North Dakota Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

If you need to compile, obtain, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's straightforward and hassle-free search to find the documents you need.

A variety of templates for business and personal purposes are organized by categories and keywords.

Step 4. Once you have located the form you need, click the Purchase Now button. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the North Dakota Employer Training Memo - Payroll Deductions with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download button to retrieve the North Dakota Employer Training Memo - Payroll Deductions.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your specific state/area.

- Step 2. Utilize the Review feature to check the content of the form. Don’t forget to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other variations of the legal form template.

Form popularity

FAQ

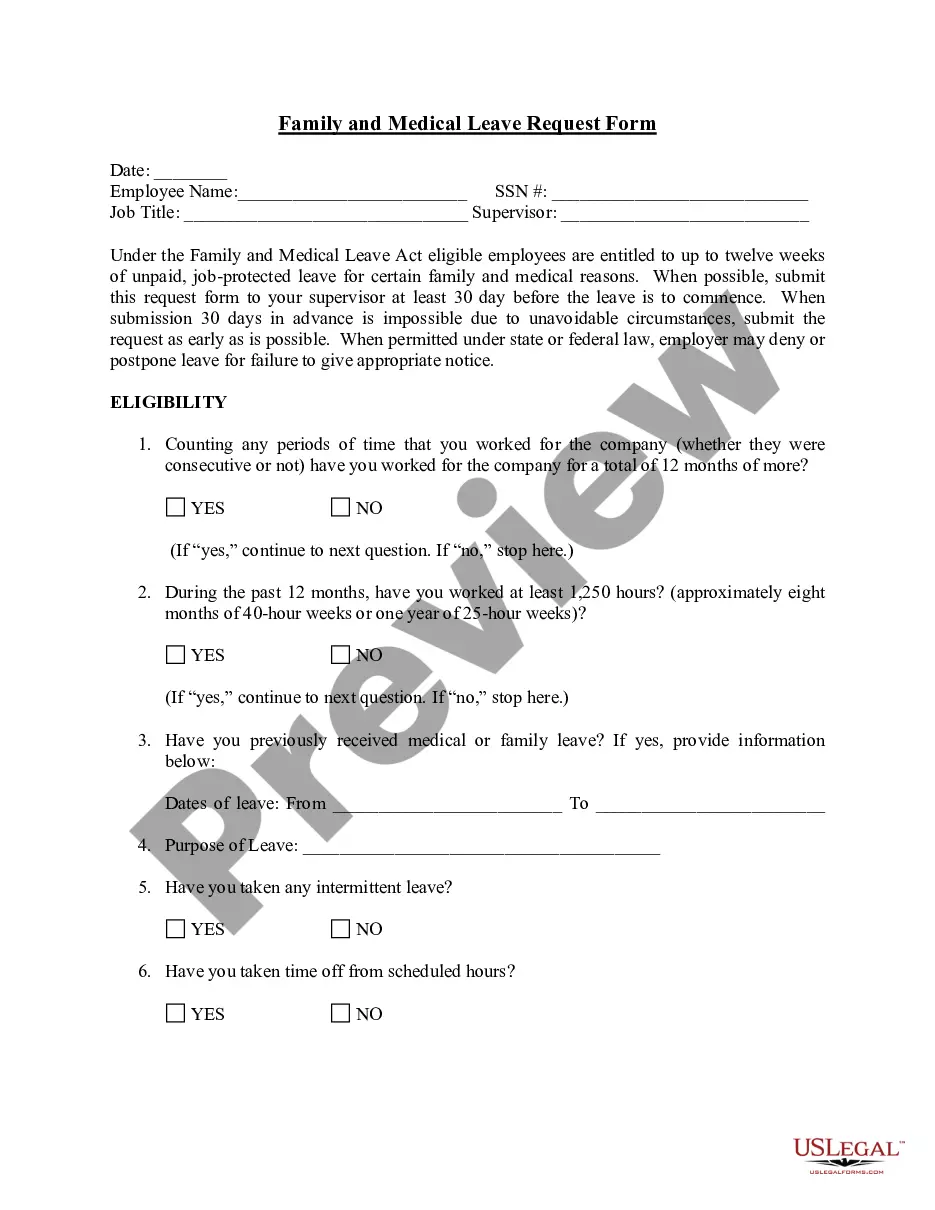

The total tax amount taken out of a paycheck varies based on your earnings and tax situation. Generally, it includes federal income tax, Social Security, Medicare, and any applicable state taxes. To better understand your specific deductions, consult the North Dakota Employer Training Memo - Payroll Deductions. This memo provides a comprehensive overview of expected deductions to help you plan your finances effectively.

Yes, employers in North Dakota are required to withhold state income taxes from their employees' paychecks. This requirement ensures that employees contribute to state-funded services and programs. Understanding these obligations is crucial for compliance, and the North Dakota Employer Training Memo - Payroll Deductions offers valuable information for employers. This memo helps clarify the withholding process and supports accurate payroll practices.

In North Dakota, the total taxes deducted from your paycheck include federal income tax, state income tax, Social Security, and Medicare. The specific amounts can vary depending on your income bracket and other personal factors. To ensure proper deductions, you may want to consult the North Dakota Employer Training Memo - Payroll Deductions. This resource outlines the necessary calculations and helps employers understand their obligations.

The amount of tax deducted from each paycheck in North Dakota depends on various factors including your income level and filing status. Typically, a percentage of your gross earnings is withheld for federal taxes, Social Security, and Medicare. Additionally, North Dakota requires state income tax deductions based on your earnings. For detailed guidance, refer to the North Dakota Employer Training Memo - Payroll Deductions, which provides essential insights.

To contact the North Dakota tax authorities, you can visit their official website for up-to-date contact information. They provide various resources, including phone numbers and email addresses, to assist you. If you have questions regarding the North Dakota Employer Training Memo - Payroll Deductions, reaching out directly will ensure you receive accurate guidance. Additionally, using platforms like US Legal Forms can help you access the necessary forms and information to navigate your inquiries effectively.

In simple terms, the sunshine law refers to legislation that mandates transparency in government operations. This law allows citizens to observe and participate in government proceedings, ensuring accountability. Understanding the implications of sunshine laws can be beneficial for employers, especially when referencing the North Dakota Employer Training Memo - Payroll Deductions, as it underscores the importance of compliance and ethical standards in business practices.

In North Dakota, common law marriage is recognized under certain conditions, but it requires specific criteria to be met. Unlike some states, North Dakota does not have a strict time frame for establishing a common law marriage. However, couples must live together and intend to be married. For employers, the North Dakota Employer Training Memo - Payroll Deductions may provide insights into how such relationships affect payroll and tax obligations.

Sunshine laws in North Dakota promote transparency in government by allowing the public to access government meetings and records. These laws ensure that the decision-making process is open and accountable. As part of the North Dakota Employer Training Memo - Payroll Deductions, understanding these laws can help employers navigate compliance and maintain ethical practices in their operations.

In North Dakota, there is no specific law limiting the number of consecutive days an employee can work without a day off. However, employers should consider the health and well-being of their employees. The North Dakota Employer Training Memo - Payroll Deductions provides guidance on managing work schedules effectively, ensuring compliance with labor laws, and promoting a positive work environment. It is essential to communicate clearly with your team about work expectations and rest periods.

Deciding between exempt and non-exempt status depends on your organization's payroll structure and the nature of the work. If the position requires advanced skills and a significant level of responsibility, exempt status may be favorable for your business. However, if the role demands hourly work and the potential for overtime, non-exempt status could be more beneficial. Consulting the North Dakota Employer Training Memo - Payroll Deductions can guide your decision-making process.