Nebraska Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building

Description

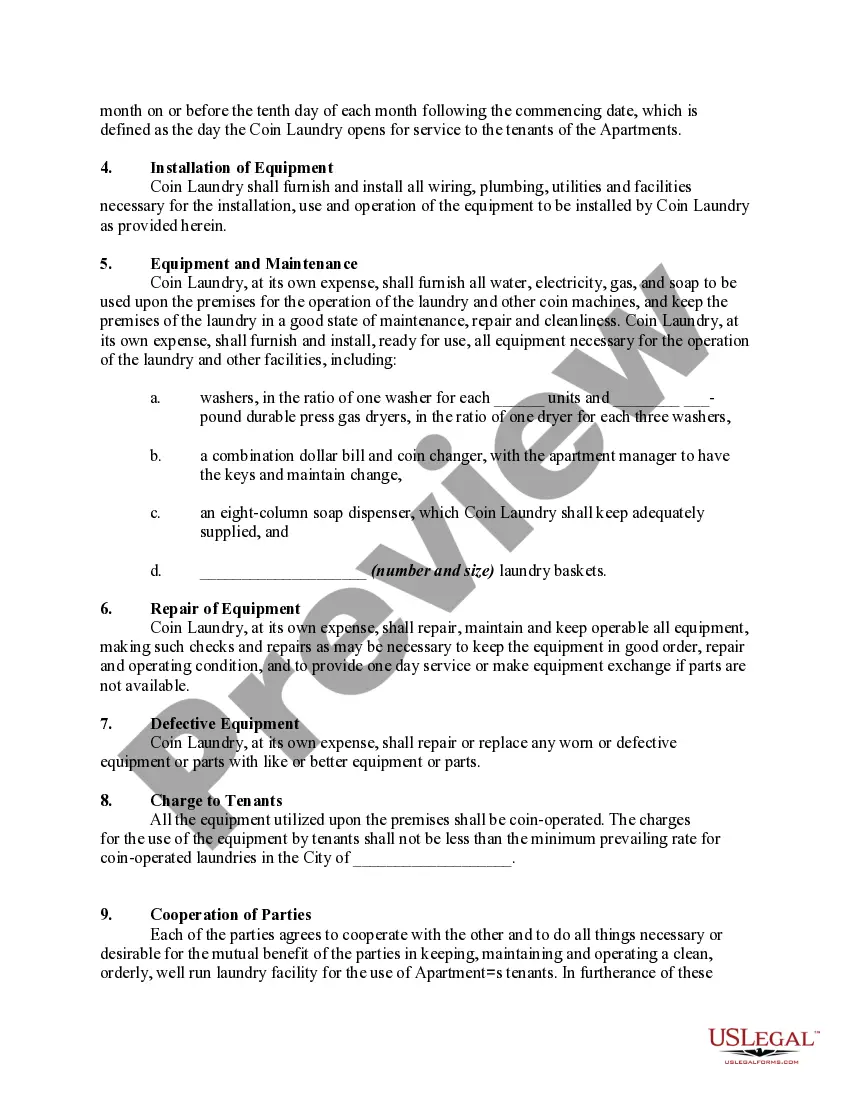

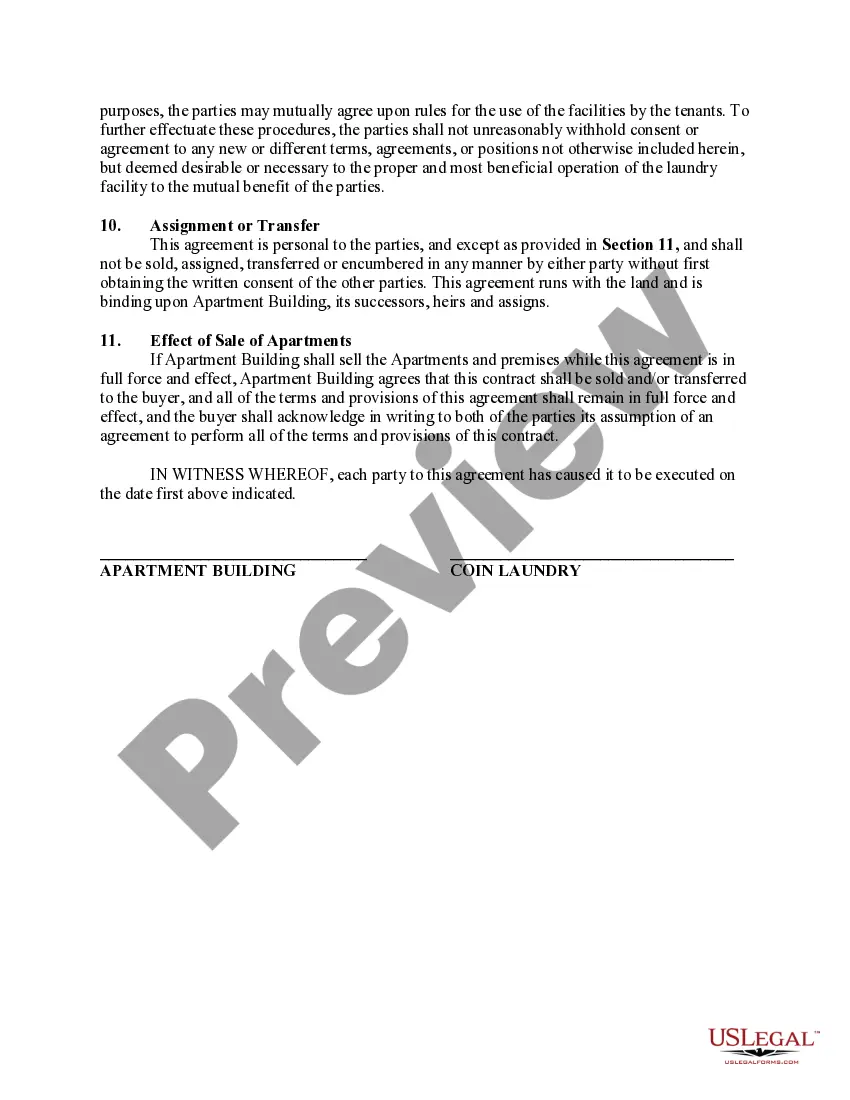

Coin-Operated Laundry in an Apartment Building.

How to fill out Agreement Granting Exclusive Right To Install, Operate And Maintain Coin-Operated Laundry In Apartment Building?

If you desire to total, obtain, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal needs are organized by categories and states, or keywords.

Step 4. After you have found the form you need, click on the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to acquire the Nebraska Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building in just a few clicks.

- If you are already a user of US Legal Forms, Log In to your account and click on the Download button to retrieve the Nebraska Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In Nebraska, the frequency of filing sales tax depends on the volume of your sales. Businesses can be required to file monthly, quarterly, or annually. If you're navigating a Nebraska Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, knowing your filing schedule helps you maintain compliance and avoid penalties.

To obtain a resale certificate in Nebraska, you need to apply through the state’s Department of Revenue. This process typically involves filling out an application form and providing pertinent business information. If you are establishing a Nebraska Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, acquiring this certificate can facilitate tax-exempt purchases for your operations.

The controlling interest transfer tax applies when ownership of a corporation or LLC changes significantly. This tax is calculated based on the value of the transaction. For those engaged in a Nebraska Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, being aware of this tax can influence business decisions regarding ownership structures.

Reg 1-013 outlines the guidelines for the Nebraska sales tax exemption on certain purchases. It explains the conditions under which sales tax does not apply, which is particularly useful for businesses like yours. If you are entering a Nebraska Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, knowing these regulations can enhance your financial strategies.

Form 13 is a crucial document in Nebraska that is used for property tax purposes. This form is specifically important for claiming exemptions or special valuations related to agricultural land and other properties. For businesses involved in a Nebraska Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, it's essential to understand how Form 13 can impact your property taxes.