North Dakota Equity Incentive Plan

Description

How to fill out Equity Incentive Plan?

Are you inside a situation in which you require files for sometimes enterprise or personal purposes just about every working day? There are plenty of authorized papers layouts available online, but locating versions you can rely on isn`t straightforward. US Legal Forms provides 1000s of kind layouts, like the North Dakota Equity Incentive Plan, that happen to be created to meet federal and state demands.

In case you are previously informed about US Legal Forms site and get an account, merely log in. Afterward, it is possible to acquire the North Dakota Equity Incentive Plan web template.

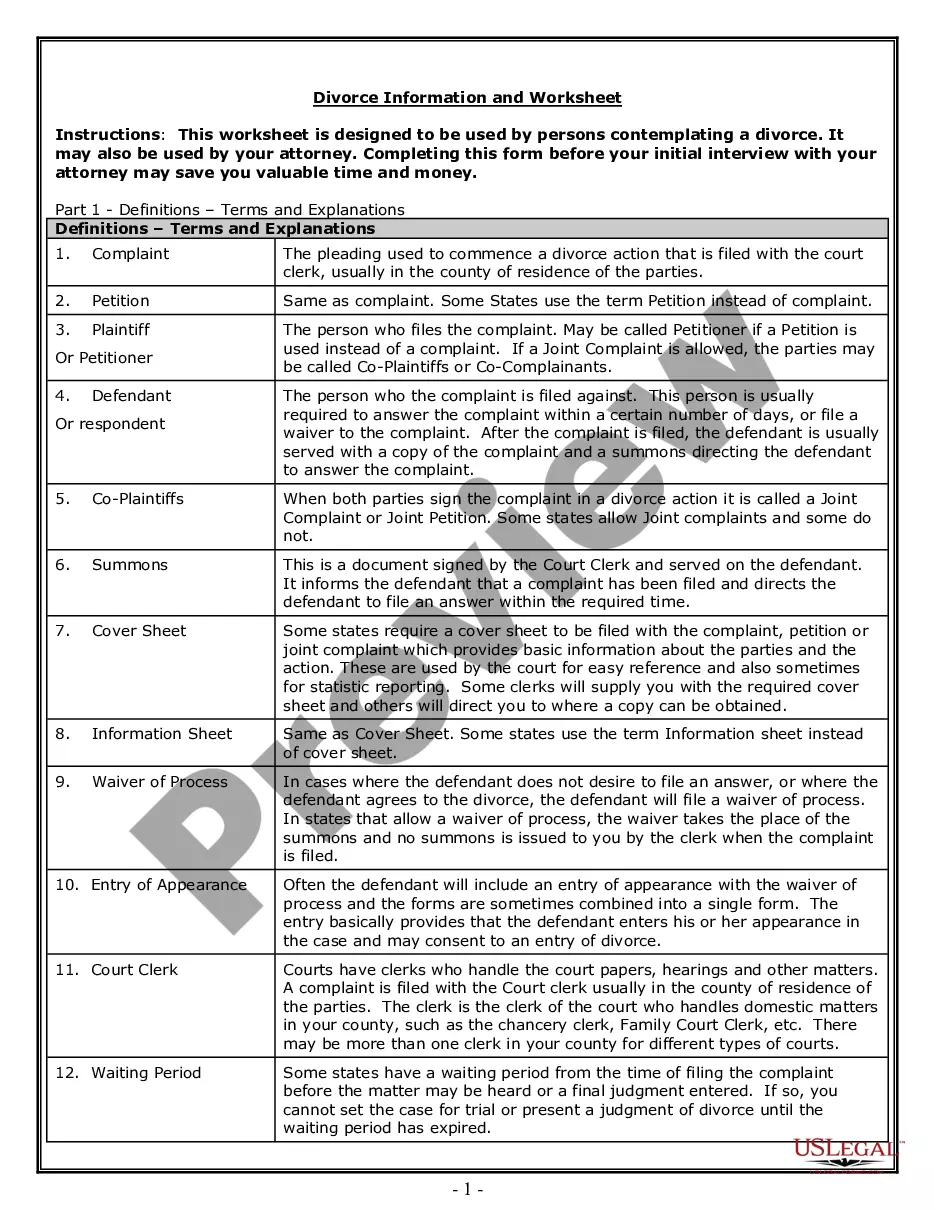

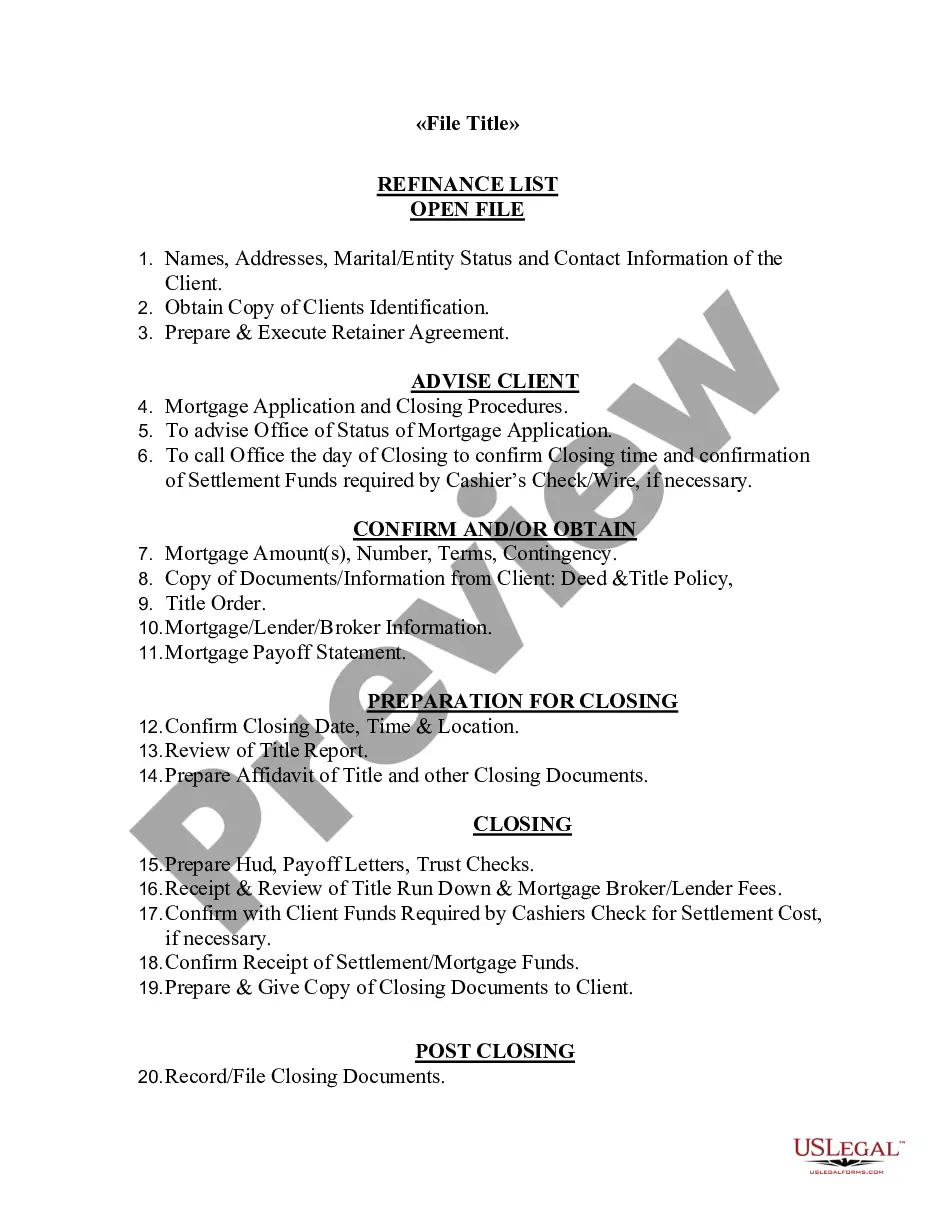

If you do not come with an profile and need to begin using US Legal Forms, follow these steps:

- Obtain the kind you want and make sure it is for your appropriate area/region.

- Use the Preview button to analyze the form.

- Read the explanation to actually have chosen the proper kind.

- In the event the kind isn`t what you`re trying to find, use the Lookup field to discover the kind that meets your needs and demands.

- If you obtain the appropriate kind, just click Get now.

- Select the rates strategy you would like, fill in the desired info to produce your account, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Pick a handy paper formatting and acquire your version.

Locate every one of the papers layouts you may have purchased in the My Forms menu. You can obtain a extra version of North Dakota Equity Incentive Plan at any time, if required. Just click on the essential kind to acquire or printing the papers web template.

Use US Legal Forms, probably the most considerable assortment of authorized forms, in order to save some time and prevent blunders. The support provides appropriately made authorized papers layouts which you can use for a variety of purposes. Generate an account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

State Tax Credit for Planned or Deferred Gifts The North Dakota Community Foundation and all of its component funds are considered qualified charities. The tax credit is 40% of the charitable deduction allowed by the IRS up to a maximum of $10,000 per year per taxpayer or $20,000 per year per couple filing jointly.

North Dakota Family Member Care Tax Credit This Tax Credit is a percentage of the taxpayer's earned income. The amount of credit is determined by eligible expenses incurred for caring for a family member. The caregiver can offset up to $4,000 in expenses with the credit, which is a percentage of income.

For filers with a filing status of single, head of household, qualifying widow(er), or married filing separately, the credit is $350. For married persons filing jointly, both of whom are full-year residents, the credit is $700.

The 2021 North Dakota Legislature created a tax relief income tax credit for residents of North Dakota. Full-year residents of North Dakota will receive a credit up to $350. For taxpayers who are full-year residents and married filing jointly, the tax credit is up to $700.

For married persons filing jointly, both of whom are full-year residents, the credit is $700. In the case of married persons filing jointly, where one spouse is a full-year resident of North Dakota and the other spouse is a nonresident of North Dakota for part or all of the year, a $350 credit is allowed.

The Automation Tax Credit program provides a tax credit of up to 20% to cover the cost of equipment leased or purchased with the intent of automating a manual process. Completed applications and supporting documentation must be submitted by Jan. 31. of the year following the purchase of the equipment.

EARNED INCOME TAX CREDIT (EITC) Latest Legislative Action: In 2021, Gov. Doug Burgum signed H.B.1515, creating a temporary, nonrefundable EITC of $350 for individuals and $700 for couples filing jointly.

Research Expense Credit. This is an income tax credit for conducting research in North Dakota. Eligibility: The credit is equal to a percentage of the excess of qualified research expenses (QRE) over a base amount: 25% for the first $100,000 of excess QRE in a tax year.