North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status

Description

How to fill out IRS 20 Quiz To Determine 1099 Vs Employee Status?

You can invest various hours online attempting to locate the legal document format that complies with the state and federal requirements you will require.

US Legal Forms offers numerous legal forms that have been evaluated by experts.

It is easy to download or print the North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status from your service.

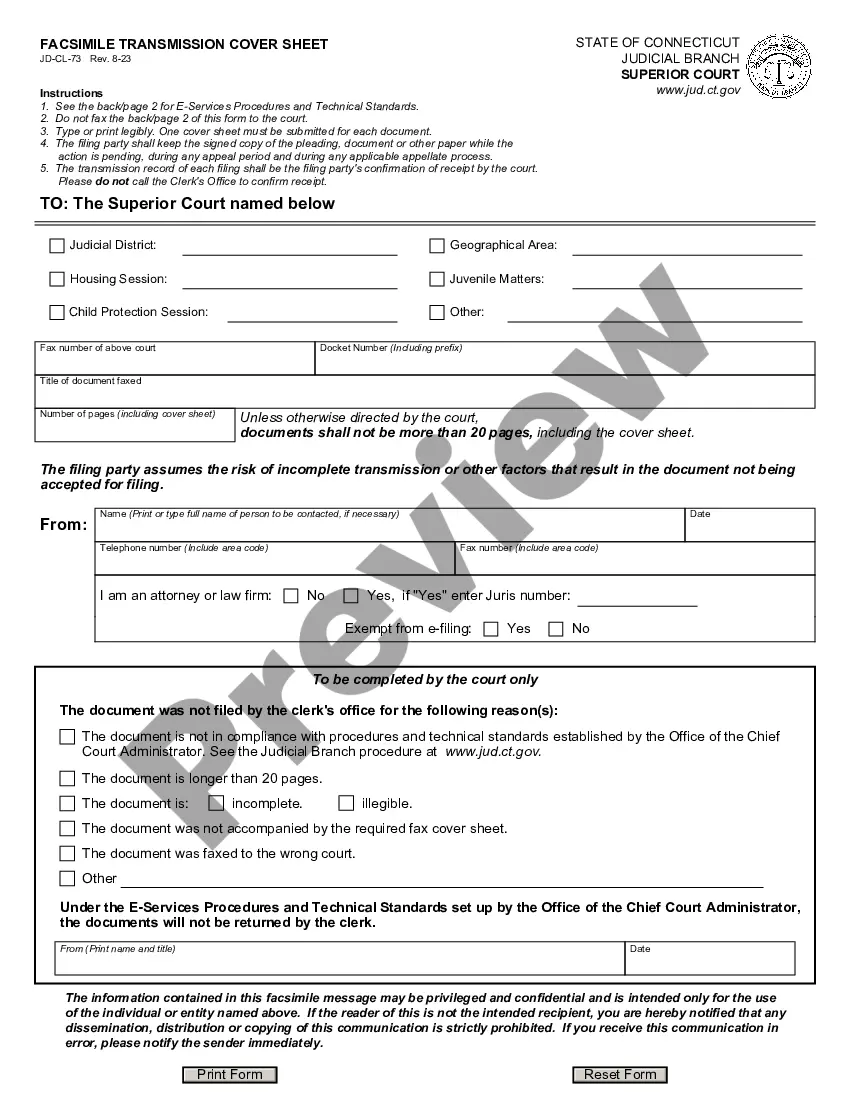

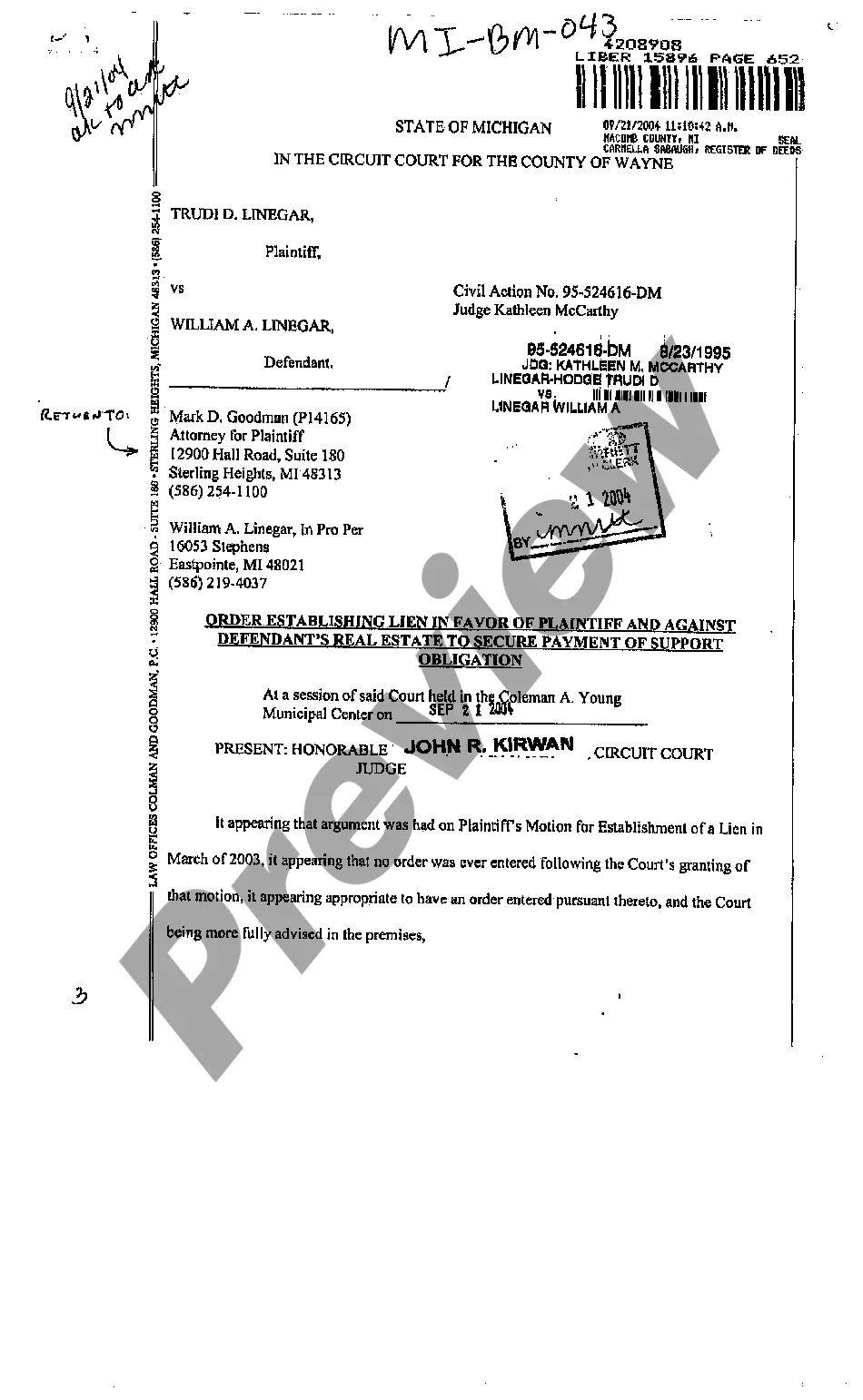

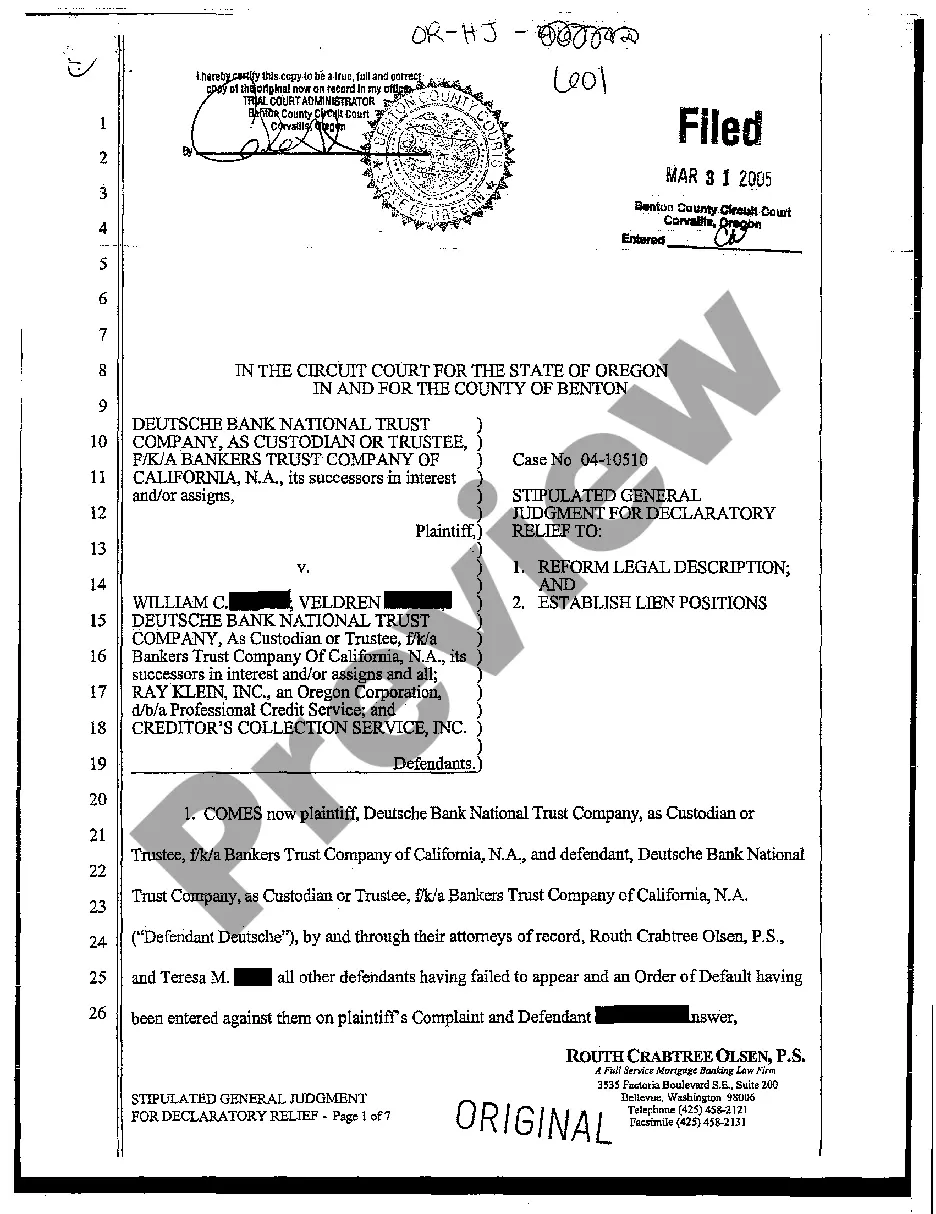

If available, utilize the Review option to browse through the document format as well.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- Then, you can complete, modify, print, or sign the North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status.

- Every legal document format you acquire is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding option.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the state/city of your choice.

- Review the form outline to make sure you have selected the appropriate form.

Form popularity

FAQ

To determine if someone is a W-2 employee or a 1099 contractor, assess the level of control and the type of payment. The North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status aids in this evaluation with relevant scenarios and questions. By using this tool, you can achieve a more accurate classification and ensure compliance.

Key questions focus on control over work execution, financial independence, and the nature of the working relationship. The North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status articulates these queries to provide a comprehensive evaluation. Answering these questions accurately helps clarify your worker's classification.

The three common tests include the Behavioral Test, the Financial Test, and the Relationship Test. These assessments form the foundation of the North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status. Completing this quiz can elucidate which test applies to your specific case.

Core determinants include control over work details, payment structure, and whether benefits are provided. The North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status simplifies this process for you. By taking this quiz, you can quickly identify which criteria apply in your situation.

Determining status often involves evaluating the degree of control and independence exercised in the work arrangement. The North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status provides a structured method to assess this. Utilizing this quiz can lead to clearer insights and help you avoid costly misclassifications.

Several factors, such as the level of control over work and the nature of the relationship, play a significant role in determining status. The North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status offers an easy way to navigate these factors. Understanding the details can help you make an informed decision regarding classification.

The IRS assesses various factors, including behavioral control and financial control, to determine independent contractor status. The North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status can help clarify these distinctions for you. This quiz guides you through the critical criteria that influence whether an individual qualifies as an independent contractor.

The IRS requires several factors to assess independent contractor status, focusing on the relationship between the worker and the employer. They look at behavioral control, financial control, and the relationship dynamics, examining aspects like payment methods and the presence of contracts. Utilizing the North Dakota IRS 20 Quiz to Determine 1099 vs Employee Status can aid you in understanding these requirements better and ensuring compliance with IRS guidelines.