North Dakota Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

How to fill out Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

Are you currently within a position the place you require papers for sometimes enterprise or person functions just about every working day? There are a variety of legitimate document templates accessible on the Internet, but locating kinds you can trust is not simple. US Legal Forms offers thousands of form templates, like the North Dakota Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement, that are composed to fulfill federal and state demands.

Should you be previously familiar with US Legal Forms site and possess a free account, simply log in. Following that, you may download the North Dakota Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement design.

Should you not offer an account and would like to start using US Legal Forms, follow these steps:

- Obtain the form you will need and ensure it is for your proper city/state.

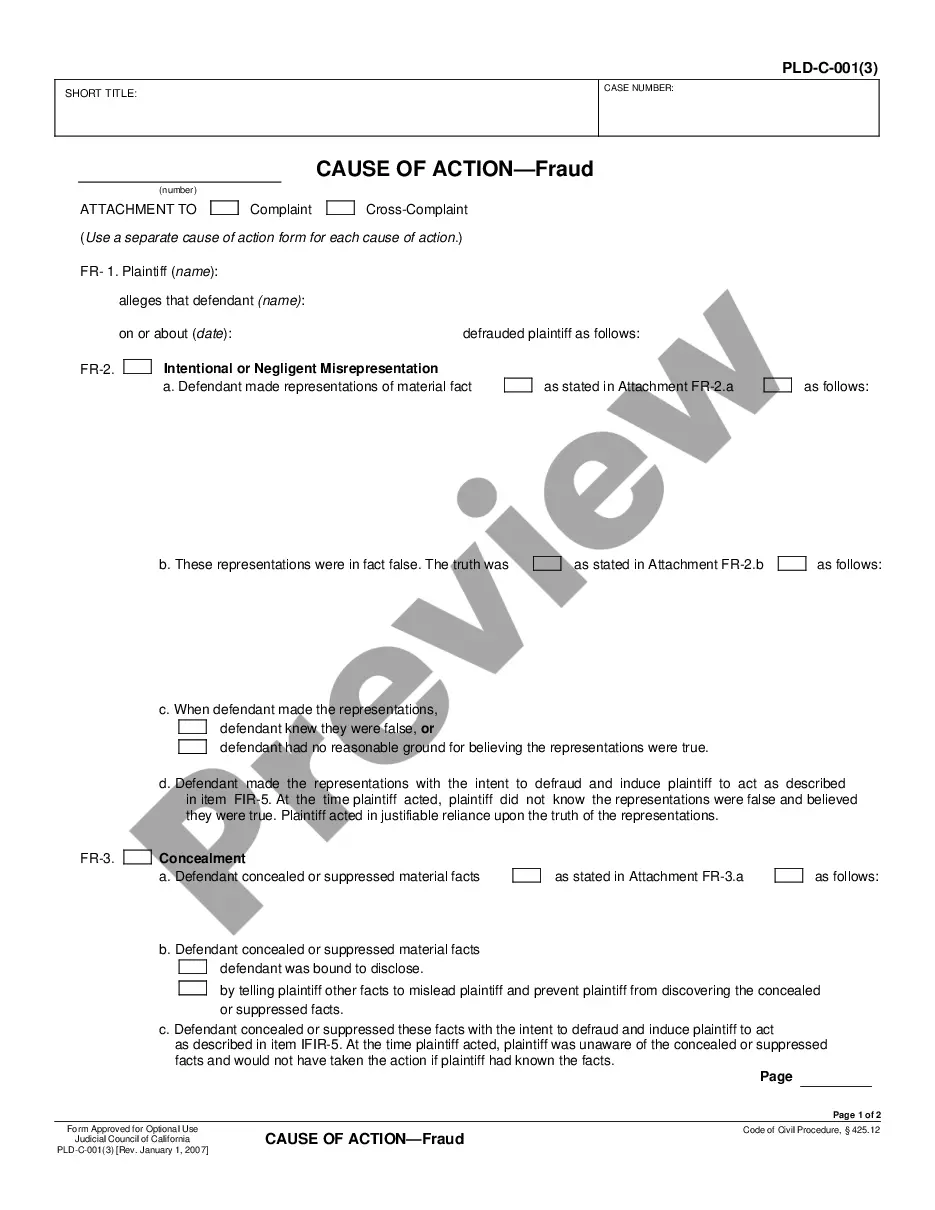

- Use the Review option to check the form.

- See the outline to actually have selected the appropriate form.

- When the form is not what you are trying to find, make use of the Research area to discover the form that fits your needs and demands.

- When you obtain the proper form, just click Acquire now.

- Choose the rates strategy you would like, complete the desired information and facts to generate your bank account, and pay for an order utilizing your PayPal or credit card.

- Decide on a hassle-free paper format and download your duplicate.

Discover all the document templates you possess bought in the My Forms menu. You can aquire a additional duplicate of North Dakota Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement any time, if needed. Just go through the needed form to download or print the document design.

Use US Legal Forms, by far the most considerable selection of legitimate types, in order to save some time and steer clear of faults. The assistance offers appropriately made legitimate document templates that you can use for a range of functions. Make a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

The agreement calculates and allocates the tax consequences attributable to a specific member or group that are reported in a consolidated return. A TSA happens when two or more corporations are consolidated or combined into a single tax filing.

A distribution agreement is one under which a supplier or manufacturer of goods agrees that an independent third party will market the goods. The distributor buys the goods on their own account and trades under their own name.

A distribution agreement is one under which a supplier or manufacturer of goods agrees that an independent third party will market and sell the goods. The distributor buys the goods on their own account and trades under their own name.

A music distribution deal is a legal agreement between an artist and a distributor that governs the distribution and sales of the artist's music. The distributor is responsible for getting the music onto various platforms such as iTunes, Spotify, Amazon Music, and other music streaming platforms.

The basic elements of a distribution agreement include the term (time period for which the contract is in effect), terms and conditions of supply and the sales territories covered by the agreement (regions within the U.S. and/or international markets).

How Distribution Agreements Work Set an appointment with the manufacturer. Negotiate the distribution terms. Review specifics, such as promotional literature. Hire a business lawyer to help you draft the terms. Sign or renegotiate the contract. Begin executing the agreement as contained within provisions.

What to include in your distribution agreement Duration of the contract (when it starts and when it ends) The supplier's products in question & how much they will cost the distributor. Relevant duties and responsibilities of either party. Minimum sales or quantity of goods. Whether or not the contract is exclusive.