North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

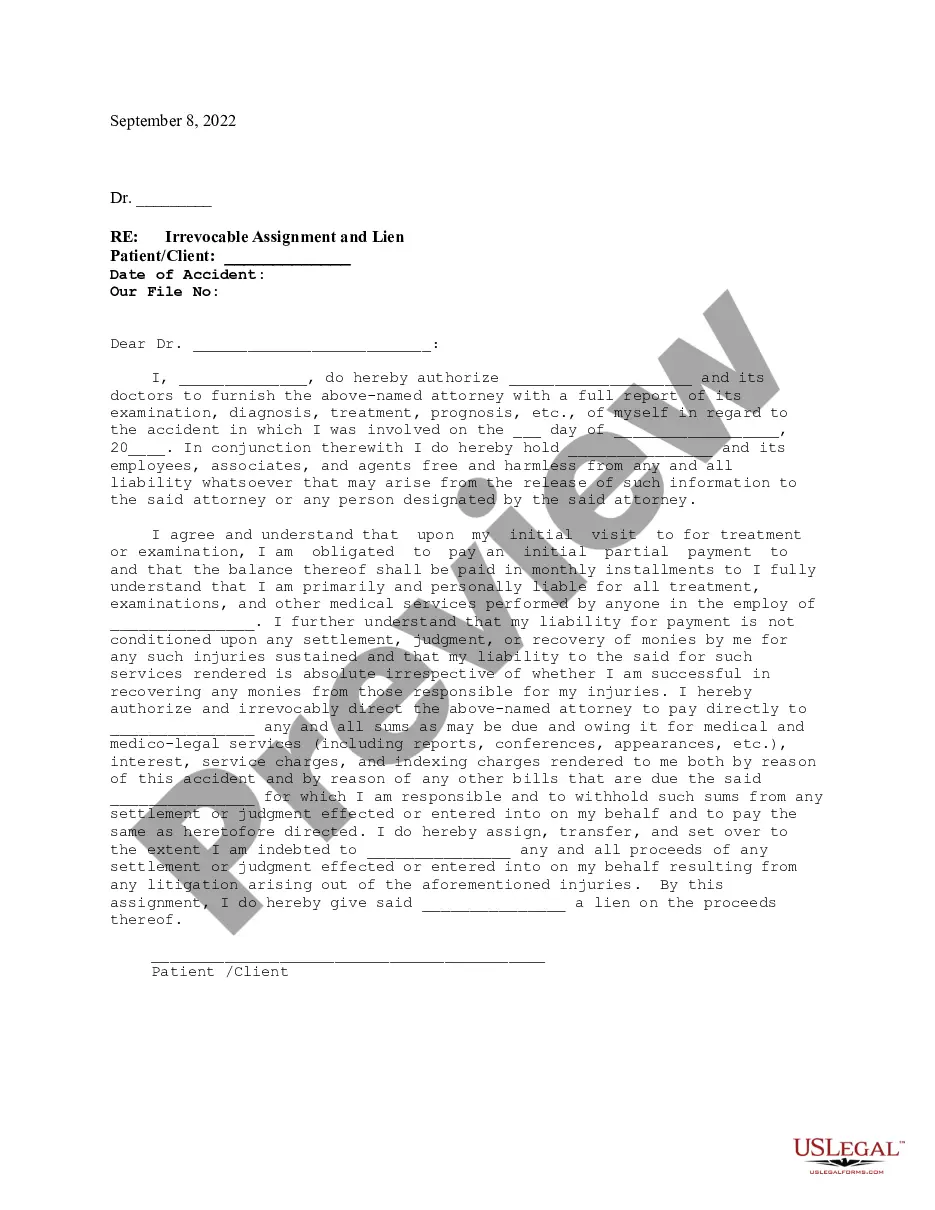

How to fill out Journalist - Reporter Agreement - Self-Employed Independent Contractor?

Are you in a circumstance where you require documents for either professional or personal purposes almost daily? There are numerous legal document templates accessible online, but finding reliable ones isn’t straightforward. US Legal Forms offers thousands of form templates, such as the North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor, which are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor template.

If you don’t have an account and want to start using US Legal Forms, follow these steps: Get the form you need and ensure it is for the correct city/county. Use the Review option to evaluate the form. Read the description to confirm you have selected the right form. If the form isn’t what you’re searching for, use the Search section to find the form that meets your needs and requirements. Once you have the correct form, click Buy now. Choose the payment plan you prefer, fill in the necessary information to create your account, and purchase your order using your PayPal or credit card. Select a convenient file format and download your copy.

- Access all of the document templates you have purchased in the My documents section. You can get an additional copy of the North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor at any time, if needed. Just select the required form to download or print the document template.

- Utilize US Legal Forms, the most comprehensive selection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes.

- Create your account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

The main difference between a freelancer and an independent contractor lies in the nature of their work. Freelancers often take on multiple short-term projects simultaneously, while independent contractors typically engage in longer-term agreements with specific clients. In the context of a North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor, understanding this distinction can help you navigate your business relationships more effectively. US Legal Forms can provide guidance and templates to help you structure these agreements properly.

To write an independent contractor agreement, start by clearly defining the relationship between the parties involved. Include essential details such as the scope of work, payment terms, and deadlines. Make sure to specify the rights and responsibilities of both the North Dakota Journalist and the client. For a seamless experience, consider using a template from US Legal Forms to ensure you cover all necessary legal elements in your North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and the responsibilities of both parties. You can start by using templates available on platforms like US Legal Forms, which offer a tailored North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor. These templates can simplify the process, allowing you to focus on the specifics of your arrangement, while also ensuring legal compliance.

As an independent contractor, you can provide proof of employment by presenting documents such as contracts, invoices, or payment records from your clients. These documents should clearly outline your role and the nature of the work performed. For those using the North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor, keeping a copy of the signed agreement can serve as valid proof as well. This ensures transparency and can ease interactions with potential clients or agencies.

Typically, the independent contractor agreement is written by the party hiring the contractor, which in this case would be the employer or media organization. However, it’s essential for both parties to review the agreement to ensure it meets their needs. You can also consider using a professional service like US Legal Forms to create a customized North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor. This can help ensure that the document covers all necessary legal aspects.

As a North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor, you typically need to complete several important documents. First, you should fill out a contract that outlines the terms of your work, including payment details and deadlines. Additionally, you may need to submit tax forms, such as the W-9, to ensure proper reporting of your income. Utilizing the uslegalforms platform can simplify this process, providing templates and guidance tailored to your needs.

To fill out an independent contractor agreement, begin by entering your details and the contractor’s information. Clearly outline the services provided, payment structure, and duration of the agreement. Make sure to reference the North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor to cover all necessary legal aspects. Using USLegalForms can help ensure you include all essential clauses and avoid common pitfalls.

The new federal rule emphasizes the importance of classifying workers correctly as independent contractors. This classification affects benefits, taxes, and legal obligations. For those working under a North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor, understanding these changes is vital for compliance. Stay informed through resources like USLegalForms to ensure you meet all regulatory requirements.

Filling out an independent contractor form involves providing your personal information, business details, and services offered. Ensure you include specific terms related to the North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor for clarity. Double-check all entries for accuracy before submission. Platforms like USLegalForms offer user-friendly forms that guide you through the process.

To write an independent contractor agreement, start by clearly defining the scope of work. Include details such as payment terms, deadlines, and confidentiality clauses. Make sure to specify that this is a North Dakota Journalist - Reporter Agreement - Self-Employed Independent Contractor to ensure compliance with local regulations. Utilizing platforms like USLegalForms can simplify this process by providing templates tailored for your needs.