North Dakota Purchase by company of its stock

Description

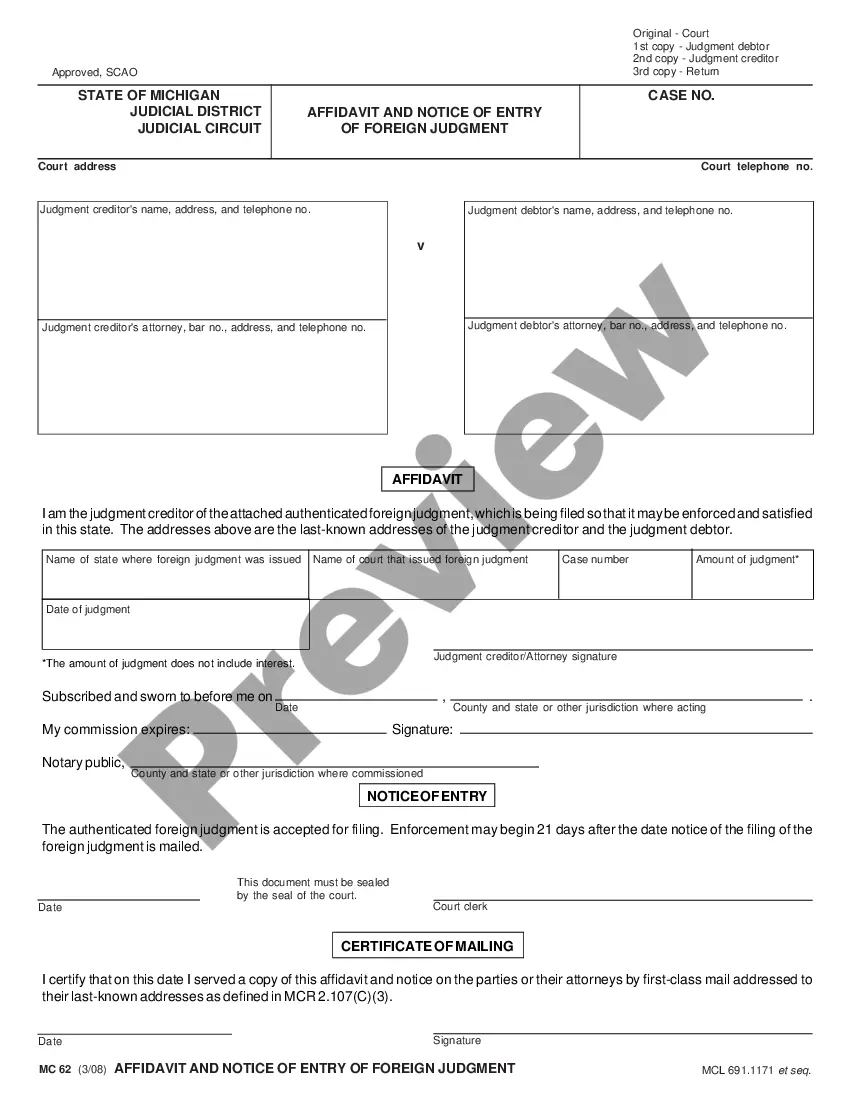

How to fill out Purchase By Company Of Its Stock?

If you need to full, download, or print out authorized papers web templates, use US Legal Forms, the largest assortment of authorized forms, that can be found on-line. Take advantage of the site`s simple and easy practical research to get the files you will need. Different web templates for organization and individual uses are categorized by categories and suggests, or key phrases. Use US Legal Forms to get the North Dakota Purchase by company of its stock in just a number of click throughs.

Should you be presently a US Legal Forms buyer, log in for your bank account and click on the Download key to get the North Dakota Purchase by company of its stock. Also you can accessibility forms you formerly saved from the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the form for your correct metropolis/country.

- Step 2. Take advantage of the Preview solution to look over the form`s information. Don`t forget to read the information.

- Step 3. Should you be unsatisfied with the form, take advantage of the Research area at the top of the display screen to locate other versions from the authorized form template.

- Step 4. After you have found the form you will need, click on the Get now key. Opt for the prices program you prefer and include your credentials to sign up on an bank account.

- Step 5. Procedure the deal. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the deal.

- Step 6. Find the file format from the authorized form and download it on the system.

- Step 7. Total, change and print out or signal the North Dakota Purchase by company of its stock.

Every single authorized papers template you buy is the one you have eternally. You may have acces to each and every form you saved in your acccount. Click on the My Forms area and decide on a form to print out or download once again.

Contend and download, and print out the North Dakota Purchase by company of its stock with US Legal Forms. There are many skilled and condition-specific forms you can use for the organization or individual needs.

Form popularity

FAQ

Top 10 Owners of Crescent Point Energy Corp CIBC Asset Management, Inc. GMT Capital Corp. BMO Asset Management Corp. TD Asset Management, Inc.

Crescent Point has agreed to sell its North Dakota assets to a private operator for US$500 million (approximately $675 million) in cash.

Aug 24 (Reuters) - Crescent Point Energy (CPG.TO) would sell its North Dakota assets to Kraken Resources for $500 million in cash, ing to sources familiar with the matter, as the Canadian oil and gas producer looks to repay its debt.

A professional corporation may render: One specific type of professional service and services ancillary thereto; or. Two or more kinds of professional services that are specifically authorized to be practiced in combination under North Dakota's licensing laws of each of the professional services to be rendered.

The Calgary-based oil and gas company announced Monday it will purchase Hammerhead Energy Inc., a Calgary-based energy company with assets in the Montney region of northwest Alberta, for a total of $2.55 billion, including approximately $455 million of Hammerhead's net debt.

Aug 24 (Reuters) - Crescent Point Energy (CPG.TO) would sell its North Dakota assets to Kraken Resources for $500 million in cash, ing to sources familiar with the matter, as the Canadian oil and gas producer looks to repay its debt. Neither of the companies immediately responded to requests for comment.