North Dakota Architect Agreement - Self-Employed Independent Contractor

Description

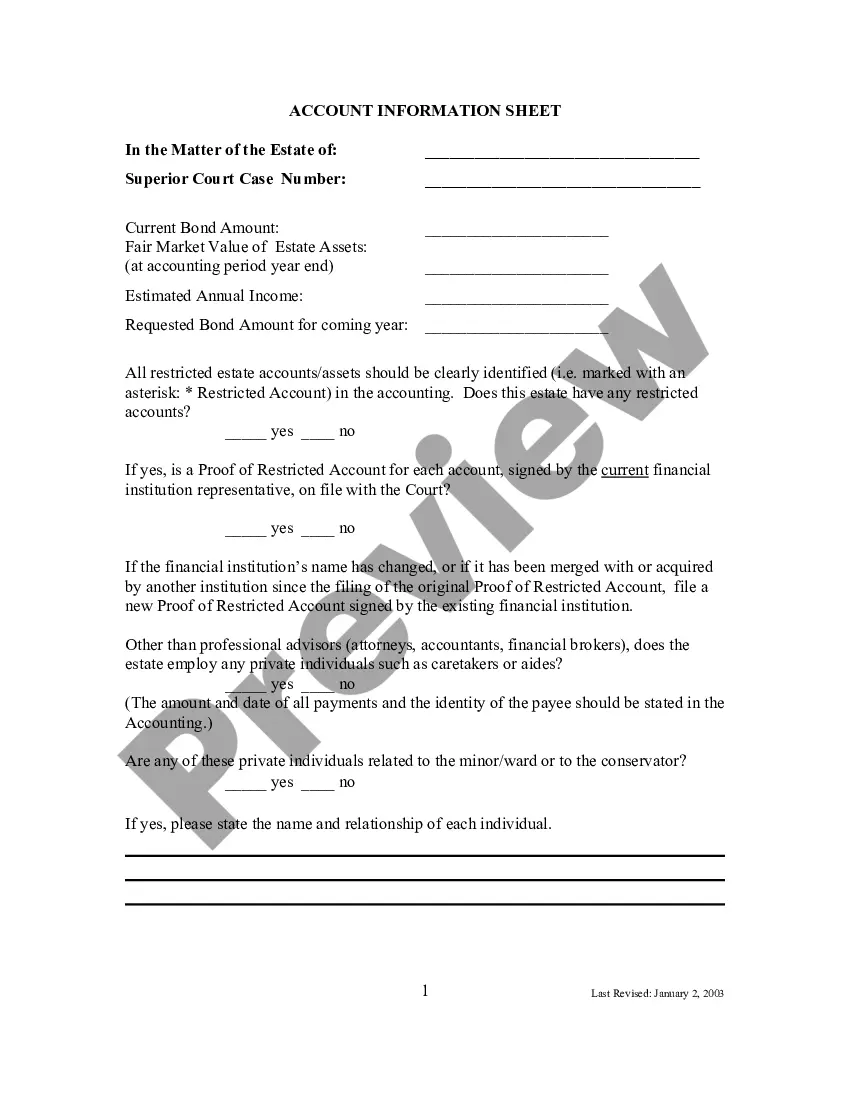

How to fill out Architect Agreement - Self-Employed Independent Contractor?

If you wish to compile, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site’s straightforward and user-friendly search to locate the documents you need. Various templates for commercial and personal purposes are organized by categories and suggests, or keywords. Use US Legal Forms to find the North Dakota Architect Agreement - Self-Employed Independent Contractor in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the North Dakota Architect Agreement - Self-Employed Independent Contractor. You can also access forms you previously saved in the My documents section of your account.

Should you use US Legal Forms for the first time, refer to the steps outlined below: Step 1. Ensure you have selected the form for your specific state/country. Step 2. Use the Review option to examine the form’s content. Remember to read the summary. Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative types in the legal document template. Step 4. Once you have found the form you want, select the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account. Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize the transaction. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the North Dakota Architect Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours forever.

- You will have access to every document you saved within your account.

- Choose the My documents section and select a document to print or download again.

- Act now and acquire, and print the North Dakota Architect Agreement - Self-Employed Independent Contractor with US Legal Forms.

- There are numerous professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

Yes, North Dakota does require a contractor license for specific types of work, particularly in the construction and architecture sectors. This requirement ensures that contractors meet the necessary standards for safety and quality. When engaging in projects governed by a North Dakota Architect Agreement - Self-Employed Independent Contractor, being aware of licensing regulations can help avoid potential legal issues. For more detailed information, consider using resources from US Legal Forms as a guide.

In North Dakota, not all contractors need a license. However, certain professions, particularly those involving construction and architecture, may require licensing to ensure compliance with state regulations. For those involved with projects under a North Dakota Architect Agreement - Self-Employed Independent Contractor, understanding these licensing requirements is essential. If you're unsure about your obligations, consulting legal resources or platforms like US Legal Forms can provide clarity.

Yes, an architect can be considered a contractor when they operate as an independent entity providing architectural services. In this role, architects often develop designs, prepare plans, and engage with clients without being employed by a specific construction company. By establishing a North Dakota Architect Agreement - Self-Employed Independent Contractor, architects can clarify their responsibilities and rights, ensuring a successful self-employed career.

An independent contractor is typically an individual who provides services to clients under a contract, without being considered an employee of the client. They maintain control over how they complete their work, making them responsible for their own taxes and benefits. In the context of the North Dakota Architect Agreement - Self-Employed Independent Contractor, this definition is crucial for establishing the professional relationship within legal boundaries. Understanding these roles ensures compliance with both state and federal regulations.

To write an independent contractor agreement, begin by clearly identifying the parties involved, including their contact information. Next, outline the services the contractor will provide, along with payment terms and timelines. It’s vital to include clauses that define the contractor's independent status, ensuring compliance with the North Dakota Architect Agreement - Self-Employed Independent Contractor. Using a platform like US Legal Forms can streamline this process, providing templates that meet legal standards.

An architect can be considered an independent contractor if they work on a freelance basis or under specific project agreements rather than as a full-time employee. This classification allows architects the flexibility to work with multiple clients simultaneously. When drafting a North Dakota Architect Agreement - Self-Employed Independent Contractor, understanding this relationship is crucial for setting terms that benefit both parties. US Legal Forms offers templates that address these distinctions effectively.

Typically, the hiring party drafts the independent contractor agreement, but it's essential for both parties to review and agree on the terms. This ensures clarity and prevents misunderstandings. When creating a North Dakota Architect Agreement - Self-Employed Independent Contractor, it's wise to consult legal advice to ensure compliance with state regulations. Utilizing services like US Legal Forms can help you create a robust and legally sound document.

To create an effective independent contractor agreement, start by clearly defining the scope of work and deliverables. Include payment terms, timelines, and responsibilities for both parties. Always ensure that the agreement complies with local laws, especially when drafting a North Dakota Architect Agreement - Self-Employed Independent Contractor. For a streamlined process, consider using a platform like US Legal Forms, where you can find templates that simplify this task.