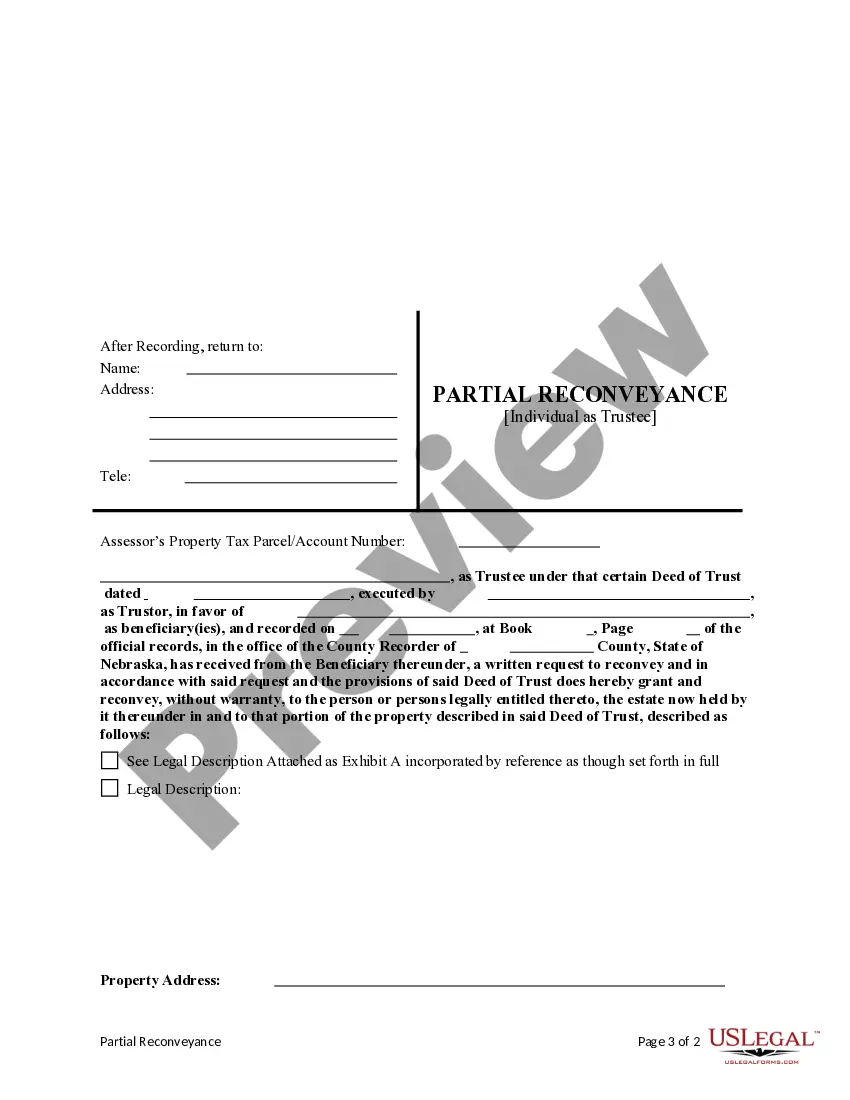

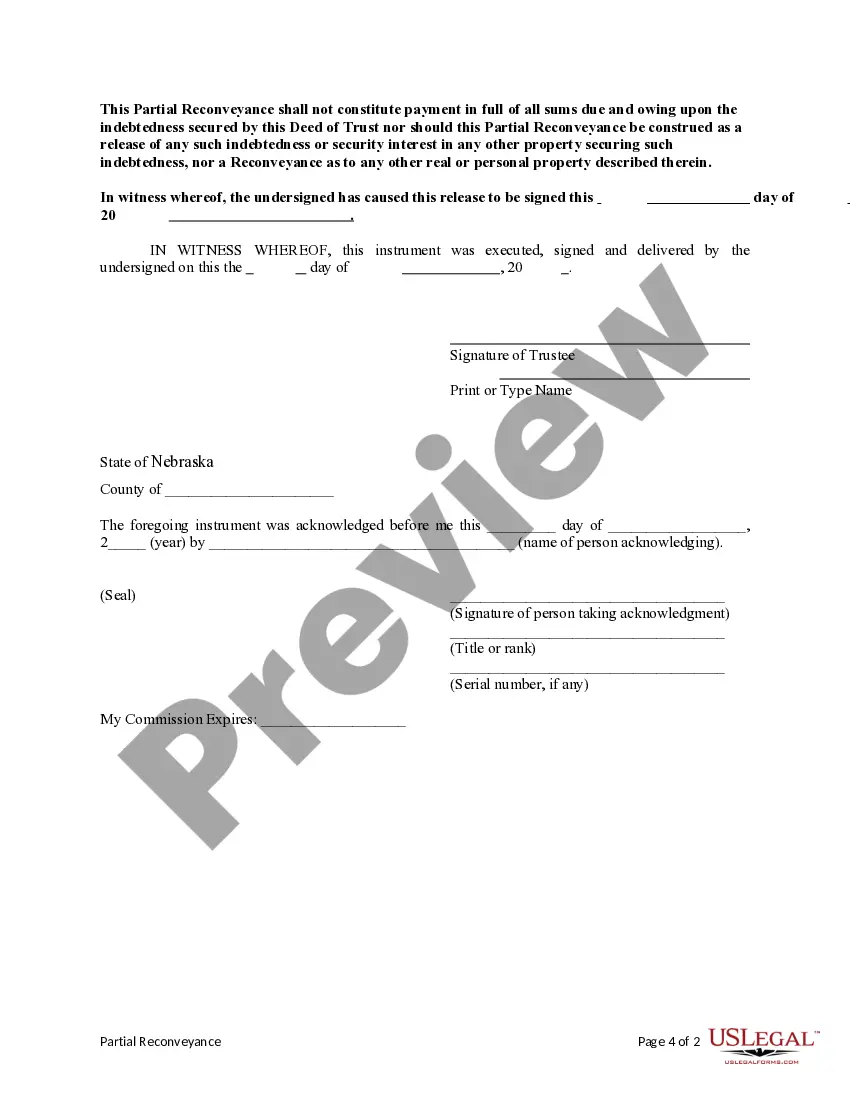

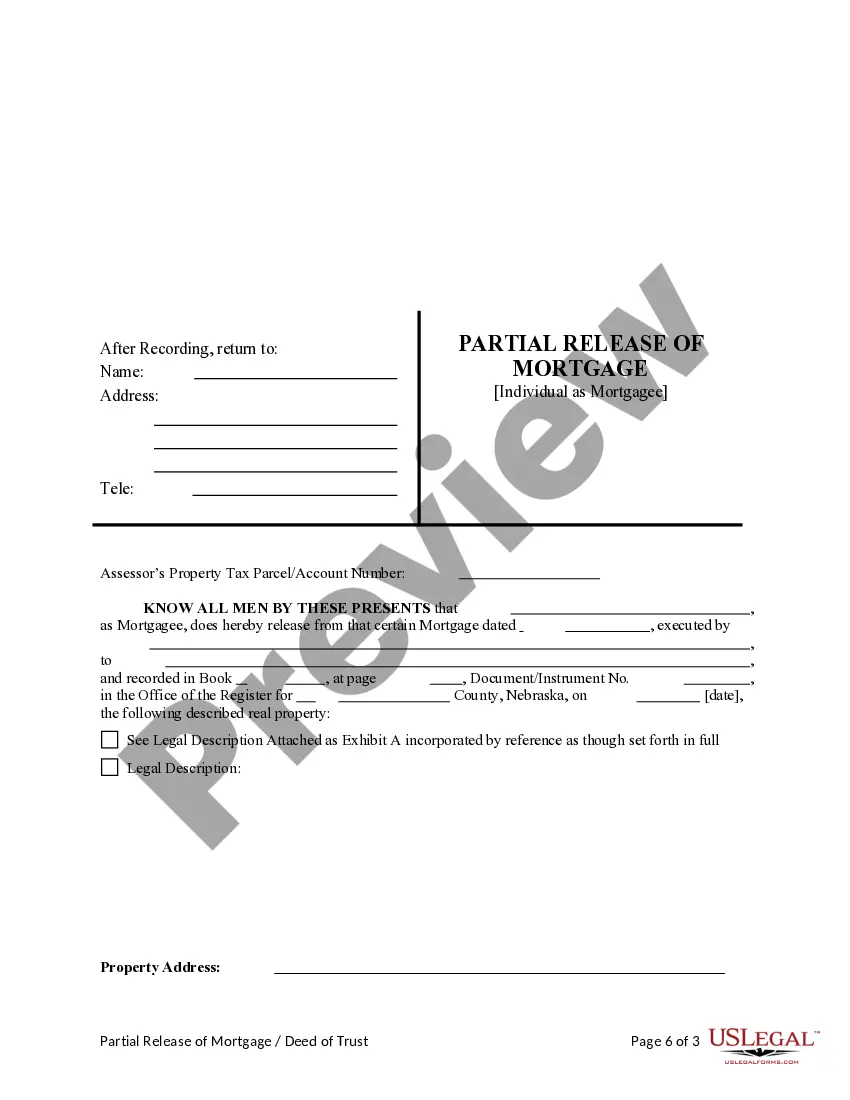

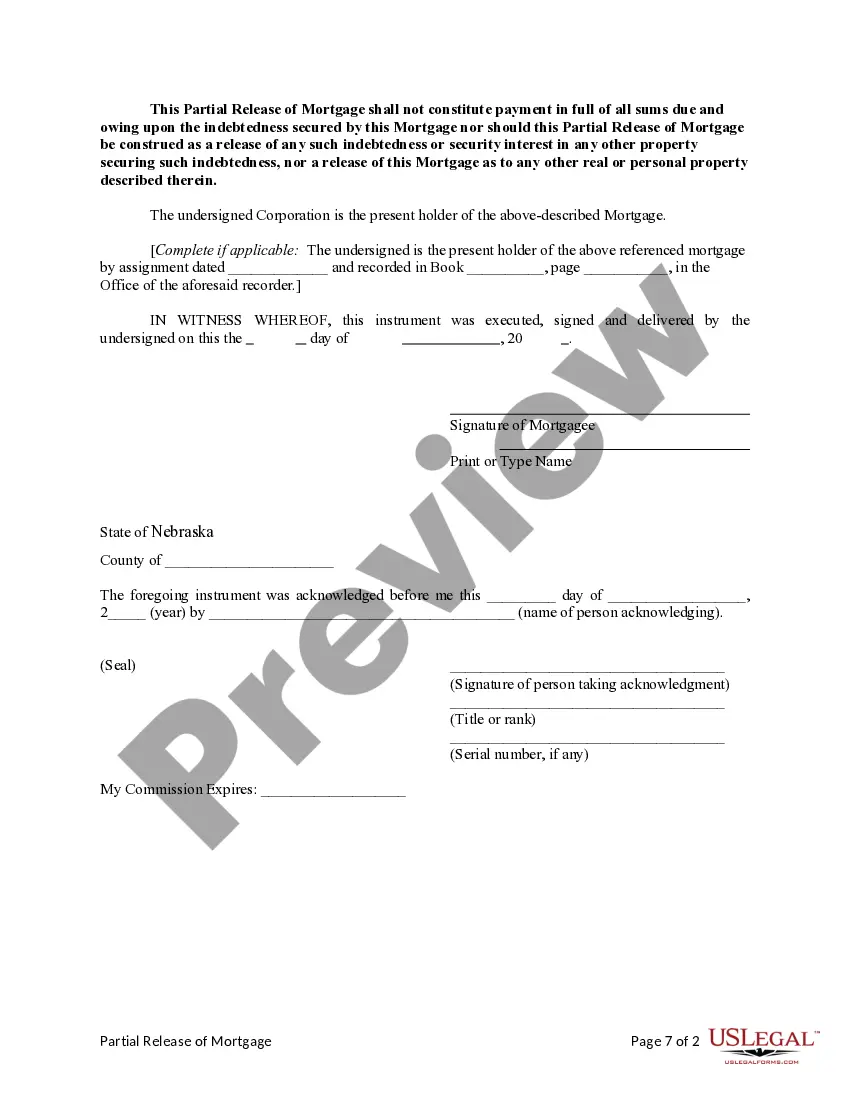

This form is for a holder of a deed of trust or mortgage to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Nebraska Partial Release of Property From Deed of Trust or Mortgage for Individual

Description

How to fill out Nebraska Partial Release Of Property From Deed Of Trust Or Mortgage For Individual?

Avoid costly attorneys and find the Nebraska Partial Release of Property From Deed of Trust or Mortgage for Individual you need at a reasonable price on the US Legal Forms website. Use our simple groups function to find and download legal and tax forms. Read their descriptions and preview them before downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to download and complete each form.

US Legal Forms subscribers basically need to log in and get the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the tips below:

- Ensure the Nebraska Partial Release of Property From Deed of Trust or Mortgage for Individual is eligible for use where you live.

- If available, look through the description and make use of the Preview option just before downloading the templates.

- If you’re sure the template meets your needs, click Buy Now.

- In case the form is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, you may fill out the Nebraska Partial Release of Property From Deed of Trust or Mortgage for Individual by hand or by using an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

The basic difference between the mortgage as a security instrument and a Deed of Trust is that in a Deed of Trust there are three parties involved, the borrower, the lender, and a trustee, whereas in a mortgage document there are only two parties involved, the borrower and the lender.

A trust deed is a legally binding arrangement and covers unsecured debts only, such as credit cards and personal loans. It does not therefore apply to your mortgage or any hire purchase agreements.

A mortgage only involves two parties the borrower and the lender.A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid. In the event of default on the loan, the trustee is responsible for starting the foreclosure process.

A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

If you or another party to the deed of trust already own the property and you enter into a deed of trust to regulate an arrangement there is usually no reason to inform your mortgage lender.Therefore the mortgage company's position is secure and they need not be concerned with a deed of trust.

Yes, you can place real property with a mortgage into a revocable living trust.So, to summarize, it's fine to put your house into a revocable trust to avoid probate, even if that house is subject to a mortgage.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.