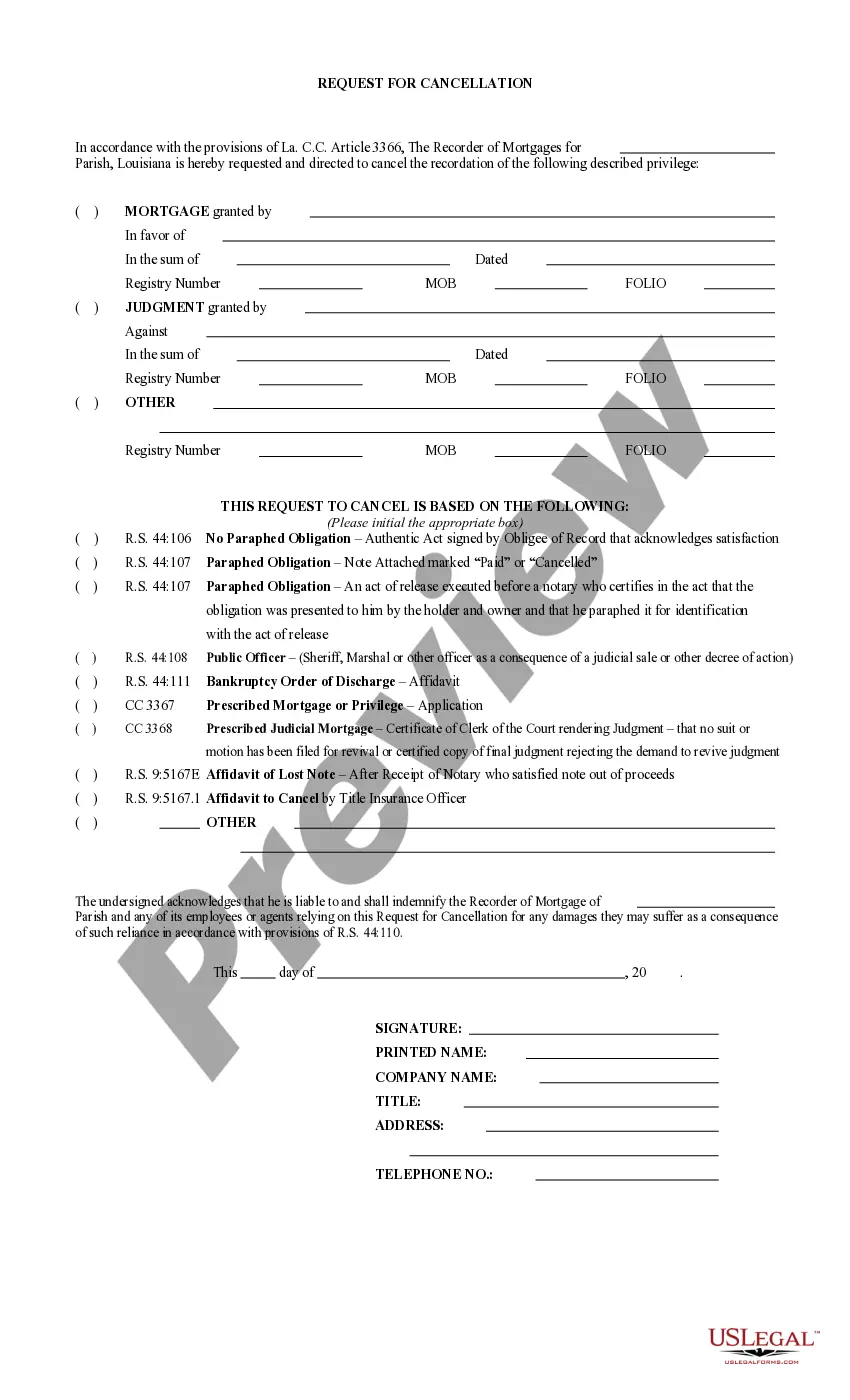

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

North Dakota Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

Are you currently in a location that necessitates documents for occasional business or personal activities nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't simple.

US Legal Forms provides a multitude of template forms, such as the North Dakota Notice of Harassment and Validation of Debt, which are designed to meet state and federal regulations.

Once you find the correct form, click Purchase now.

Select the payment plan you want, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Dakota Notice of Harassment and Validation of Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to review the form.

- Examine the details to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

An example of a debt validation letter includes your request for proof of the debt, your personal details, and a reference to the North Dakota Notice of Harassment and Validation of Debt. The letter should ask the creditor to verify the debt's legitimacy and provide documentation. For a more effective letter, consider using a template from US Legal Forms, which offers professionally crafted examples to serve your needs.

The 11-word phrase to stop debt collectors is: 'I request that you cease all communication with me immediately.' This phrase can assert your rights under the North Dakota Notice of Harassment and Validation of Debt. Using this statement can help you regain control over your situation. Always consider following up with a formal debt validation letter for added protection.

Filling out a debt validation letter requires you to include your name, address, and the account number associated with the debt. Clearly state that you are requesting validation of the debt and refer to the North Dakota Notice of Harassment and Validation of Debt for context. Be sure to sign the letter and keep a copy for your records. Utilizing a template from US Legal Forms can guide you step by step.

Yes, sending a debt validation letter is a good idea, especially if you believe the debt is inaccurate or unverifiable. This letter not only asserts your rights but also prompts the creditor to provide proper documentation of the debt. By invoking the North Dakota Notice of Harassment and Validation of Debt, you protect yourself from aggressive collection tactics. US Legal Forms offers templates that make this task easier for you.

To obtain a debt validation letter, you should first request it from the creditor or debt collector. Under the Fair Debt Collection Practices Act, you have the right to ask for verification of the debt. You can send a written request to the collector, including your personal information and details about the debt in question. Using the resources available on USLegalForms, you can find templates to help you draft a clear and effective request, ensuring you are informed about your rights related to the North Dakota Notice of Harassment and Validation of Debt.

In North Dakota, a debt generally becomes uncollectible after six years, depending on the type of debt. This time frame begins from the date of your last payment or acknowledgment of the debt. Understanding the North Dakota Notice of Harassment and Validation of Debt can provide clarity on your rights and the timeline for debt collection, helping you make informed decisions.

Yes, debt validation is a good idea as it allows you to verify the legitimacy of the debt. By requesting validation, you protect yourself from paying debts you may not owe. The North Dakota Notice of Harassment and Validation of Debt supports this process, helping you understand your rights and the necessary steps to take.

You can report harassment from debt collectors to several agencies, including the Consumer Financial Protection Bureau and your state’s attorney general's office. It's important to also keep a record of your complaints for future reference. The North Dakota Notice of Harassment and Validation of Debt emphasizes your right to report such behavior, ensuring you have the support you need during this challenging time.

To file harassment against a debt collector, you should document every instance of harassment, including dates, times, and the nature of the communication. After collecting this information, you can file a complaint with the Consumer Financial Protection Bureau or your state’s attorney general. Remember, the North Dakota Notice of Harassment and Validation of Debt provides you with the necessary framework to ensure your complaint is taken seriously.

Filing a debt validation claim involves notifying the debt collector in writing that you dispute the debt and request validation. You should include your personal information, details of the debt, and your request for proof. Utilizing the North Dakota Notice of Harassment and Validation of Debt can guide you through this process, ensuring that you follow the correct steps effectively.