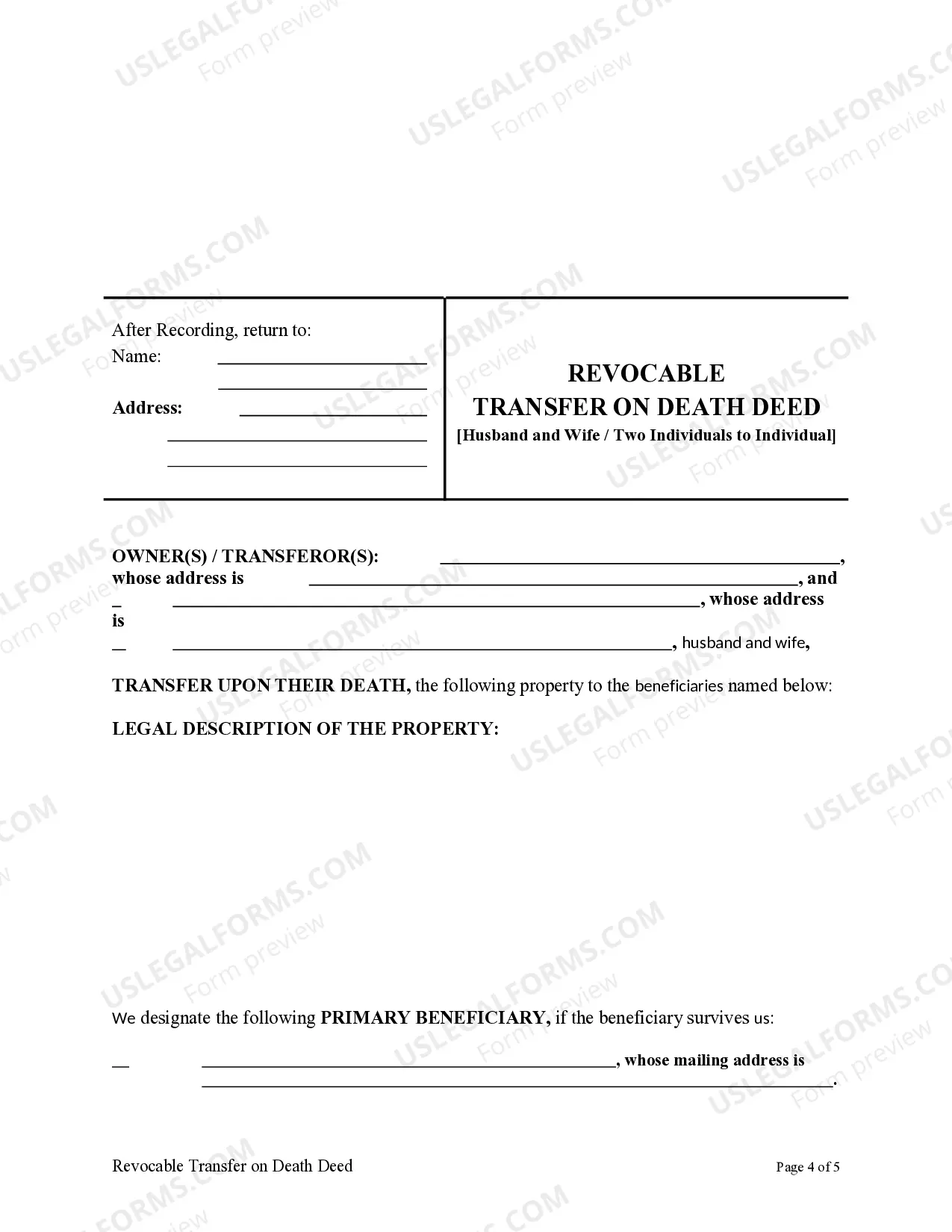

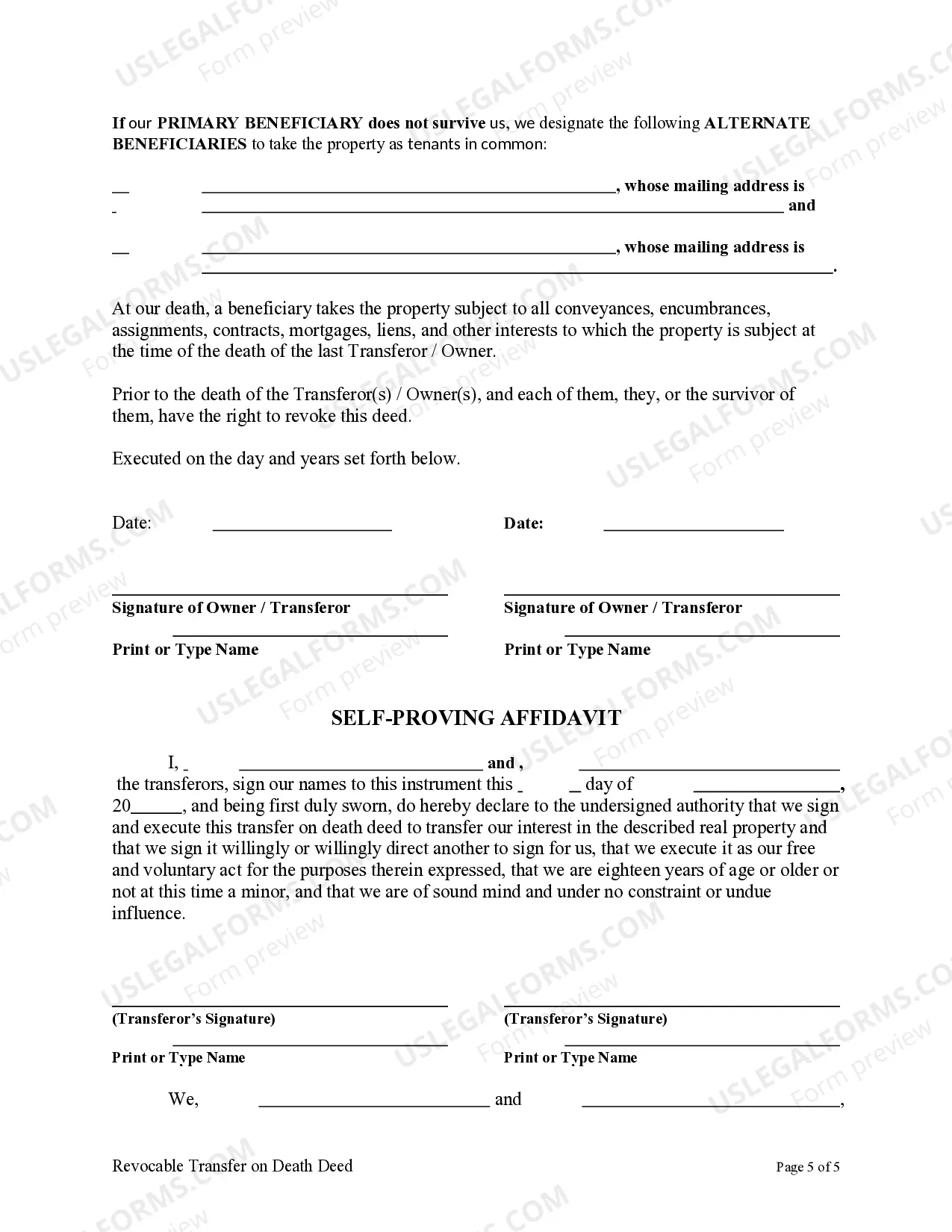

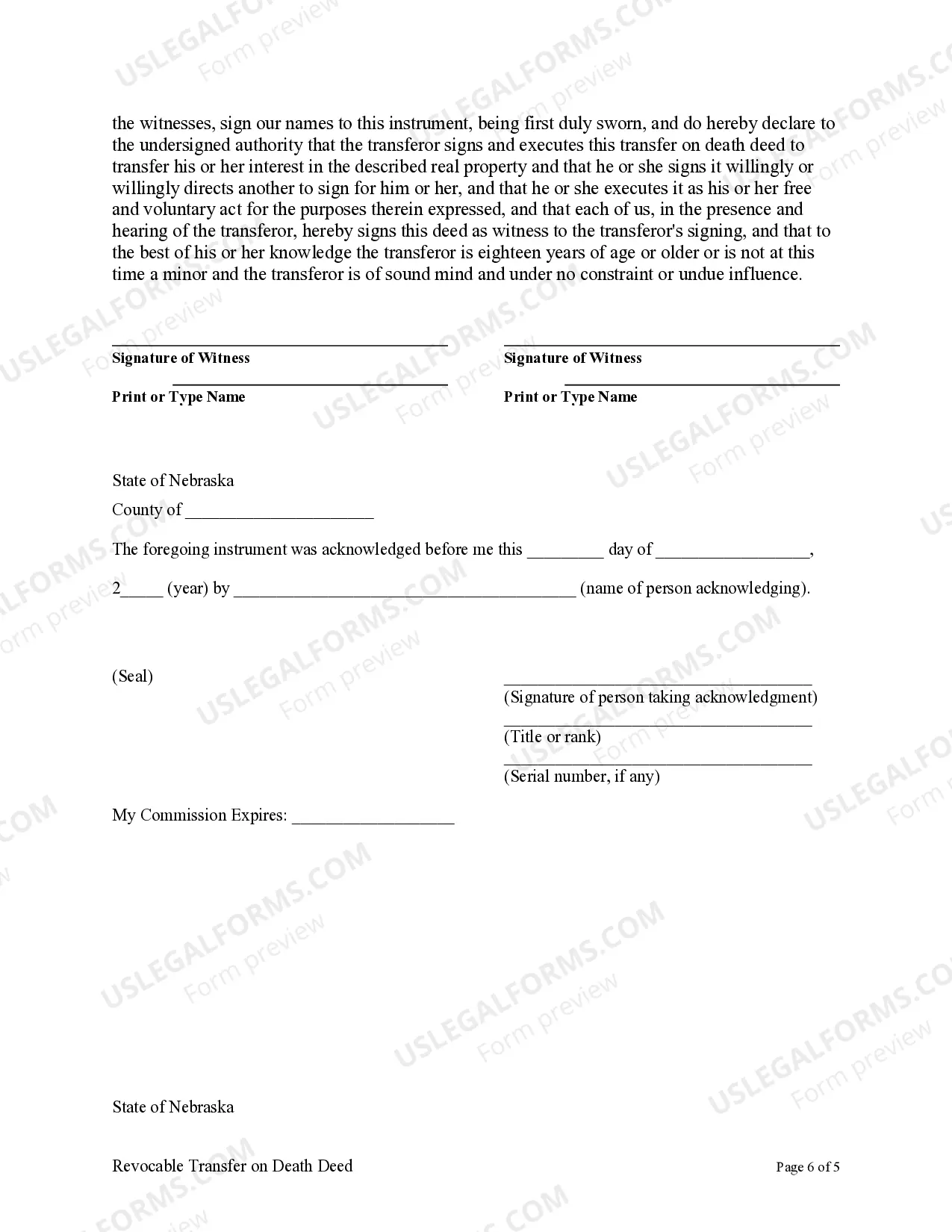

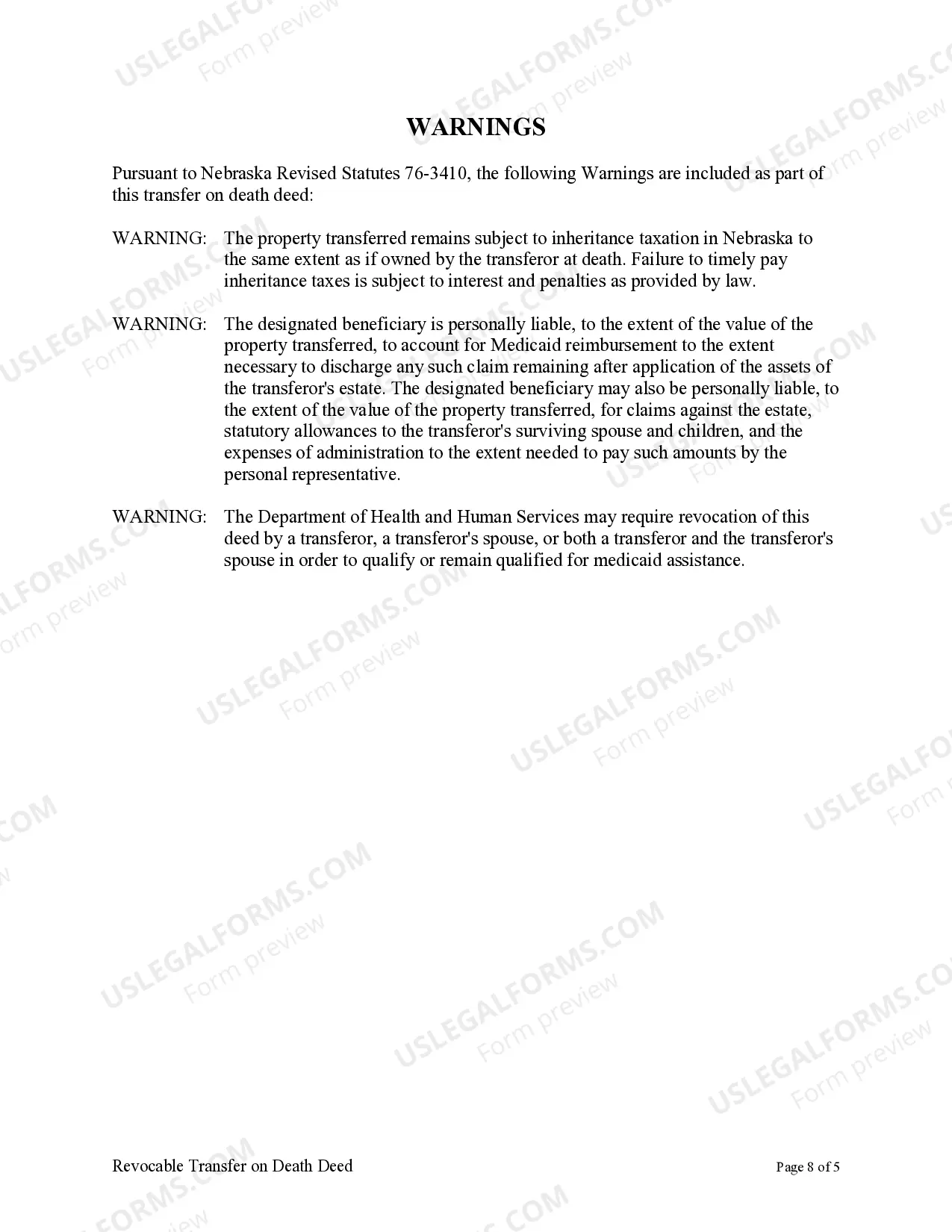

Nebraska Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual

Description

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife / Two Individuals To Individual?

Avoid expensive attorneys and find the Nebraska Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual you want at a reasonable price on the US Legal Forms website. Use our simple categories functionality to find and obtain legal and tax files. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to download and fill out each form.

US Legal Forms customers just need to log in and get the particular document they need to their My Forms tab. Those, who have not got a subscription yet should stick to the tips listed below:

- Make sure the Nebraska Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual is eligible for use where you live.

- If available, read the description and use the Preview option before downloading the sample.

- If you’re confident the document meets your needs, click on Buy Now.

- If the form is wrong, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to your gadget or print it out.

Right after downloading, you can fill out the Nebraska Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual by hand or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.

TOD becomes effective for joint accounts if both owners pass away simultaneously. Joint and TOD registration generally allow an account to pass outside the probate estate, enabling the surviving owner or beneficiaries to avoid the time and expense of that process for this account.

If you own an account jointly with someone else, then after one of you dies, in most cases the surviving co-owner will automatically become the account's sole owner. The account will not need to go through probate before it can be transferred to the survivor.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.