This operating agreement exhibit provides that the Operator shall prepare and file all required federal and state partnership income tax returns. In preparing the returns Operator shall use its best efforts and in doing so shall incur no liability to any other Party with regard to the returns.

North Dakota Exhibit G to Operating Agreement Tax Partnership Agreement

Description

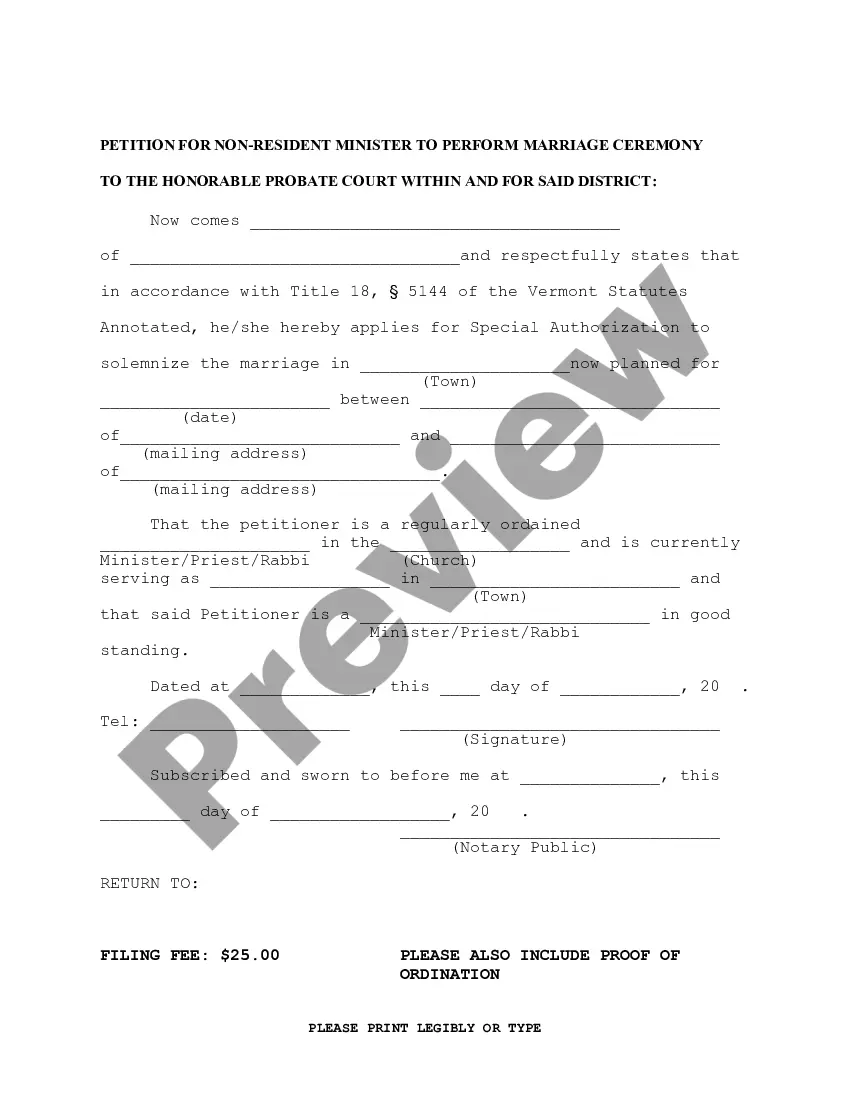

How to fill out Exhibit G To Operating Agreement Tax Partnership Agreement?

Are you presently within a place where you require files for possibly company or specific purposes virtually every working day? There are a variety of authorized file templates available on the Internet, but finding versions you can rely on is not simple. US Legal Forms offers a huge number of form templates, like the North Dakota Exhibit G to Operating Agreement Tax Partnership Agreement, which are published to fulfill federal and state requirements.

In case you are presently acquainted with US Legal Forms internet site and also have a merchant account, just log in. Following that, you can down load the North Dakota Exhibit G to Operating Agreement Tax Partnership Agreement design.

Should you not have an accounts and wish to begin using US Legal Forms, abide by these steps:

- Find the form you want and ensure it is to the proper area/county.

- Utilize the Review switch to analyze the shape.

- Look at the information to actually have chosen the right form.

- If the form is not what you`re searching for, take advantage of the Lookup industry to obtain the form that suits you and requirements.

- Once you find the proper form, simply click Get now.

- Pick the costs plan you would like, fill in the desired information and facts to produce your bank account, and pay for the transaction making use of your PayPal or bank card.

- Decide on a handy file formatting and down load your version.

Find all of the file templates you have purchased in the My Forms food list. You can aquire a extra version of North Dakota Exhibit G to Operating Agreement Tax Partnership Agreement anytime, if required. Just select the essential form to down load or print out the file design.

Use US Legal Forms, by far the most extensive variety of authorized forms, in order to save efforts and steer clear of blunders. The assistance offers appropriately created authorized file templates that can be used for an array of purposes. Make a merchant account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Filing an Extension. You may have extended time to file your North Dakota individual, corporation, S corporation, partnership, or fiduciary income tax return by receiving a federal extension or a North Dakota extension.

A partnership may, but is not required to, make estimated income tax payments. For more information, including payment options, obtain the 2023 Form 58-ES. A partnership must withhold North Dakota income tax at the rate of 2.90% from the year-end distributive share of North Dakota income of a nonresident partner.

Business Extensions North Dakota accepts the timely filed federal extension request as an extension to file the state return. If the federal return is not being extended but additional time is needed to complete and file the North Dakota return, a separate North Dakota extension may be applied for by filing Form 101.

The pass-through entities that can elect to pay this tax are S corporations, general partnerships, limited liability companies taxed as partnerships, limited liability partnerships or limited partnerships.

A partnership may, but is not required to, make estimated income tax payments. For more information, including payment options, obtain the 2023 Form 58-ES. A partnership must withhold North Dakota income tax at the rate of 2.90% from the year-end distributive share of North Dakota income of a nonresident partner.

Share: Most states don't require you to file separate state extension forms if you don't owe any additional taxes. When you file your state return, you only need to attach a copy of your federal extension form. If you owe state tax, you typically must file state tax extension to avoid penalties.

If you think you may need more time to prepare your return, you should file for an extension using Form 7004. The due date for your partnership return will be extended until September 15, 2024.