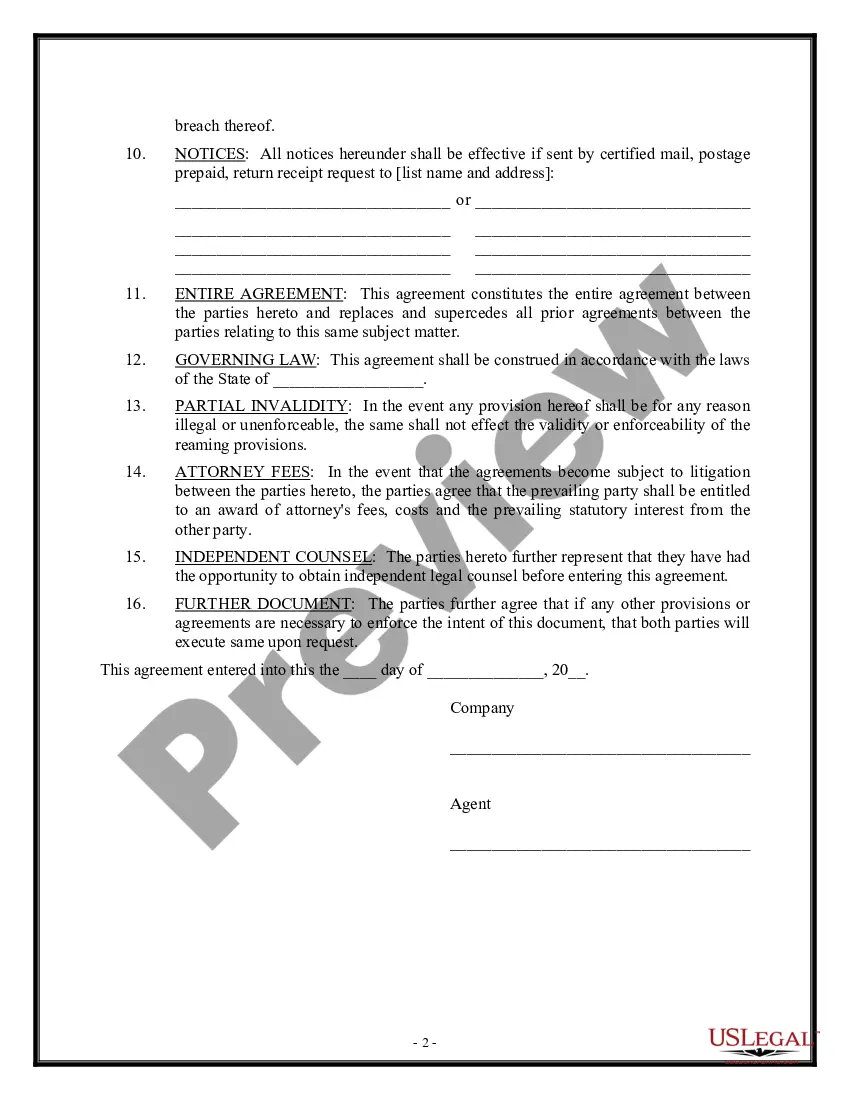

Nebraska Commission Agreement - General

Description

How to fill out Commission Agreement - General?

You can spend hours online trying to locate the proper legal document template that aligns with the federal and state requirements you desire.

US Legal Forms offers a vast array of legal forms that are examined by experts.

You can quickly download or print the Nebraska Commission Agreement - General from their service.

In order to locate another version of the form, utilize the Research field to find the template that fulfills your needs and criteria.

- If you have a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, edit, print, or sign the Nebraska Commission Agreement - General.

- Every legal document template you acquire is yours indefinitely.

- To retrieve another copy of the purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for the area/town of your choice.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

To transfer LLC ownership in Nebraska, review your operating agreement for specific procedures. Typically, this includes documenting the transfer, obtaining member approval, and filing updates with the Nebraska Secretary of State. Utilizing a Nebraska Commission Agreement - General can facilitate a smooth transition and maintain accurate records of ownership changes.

Transferring an LLC to another state involves a process known as 'domestication,' which is not available in every state. If permitted, this usually requires filing paperwork in both the old and new states. A Nebraska Commission Agreement - General can help you navigate the complexities of this process, ensuring compliance with both states' laws.

Transferring ownership of an LLC can have various tax implications, depending on the nature of the transfer and the LLC’s structure. Generally, it may trigger capital gains taxes or affect the way profits and losses are reported. Consulting a tax professional is wise, and a Nebraska Commission Agreement - General can also provide insights on how ownership changes may impact your tax responsibilities.

Changing ownership of an LLC in Nebraska typically involves updating the operating agreement and notifying the Nebraska Secretary of State. Depending on your LLC’s structure, this may require a vote among members. A Nebraska Commission Agreement - General can streamline this process and ensure that all necessary changes are documented.

While Nebraska does not legally require LLCs to have an operating agreement, it is highly recommended. An operating agreement outlines the structure and management of your LLC, helping to prevent disputes among members. Using a Nebraska Commission Agreement - General can aid in the creation of a comprehensive operating agreement that suits your business needs.

To file a DBA (Doing Business As) in Nebraska, you must first choose a name that complies with state regulations. Then, you need to submit a registration form and any required fees to the county clerk where your business is located. A Nebraska Commission Agreement - General can guide you through the process, helping you ensure that your DBA is properly filed and protected.

Yes, Nebraska requires every LLC to have a registered agent. The registered agent acts as the official point of contact for receiving legal documents and notices. This requirement ensures that your LLC maintains good standing, and utilizing a Nebraska Commission Agreement - General can simplify compliance with this obligation.

To remove someone from an LLC in Nebraska, you need to follow specific procedures outlined in your operating agreement or state laws. Generally, this involves holding a vote among members to approve the removal and then filing the necessary paperwork with the Nebraska Secretary of State. A Nebraska Commission Agreement - General can help clarify the process and establish terms for the removal.

Changing the name of your LLC with the IRS involves filing Form 8822-B, notifying them of the name change. This form ensures your business records are up-to-date. Additionally, updating your Nebraska Commission Agreement - General will help avoid any confusion regarding your business identity.

Yes, you can change the name of your LLC in Nebraska and retain the same Employer Identification Number (EIN). The IRS allows businesses to keep their EIN as long as there are no substantial changes to the business structure. However, ensure that your Nebraska Commission Agreement - General reflects the name change to maintain accurate records.