North Dakota Oil Cleanup Services Contract - Self-Employed

Description

How to fill out Oil Cleanup Services Contract - Self-Employed?

If you desire to complete, obtain, or print authentic document templates, utilize US Legal Forms, the finest collection of genuine forms available on the web.

Employ the site’s straightforward and user-friendly search to procure the documents you need.

Various templates for business and specific purposes are sorted by categories and suggestions, or keywords.

Every legal document format you purchase is yours indefinitely.

You have access to each form you downloaded in your account. Go to the My documents section and select a form to print or download again.

- Use US Legal Forms to acquire the North Dakota Oil Cleanup Services Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to retrieve the North Dakota Oil Cleanup Services Agreement - Self-Employed.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct region/country.

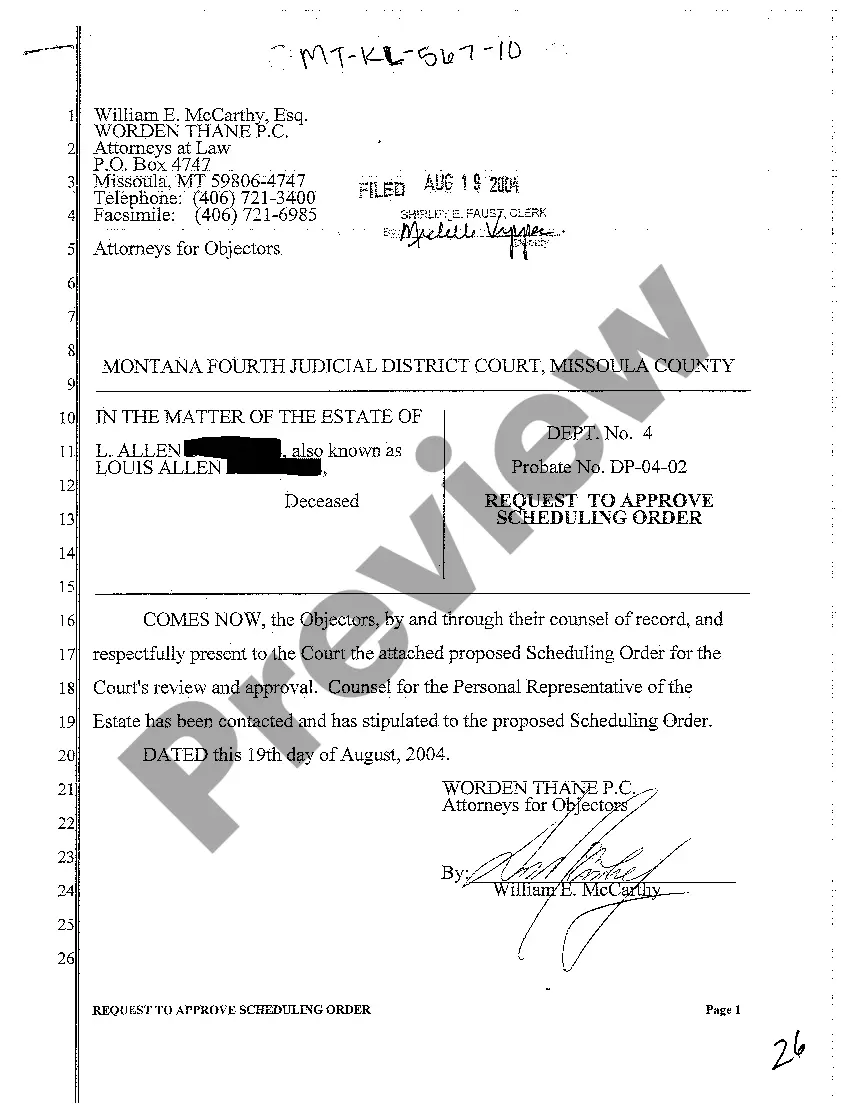

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the document, use the Search bar at the top of the screen to find other versions of the legal document format.

- Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it onto your device.

- Step 7. Fill out, modify, and print or sign the North Dakota Oil Cleanup Services Agreement - Self-Employed.

Form popularity

FAQ

Yes, oil companies in North Dakota are subject to various taxes, including production taxes and royalties. These taxes can significantly affect profitability and operational costs. For those working under a North Dakota Oil Cleanup Services Contract - Self-Employed, it is critical to understand how these taxes might impact your contracting opportunities and overall project costs.

North Dakota imposes a tax on oil production that generally starts at 5% of the gross value. This tax contributes to the state’s economy and funding for infrastructure. If you are involved in North Dakota Oil Cleanup Services Contract - Self-Employed, understanding the tax implications can help you better plan your financial strategy.

The North Dakota oil boom has seen fluctuations, but significant production continues in the state. This ongoing activity creates a demand for services, particularly in cleanup, making the North Dakota Oil Cleanup Services Contract - Self-Employed a valuable option for contractors looking to engage in this market and provide essential support.

In North Dakota, mineral rights do not automatically expire but may become dormant if not actively used or leased. It is crucial to stay informed about the management of these rights, especially if you are contracting for services related to the North Dakota Oil Cleanup Services Contract - Self-Employed to ensure you secure necessary permissions efficiently.

The admin code 43 02 03 30 outlines regulations relevant to oil cleanup services in North Dakota. This code establishes standards that self-employed contractors must follow when performing oil cleanup tasks. Understanding this code is essential for compliance, especially for those engaged in North Dakota Oil Cleanup Services Contract - Self-Employed.

tomonth lease agreement typically includes information such as the names of the parties involved, property address, rent amount, and payment terms. It may also specify the notice period for either party to terminate the lease. The document must clearly outline any additional terms or conditions to ensure both parties understand their rights and responsibilities. For selfemployed individuals, such as those entering North Dakota Oil Cleanup Services Contracts, having a clear agreement is crucial for project planning.

One disadvantage of a month-to-month lease is the potential for frequent rent increases, as landlords may adjust rates more often than with long-term leases. Additionally, tenants often face less stability, as landlords can terminate leases with relatively short notice. For those engaged in North Dakota Oil Cleanup Services Contracts, the lack of stability may not align well with project timelines. Thus, it is essential to weigh these factors when considering your rental options.

A month to month lease agreement in North Dakota outlines the terms under which a tenant can stay in a rental property on a monthly basis. It typically includes details such as the rent amount, payment due dates, and notice requirements for termination. This agreement grants flexibility to tenants who may need to adapt quickly to changing circumstances. If you are self-employed and involved in North Dakota Oil Cleanup Services Contracts, this type of lease can suit your project needs well.

tomonth lease in North Dakota is a rental agreement that allows tenants to occupy a property on a monthly basis, without a longterm commitment. This type of lease can be beneficial for both landlords and tenants, as it offers flexibility. Tenants can move out with minimal notice, while landlords can adjust rent terms with proper notification. For selfemployed individuals requiring North Dakota Oil Cleanup Services Contracts, this rental structure may provide a suitable temporary arrangement.

In North Dakota, individuals may stop paying property taxes at age 65, provided they meet certain qualifications such as income limits. This age exemption is designed to support senior citizens, making it easier for them to manage their finances. If you're involved in industries like North Dakota Oil Cleanup Services Contract - Self-Employed, understanding these exemptions can impact your business planning. For more detailed contracts and legal guidance, check out US Legal Forms.