Nebraska Bill of Sale - Quitclaim

Description

How to fill out Bill Of Sale - Quitclaim?

US Legal Forms - among the top libraries of legal forms in the United States - offers a diverse selection of legal document templates that you can download or print.

By using the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms like the Nebraska Bill of Sale - Quitclaim within moments.

If you already have a subscription, Log In and download the Nebraska Bill of Sale - Quitclaim from the US Legal Forms catalog. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction by using your credit card or PayPal account.

Select the format and download the form to your device. Make edits. Fill, modify, print, and sign the downloaded Nebraska Bill of Sale - Quitclaim. Each document you add to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nebraska Bill of Sale - Quitclaim with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates to meet your business or personal needs.

- First, ensure you have selected the correct form for your city/region.

- Click the Review button to examine the content of the form.

- Check the form summary to confirm that you have selected the appropriate one.

- If the form does not meet your requirements, use the Search feature at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Purchase now button.

- Choose the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Generally, you do not need a notary to sell a car in Nebraska, but having a notarized bill of sale can provide added security in your transaction. Both the buyer and seller benefit from a clear, signed document that verifies the terms of the sale. If you want to elevate your selling experience, consider using the Nebraska Bill of Sale - Quitclaim to create a professional and secure transaction.

In Nebraska, a bill of sale does not need to be notarized for most transactions. However, having it notarized can provide an extra layer of protection and verification for both the buyer and seller. It's a good idea to consider notarization, especially for high-value transactions. Using a Nebraska Bill of Sale - Quitclaim can enhance clarity and accountability in your agreements.

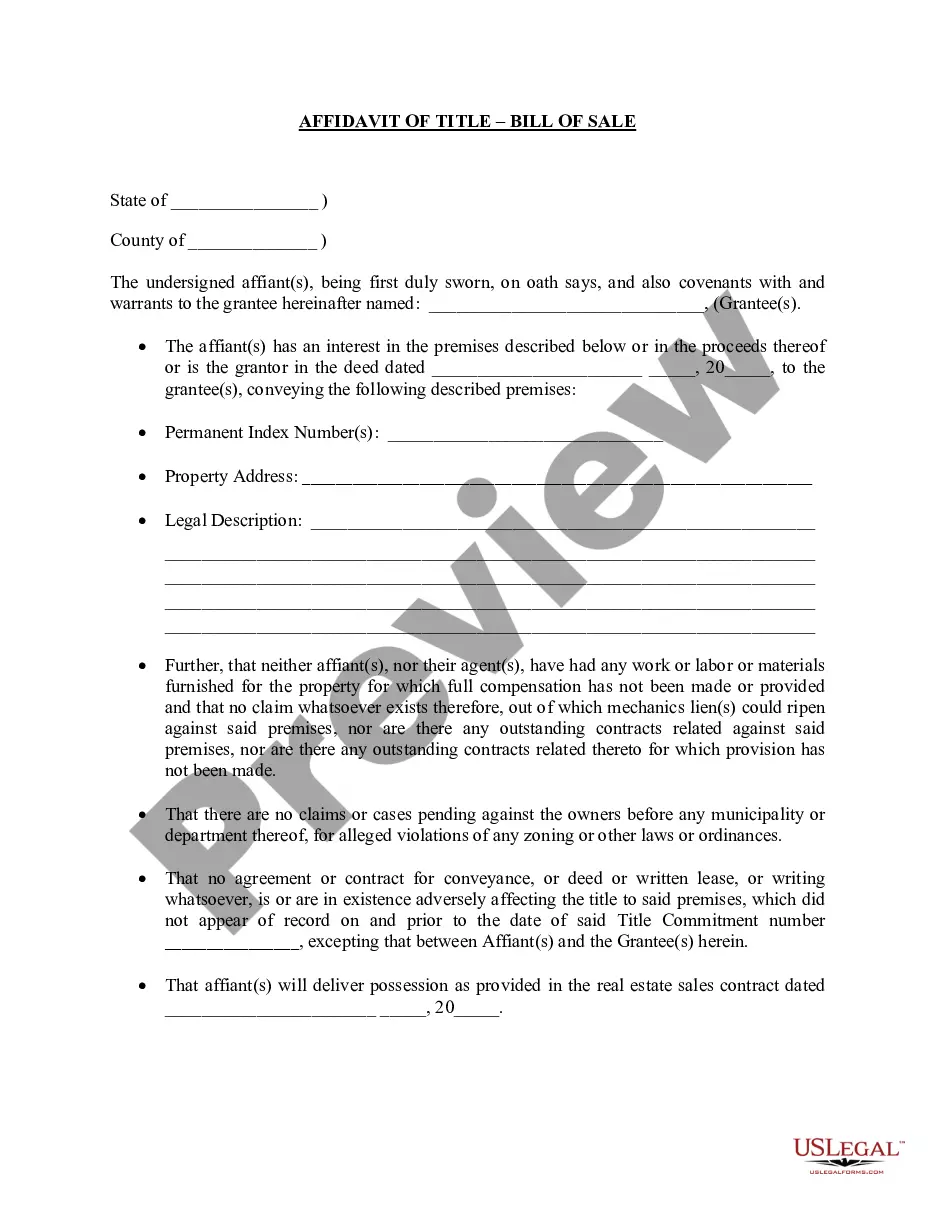

To properly fill out a quit claim deed, start by providing the names of the current owner and the recipient. Clearly describe the property, including its address and legal boundaries. It's crucial to have the document notarized and then file it with the county recorder's office. For an efficient process, consider using the Nebraska Bill of Sale - Quitclaim from US Legal Forms to guide you through each step.

An example of a quitclaim is when a property owner transfers their interest in a property to a family member, without guaranteeing the title's quality. The grantor simply relinquishes any claim to the property. This type of transfer is commonly used among friends or family to clear up property lines or during divorce settlements. Make sure to utilize the Nebraska Bill of Sale - Quitclaim for a smooth transaction.

To fill out a quit claim deed in Nebraska, start by obtaining a blank form from a reliable source. Include the grantor's name, the grantee's name, and a detailed legal description of the property. Ensure you sign the document in front of a notary public to validate it. You can simplify this process by using the Nebraska Bill of Sale - Quitclaim available on the US Legal Forms platform.

Those who benefit most from a quitclaim deed are individuals looking to transfer property easily and informally, such as family members during estate planning. A Nebraska Bill of Sale - Quitclaim allows for quick transfers without extensive legal processes. However, parties involved must be aware of the associated risks and lack of protection, making it essential to weigh the pros and cons before finalizing the deed.

Typically, quitclaim deeds, including those involving a Nebraska Bill of Sale - Quitclaim, are not reported to the IRS at the time of transfer. However, if there is a capital gain from the property, that gain may need to be reported when you sell it later. It's best to consult with a tax professional to understand any tax obligations that may arise from your specific situation.

Yes, you can create a quit claim deed yourself, but it is advisable to follow the proper guidelines to ensure legality. You can use resources like USLegalForms to access templates that comply with Nebraska laws. Doing it yourself means you must ensure accuracy and completeness, as any errors can lead to disputes down the line. Consulting a legal expert can also add an extra layer of protection.

A significant disadvantage of a quitclaim deed is the lack of title insurance. Unlike a traditional deed, a quit claim doesn't ensure that the title is clear, leaving the buyer susceptible to future claims. Furthermore, disputes may arise if the property has unknown issues that weren't disclosed, which can lead to unintended financial consequences for the grantee. Therefore, researching thoroughly before signing a Nebraska Bill of Sale - Quitclaim is crucial.

One negative aspect of a Nebraska Bill of Sale - Quitclaim is that it transfers ownership without any guarantees. This means the grantee receives only the seller's interest in the property, which may be limited or non-existent. Additionally, if there are liens or debts associated with the property, the grantee may be responsible for them. It's essential to understand these risks before proceeding.