Nebraska Lease or Rental of Computer Equipment

Description

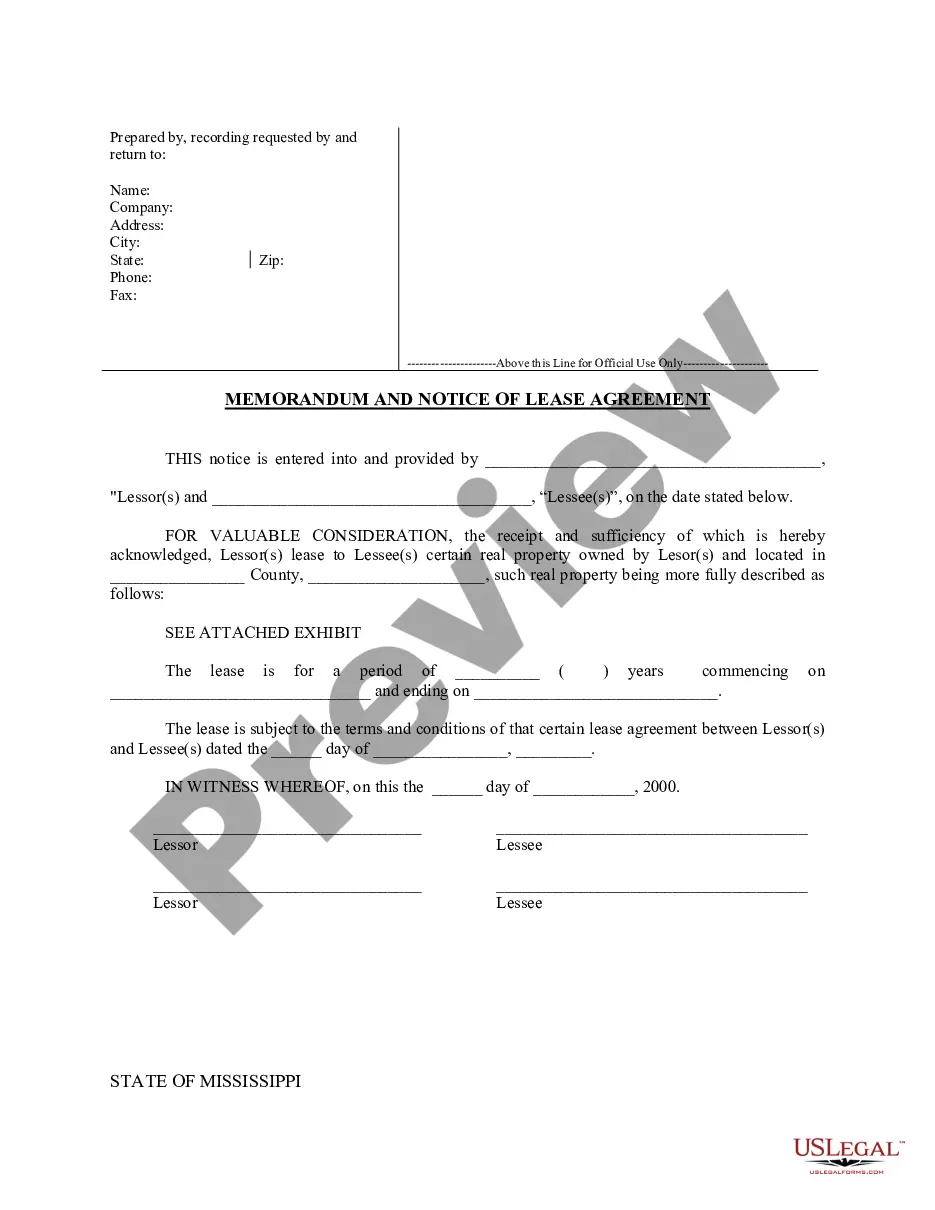

How to fill out Lease Or Rental Of Computer Equipment?

Selecting the most suitable authentic document template can be challenging.

Certainly, there are many templates accessible on the internet, but how can you find the genuine form you need.

Utilize the US Legal Forms platform. The service offers thousands of templates, including the Nebraska Lease or Rental of Computer Equipment, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and review the form description to confirm it is the right one for you.

- All forms are vetted by specialists and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to locate the Nebraska Lease or Rental of Computer Equipment.

- Use your account to browse through the legitimate forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

When it comes to a rental property, you can write off several expenses like mortgage interest, property taxes, and maintenance costs. Additionally, if you're leasing equipment for the property, such as computers or appliances through the Nebraska Lease or Rental of Computer Equipment, those expenses can also be deducted. Proper record-keeping helps ensure you maximize your deductions come tax time.

You can write off various types of equipment on your taxes, including computers, machinery, and tools that your business uses. Specifically, when discussing the Nebraska Lease or Rental of Computer Equipment, almost any equipment used for business purposes can qualify for a deduction. Keep in mind that you'll need proper documentation to support your claims.

Yes, you can usually write off rental equipment on your taxes. The IRS allows businesses to deduct the expenses related to equipment rentals, which can significantly lower taxable income. Therefore, if you are using equipment through the Nebraska Lease or Rental of Computer Equipment, you should take advantage of this deduction.

Filing a rental, particularly for the Nebraska Lease or Rental of Computer Equipment, involves a few straightforward steps. First, gather all necessary documents, including your rental agreement and payment records. Then, you will need to report the rental income and expenses on your tax returns, ensuring you follow IRS guidelines accurately.

In many cases, rental equipment is not tax exempt. However, specific exemptions can depend on the nature of your business and the type of equipment rented. For instance, the Nebraska Lease or Rental of Computer Equipment may have different guidelines based on state laws. Consulting a tax professional can help clarify your situation.

Being exempt from Nebraska withholding means that certain individuals or organizations do not have to have state income taxes withheld from their payments. This can apply to specific business structures or scenarios, including those facilitating a Nebraska Lease or Rental of Computer Equipment. Understanding your withholding status is essential for proper financial planning.

The controlling interest transfer tax applies when there is a change in control of certain entities in Nebraska, impacting ownership structures. While it is not directly related to a Nebraska Lease or Rental of Computer Equipment, being aware of this tax is vital for businesses considering changes in structure or ownership. Consult with a legal expert to navigate these complexities.

Yes, software as a service (SaaS) is typically taxable in Nebraska. When you enter into a Nebraska Lease or Rental of Computer Equipment that includes SaaS, sales tax applies to those services. Understanding the tax implications helps ensure compliance and can influence your budgeting for technology services.

Regulation 1 020 discusses the tax treatment of certain services and transactions, including leases and rentals of property in Nebraska. This regulation impacts the Nebraska Lease or Rental of Computer Equipment by outlining how various services are taxed. Staying informed about Reg 1 020 will enhance your understanding of your financial responsibilities.

Form 13 is a Nebraska sales tax exemption certificate used by businesses to claim exemption on certain purchases, including some rental agreements. When you engage in a Nebraska Lease or Rental of Computer Equipment, this form can help clarify any tax-exempt status you may claim. Always ensure you follow proper protocol when utilizing Form 13.