Nebraska Consulting Agreement - with Former Shareholder

Description

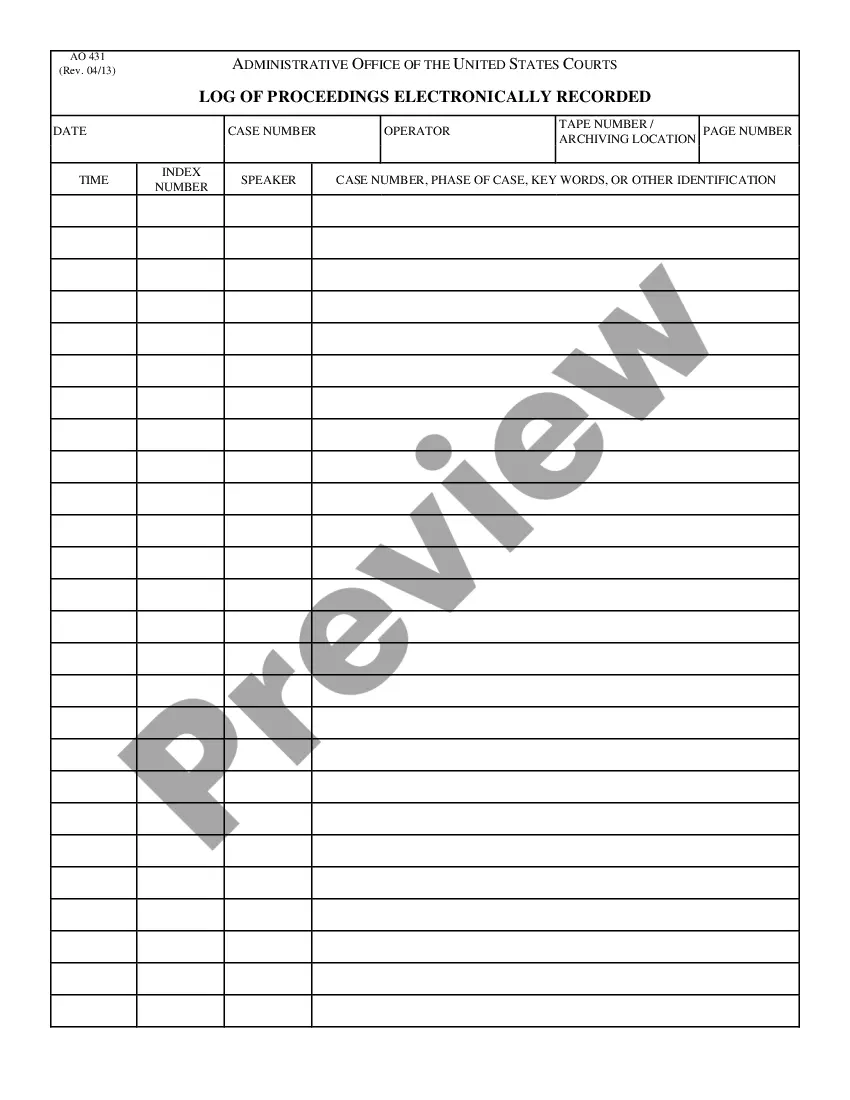

How to fill out Consulting Agreement - With Former Shareholder?

If you want to finalize, obtain, or create legal document templates, utilize US Legal Forms, the premier collection of legal documents, available online. Use the website's straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords. Utilize US Legal Forms to retrieve the Nebraska Consulting Agreement - with Former Shareholder in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to access the Nebraska Consulting Agreement - with Former Shareholder. You can also access forms you previously saved from the My documents tab of your account.

Every legal document template you purchase is yours permanently. You will have access to every form you saved in your account. Select the My documents section and choose a form to print or download again.

Compete and acquire, and print the Nebraska Consulting Agreement - with Former Shareholder using US Legal Forms. There are thousands of professional and state-specific forms available for your personal or business needs.

- Step 1. Ensure you have selected the form for the correct city/state.

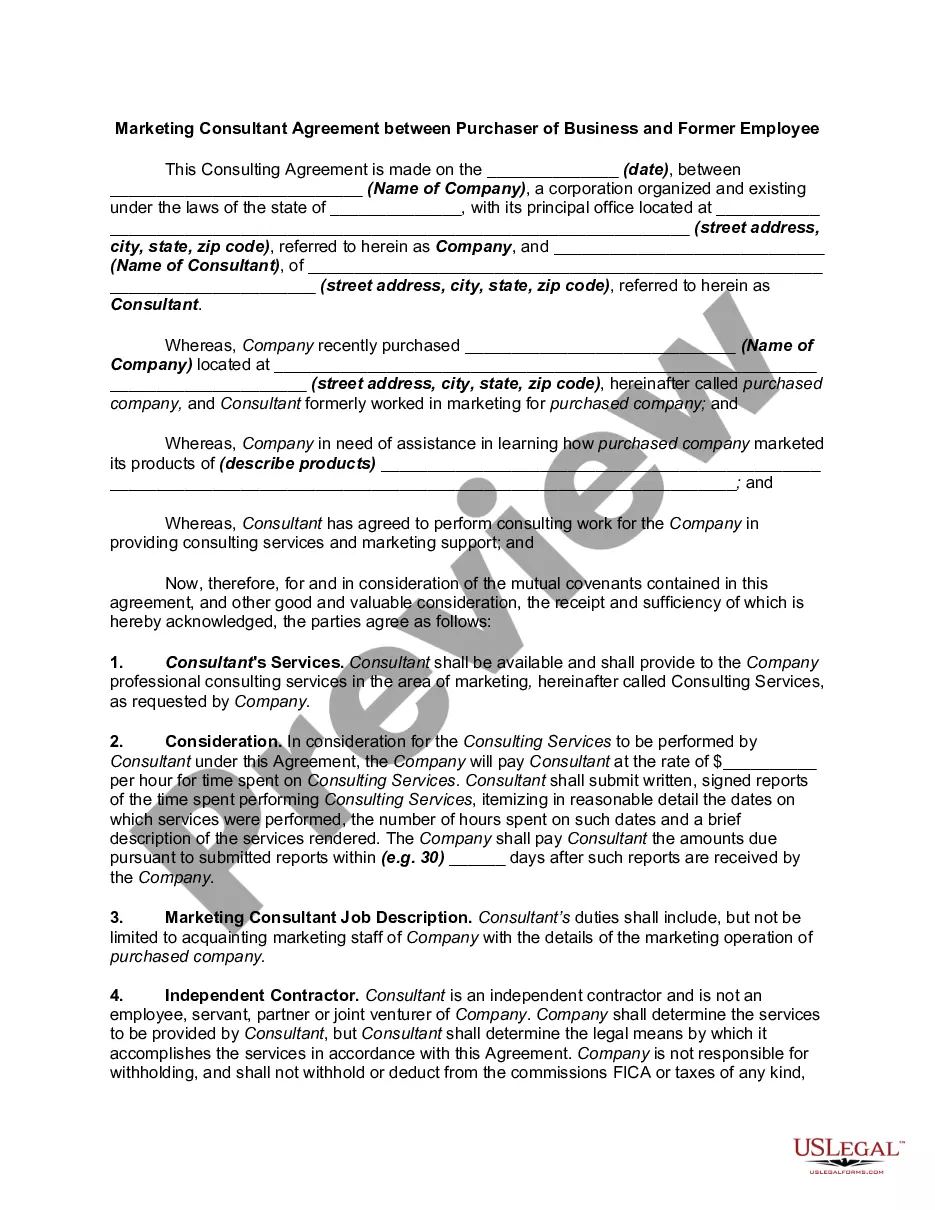

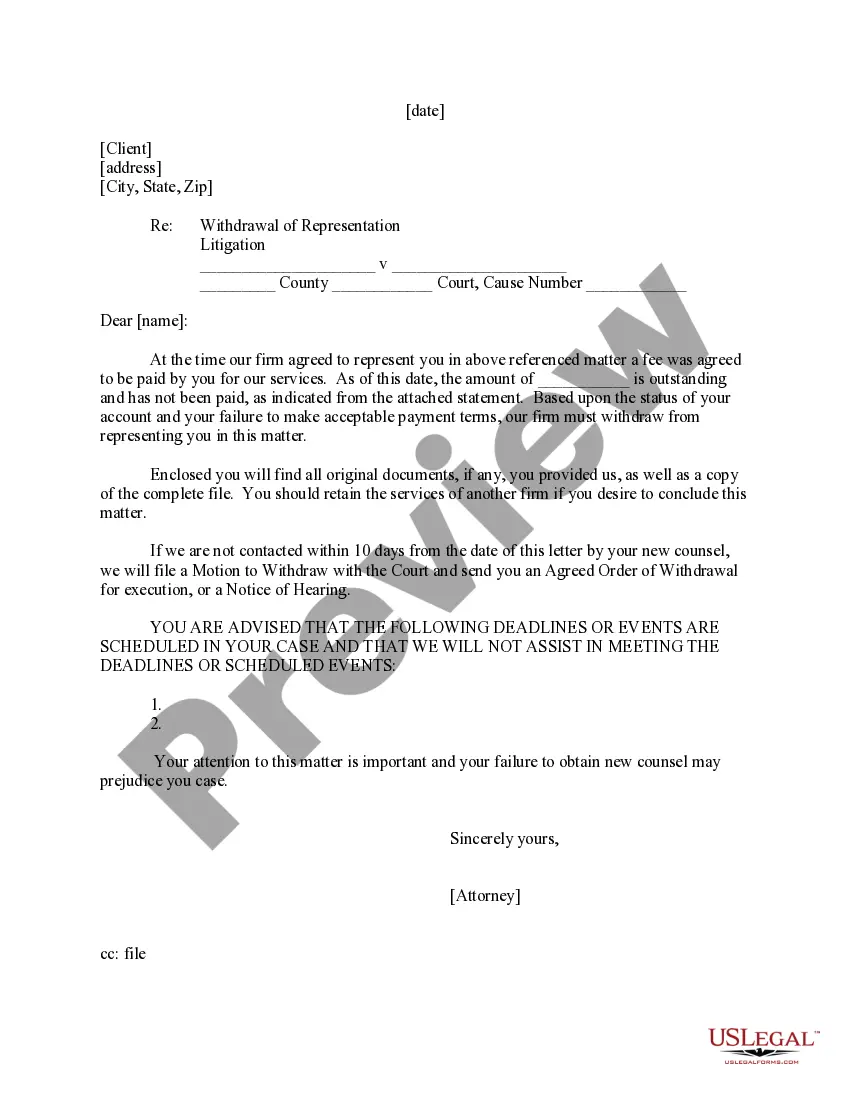

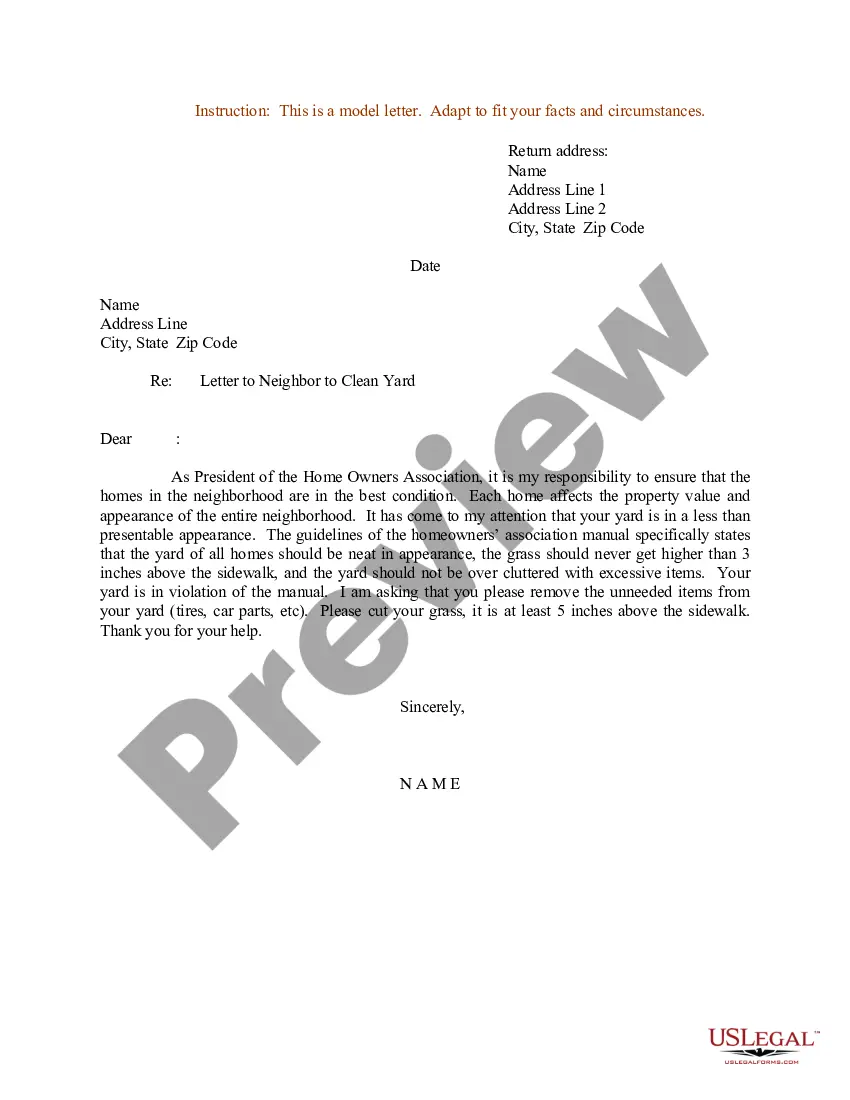

- Step 2. Use the Review option to check the form's content. Do not forget to read the description.

- Step 3. If you are dissatisfied with the type, utilize the Search area at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify and print or sign the Nebraska Consulting Agreement - with Former Shareholder.

Form popularity

FAQ

A shareholder agreement typically governs the relationships among shareholders in a corporation, detailing their rights and responsibilities. In contrast, an LLC agreement outlines the operations and management of a limited liability company. When working with a Nebraska Consulting Agreement - with Former Shareholder, knowing these differences can help streamline your business structure and planning.

A consultant agreement usually involves providing professional advice or services on a project basis, while a contractor agreement often involves work that requires more direct involvement. Both agreements serve distinct purposes, and understanding their differences is crucial for compliance. For those entering a Nebraska Consulting Agreement - with Former Shareholder, recognizing these distinctions can guide your contract decisions.

Choosing between a statement of work and a consulting agreement depends on your project scope. A statement of work is more detailed and typically outlines deliverables, timelines, and specific tasks, while a consulting agreement provides broader terms. In many cases, a Nebraska Consulting Agreement - with Former Shareholder can serve as the foundation, supplemented by a statement of work for finer details.

A Managed Services Agreement (MSA) focuses on ongoing operational support and services, while a Master Services Agreement sets the overarching terms for various projects. The MSA is more about continuous service delivery, whereas the standard MSA defines the relationship for multiple engagements. Utilizing a Nebraska Consulting Agreement - with Former Shareholder can clarify these roles based on your specific needs.

Verbal agreements can be legally binding in Nebraska, but proving their terms can be challenging. It is often advisable to have written agreements, such as a Nebraska Consulting Agreement - with Former Shareholder, to avoid misunderstandings. Written documentation provides clear evidence of the agreement and protects all parties involved.

While not all shareholders must agree to a shareholders agreement, having consensus is beneficial. A shareholders agreement outlines the rights and responsibilities of shareholders, providing clarity and preventing disputes. In cases involving a Nebraska Consulting Agreement - with Former Shareholder, having an agreed-upon shareholders agreement can facilitate smoother negotiations and discussions.

A Master Services Agreement (MSA) in consulting is a strategic document that establishes the general terms and conditions under which future projects will be executed. This agreement covers multiple projects rather than just one, making it easier to manage ongoing relationships. When using a Nebraska Consulting Agreement - with Former Shareholder, the MSA can help set clear expectations for collaboration.

A consulting agreement outlines the specific duties and terms between a consultant and a client, while a Master Services Agreement (MSA) provides a framework for a broader range of services to be delivered over time. In the context of a Nebraska Consulting Agreement - with Former Shareholder, the consulting agreement focuses on individual tasks, whereas the MSA governs the overall relationship. Understanding these differences helps you choose the right agreement for your needs.

Writing your own shareholder agreement is possible, and it allows you to customize the terms as needed. Just ensure it complies with legal standards and addresses essential points like voting rights and profit distribution. Utilizing a Nebraska Consulting Agreement - with Former Shareholder template from uslegalforms can guide you in creating a more effective and legally sound document.

An LLC does not have shareholders; instead, it has members. However, it can benefit from an operating agreement that functions similarly to a shareholders agreement. A Nebraska Consulting Agreement - with Former Shareholder can help you establish clear guidelines and procedures for member decisions and responsibilities.