This form is a Class Action Complaint. Plaintiffs seek damages and injunctive relief from defendants for liability under the Racketeer Influenced and Corrupt Organizations Act(RICO). Plaintiffs contend that the defendants' actions justify an award of substantial punitive damages against each.

Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers

Description

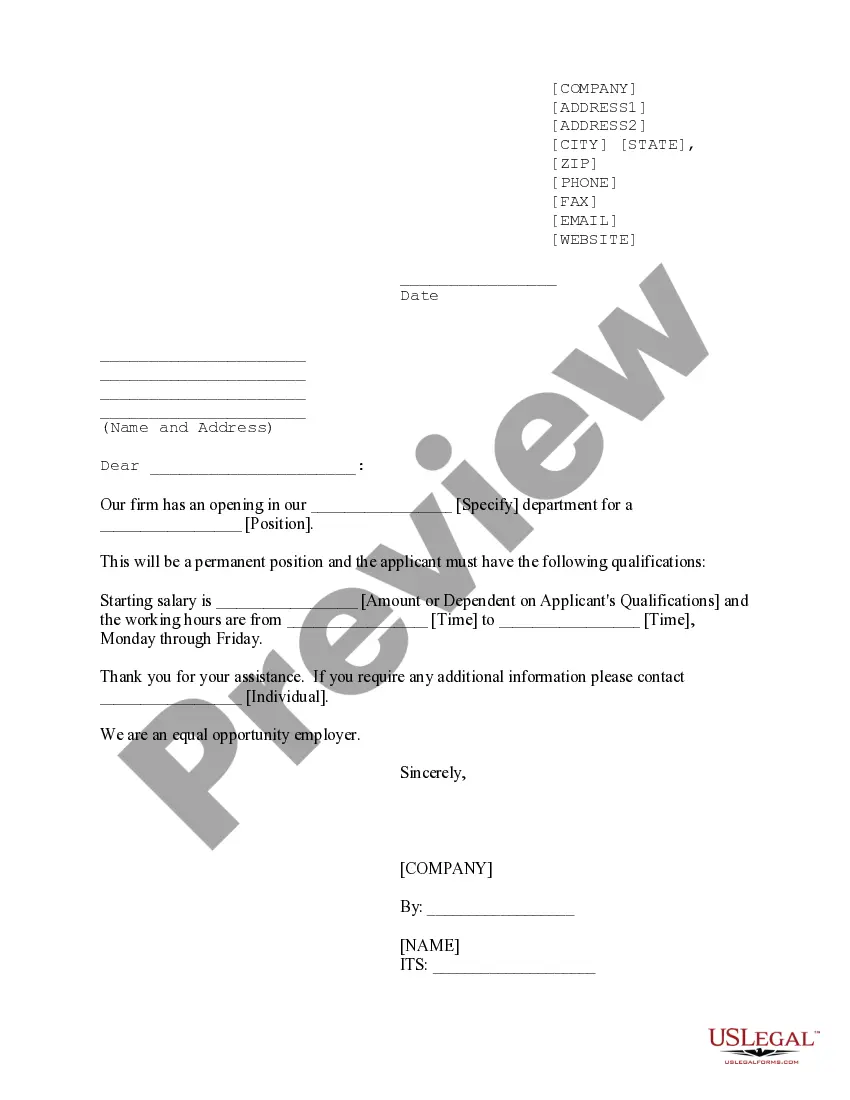

How to fill out Complaint For Class Action For Wrongful Conduct - RICO - By Insurers?

Are you presently in a position where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding forms you can trust isn't simple.

US Legal Forms offers thousands of form templates, including the Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers, which can be customized to meet state and federal regulations.

Select the pricing plan you prefer, provide the required information to create your account, and place an order using your PayPal or credit card.

Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers anytime, if necessary. Just click on the needed form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Preview button to review the form.

- Check the details to ensure you have selected the correct form.

- If the form isn't what you're looking for, use the Search box to find the form that meets your needs and requirements.

- Once you locate the correct form, click on Get now.

Form popularity

FAQ

If your insurance claim is denied, start by reviewing the denial letter to understand the insurer's reasoning. It's important to gather all necessary documentation that supports your claim. If you believe the denial is unjust, you can file a complaint with the Nebraska Department of Insurance. Furthermore, for serious cases of wrongful conduct, you may want to explore filing a Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers to address systemic issues with the insurer.

When writing a complaint letter against an insurance company, start by clearly stating your concerns, including specific details about your policy and the issue at hand. Include any supporting documents that validate your claims. Be concise and direct, using a respectful tone throughout your letter. For more complex cases involving wrongful conduct, consider referencing a Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers to outline broader issues.

Insurance companies in Nebraska are regulated by the Nebraska Department of Insurance. This department ensures that insurers operate fairly and comply with state laws. If you believe your insurer has engaged in wrongful conduct, you can report them to this regulatory body. Moreover, if your case involves class action claims, consider utilizing a Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers as part of your strategy.

To file a complaint against an insurance company in Nebraska, you should first gather all relevant documentation, including your policy details and any correspondence related to your claim. Next, you can visit the Nebraska Department of Insurance website to find the formal complaint process. Additionally, if your situation involves potential wrongful conduct under RICO, consider submitting a Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers to strengthen your case.

To take action against an insurance company, you can file a Nebraska Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. Begin by gathering all relevant documentation, including your policy details and any correspondence with the insurer. Next, consider consulting with a legal expert who specializes in RICO claims to assess your situation. Finally, utilize platforms like uslegalforms to access the necessary forms and guides to streamline your complaint process.

010.01(B) When a loss requires replacement of items and the replacement items do not reasonably match in quality, color or size, the insurer shall replace all items in the area so as to conform to a reasonably uniform appearance.

Further, although Nebraska law has a five-year statute of limitations for contracts, Nebraska's limitation was not found to prohibit contractual limitation periods arising from policies issued in other states, just those policies issued in Nebraska.

If this has happened to you, you may be able to recover your damages from your insurer through a bad faith lawsuit. In a successful insurance bad faith lawsuit, you could receive compensation for the losses you suffered as well as recover your attorney fees.

Stat. § 44-2012. An insured seeking damages for a bad faith settlement of a first-party insurance claim must prove the insurer had no reasonable basis for denying the claim and that the insurer knew of, or recklessly disregarded, the lack of reasonable basis for the denial.