North Dakota Assignment of Overriding Royalty Interest (By Owner of Override)

Description

How to fill out Assignment Of Overriding Royalty Interest (By Owner Of Override)?

Discovering the right legitimate record design can be a have a problem. Needless to say, there are a lot of templates available online, but how will you obtain the legitimate form you will need? Make use of the US Legal Forms site. The assistance gives 1000s of templates, like the North Dakota Assignment of Overriding Royalty Interest (By Owner of Override), which can be used for enterprise and private demands. All the forms are checked by professionals and meet federal and state needs.

If you are presently listed, log in in your profile and then click the Down load key to find the North Dakota Assignment of Overriding Royalty Interest (By Owner of Override). Make use of profile to appear throughout the legitimate forms you may have bought formerly. Proceed to the My Forms tab of the profile and obtain one more version from the record you will need.

If you are a brand new end user of US Legal Forms, listed here are straightforward guidelines that you can follow:

- Initial, make certain you have chosen the appropriate form for your personal area/state. It is possible to look over the form using the Preview key and look at the form explanation to make sure this is basically the best for you.

- When the form fails to meet your preferences, take advantage of the Seach field to discover the correct form.

- When you are positive that the form is acceptable, go through the Purchase now key to find the form.

- Pick the pricing prepare you want and type in the essential information and facts. Make your profile and pay money for the order using your PayPal profile or credit card.

- Choose the data file structure and download the legitimate record design in your device.

- Comprehensive, change and printing and signal the received North Dakota Assignment of Overriding Royalty Interest (By Owner of Override).

US Legal Forms is the biggest library of legitimate forms for which you can see different record templates. Make use of the company to download skillfully-produced papers that follow status needs.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

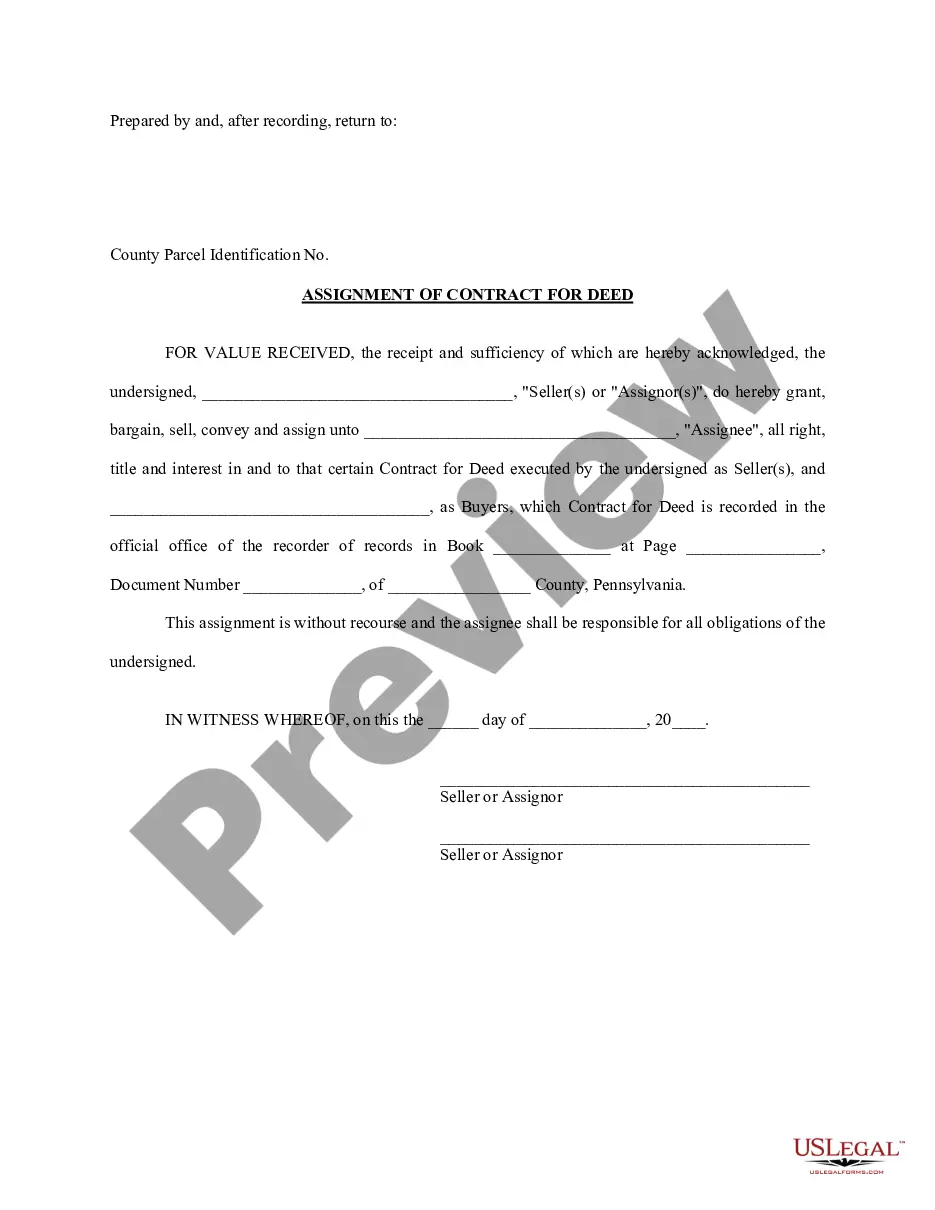

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.