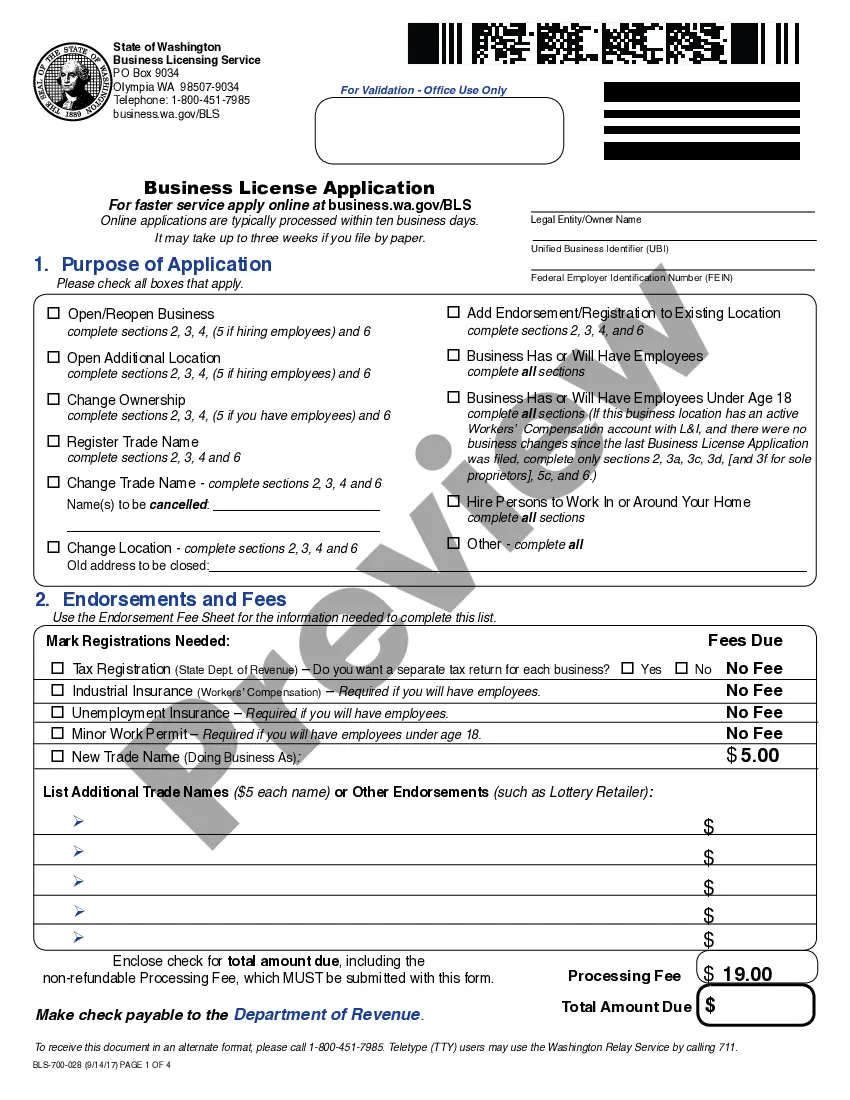

Outline of the Acquisition Process Representing Sellers and Buyers in the Sale of Producing Properties, this form is is a outline of the acquisition representing the sellers and buyers in the sale of producing properties in the dealing with oil, gas or minerals.

North Dakota Outline of the Acquisition Process Representing Sellers and Buyers in the Sale of Producing Properties

Description

How to fill out Outline Of The Acquisition Process Representing Sellers And Buyers In The Sale Of Producing Properties?

If you have to comprehensive, download, or printing legitimate papers web templates, use US Legal Forms, the greatest selection of legitimate types, which can be found on the Internet. Utilize the site`s basic and practical lookup to obtain the paperwork you require. Various web templates for company and person reasons are sorted by categories and suggests, or keywords. Use US Legal Forms to obtain the North Dakota Outline of the Acquisition Process Representing Sellers and Buyers in the Sale of Producing Properties within a few click throughs.

If you are previously a US Legal Forms customer, log in to the bank account and click on the Acquire key to find the North Dakota Outline of the Acquisition Process Representing Sellers and Buyers in the Sale of Producing Properties. Also you can accessibility types you formerly downloaded from the My Forms tab of the bank account.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for your correct town/land.

- Step 2. Use the Review method to look over the form`s content material. Don`t neglect to read the description.

- Step 3. If you are not happy together with the kind, take advantage of the Research area near the top of the display screen to locate other variations of your legitimate kind format.

- Step 4. When you have identified the shape you require, click on the Purchase now key. Choose the costs strategy you choose and include your references to sign up on an bank account.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the deal.

- Step 6. Pick the structure of your legitimate kind and download it on your own device.

- Step 7. Complete, change and printing or indicator the North Dakota Outline of the Acquisition Process Representing Sellers and Buyers in the Sale of Producing Properties.

Every single legitimate papers format you acquire is the one you have for a long time. You have acces to each and every kind you downloaded with your acccount. Select the My Forms area and choose a kind to printing or download once again.

Compete and download, and printing the North Dakota Outline of the Acquisition Process Representing Sellers and Buyers in the Sale of Producing Properties with US Legal Forms. There are millions of expert and status-distinct types you may use for the company or person requires.

Form popularity

FAQ

Detail every physical, financial, and intangible asset that will be affected by the change in ownership. This list could include buildings, vehicles, machinery, furniture, cash, bank accounts, business name, intellectual property, and more.

A purchase and sale agreement is used to document the parties' intentions and the terms they have agreed will govern the transaction. You can include specific terms like the product or property, the price of the product or property, conditions for the delivery of the product, and the date of product delivery.

The seller disclosure in North Dakota is a statement that contains the property's condition?its major and minor features, and even those not asked in the form. It's the seller's responsibility to provide a written disclosure to the prospective buyer before both parties sign to any agreement.

Elements of a sales agreement Buyer and seller names and contact information. Description of goods, services, or property being purchased. Payment amount, dates, and method. Liability of each party in the case of loss, damage, or delivery failure.

To establish legality, a real estate contract must include a legal purpose, legally competent parties, agreement by offer and acceptance, consideration, and consent.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

How to Write a Sales Agreement Step 1 ? Identify Party Information. ... Step 2 ? Provide a Description of the Goods. ... Step 3 ? Include the Purchase Price and Payment Information. ... Step 4 ? Determine the Delivery Method. ... Step 5 ? Allocate Risk of Loss. ... Step 6 ? Include a Right of Inspection Provision. ... Step 7 ? Establish Warranties.