the resolution.

The resolution of directors is a formal statement that expresses the decisions made during a board meeting. In the context of a Nebraska Corporate Resolution Authorizing a Charitable Contribution, this document outlines the board's agreement on donating to a charitable cause. It serves as a legal record, ensuring that the decision is documented and recognized by all members.

The format for writing a resolution typically begins with a title, followed by a preamble that provides context. For example, a Nebraska Corporate Resolution Authorizing a Charitable Contribution would include statements of intent and approval by the board. Conclude with the signatures of the officers and the date, ensuring that it complies with legal standards.