North Dakota Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

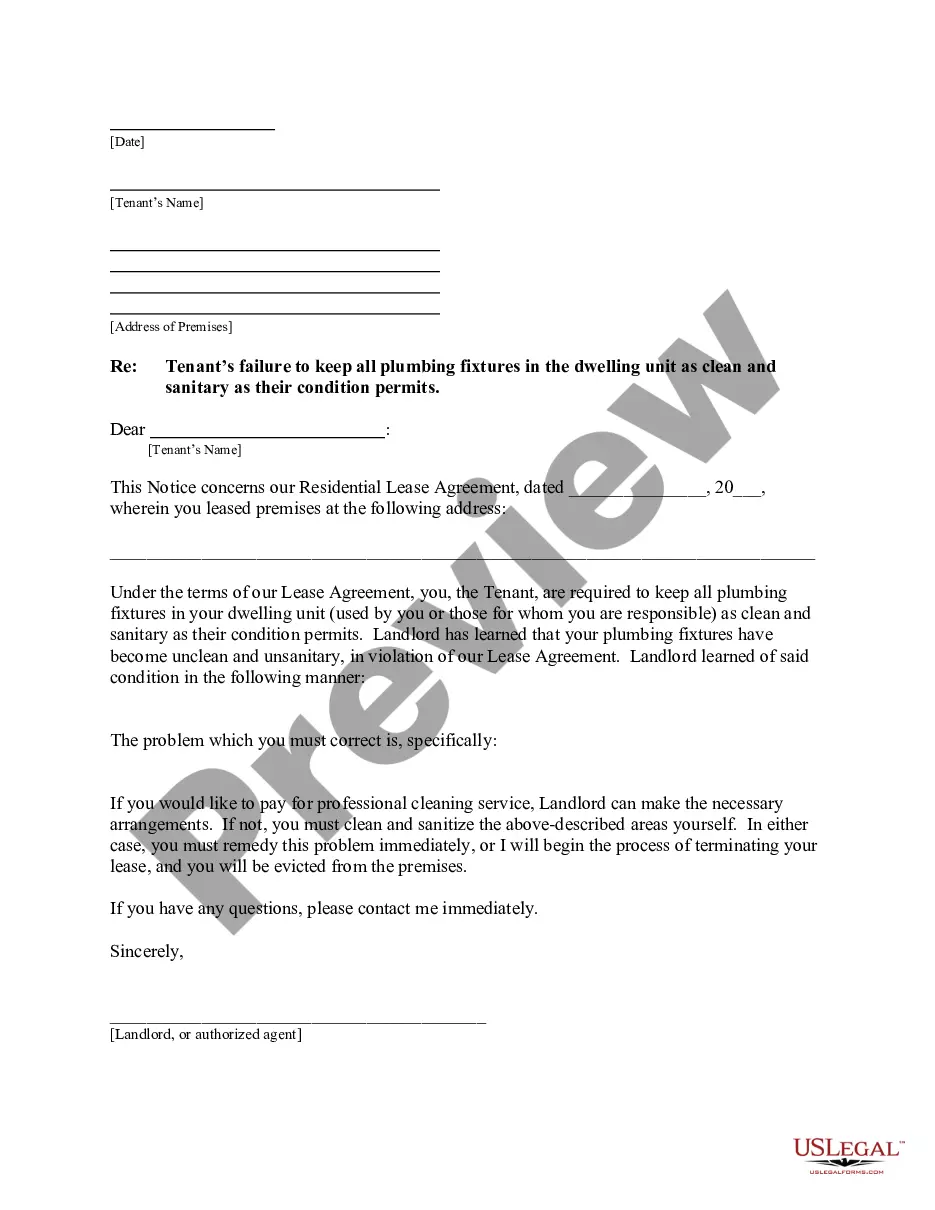

How to fill out Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

If you want to full, obtain, or printing legitimate record templates, use US Legal Forms, the biggest selection of legitimate kinds, that can be found on the web. Take advantage of the site`s simple and convenient look for to obtain the files you want. Various templates for company and specific purposes are sorted by classes and says, or keywords and phrases. Use US Legal Forms to obtain the North Dakota Approval of employee stock purchase plan for The American Annuity Group, Inc. within a handful of clicks.

If you are presently a US Legal Forms client, log in to the accounts and click the Down load key to find the North Dakota Approval of employee stock purchase plan for The American Annuity Group, Inc.. You can also access kinds you in the past downloaded within the My Forms tab of the accounts.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have selected the shape to the correct town/land.

- Step 2. Utilize the Preview solution to look through the form`s information. Don`t neglect to see the information.

- Step 3. If you are not happy with the type, make use of the Look for field at the top of the monitor to get other models in the legitimate type format.

- Step 4. Once you have discovered the shape you want, click the Purchase now key. Choose the costs prepare you prefer and add your credentials to sign up on an accounts.

- Step 5. Process the deal. You may use your credit card or PayPal accounts to accomplish the deal.

- Step 6. Choose the format in the legitimate type and obtain it in your device.

- Step 7. Complete, revise and printing or sign the North Dakota Approval of employee stock purchase plan for The American Annuity Group, Inc..

Each legitimate record format you get is your own permanently. You may have acces to each and every type you downloaded in your acccount. Click on the My Forms section and pick a type to printing or obtain once more.

Compete and obtain, and printing the North Dakota Approval of employee stock purchase plan for The American Annuity Group, Inc. with US Legal Forms. There are millions of skilled and condition-certain kinds you can utilize for your personal company or specific requirements.

Form popularity

FAQ

Section 423(a) provides that section 421 applies to the transfer of stock to an individual pursuant to the exercise of an option granted under an employee stock purchase plan if: (i) No disposition of the stock is made within two years from the date of grant of the option or within one year from the date of transfer of ...

How is the $25,000 limit calculated? The basic rule is that each employee cannot purchase more than $25,000 per year, valued using the fair market value on the date he/she enrolled in the current offering.

Section 423 of the Code permits a plan to exclude employees who have been employed for less than two years or who are employed for less than 20 hours per week or five months per year. Also, owners of 5% or more of the common stock of a company by statute are not permitted to participate.

Once approved by the stockholders, an ESPP does not need to be approved by the stockholders again unless there is an amendment to the ESPP that would be considered the ?adoption of a new plan.? As a practical matter, this means a change in the number of shares reserved for issuance or a change in the related ...

With qualified Section 423 employee stock purchase plans, you are not taxed at the time the shares are purchased, only when you sell. Depending on whether the shares were held for the required holding period, a portion of your gain may be taxed as capital gains or as ordinary income.

To qualify, ESPPs generally have to be available to all full-time employees with a certain amount of time vested in the job. Participants may need to hold their shares for at least one year after the purchase date and two years after the grant date to take advantage of the long-term capital gains rate.

Employee Stock Purchase Plans (ESPPs) are widely regarded as one of the most simple and straightforward equity compensation strategies available to businesses today. There are two major types of ESPP: 1) Qualified ESPP offering tax advantages and 2) Non-qualified ESPP offering flexibility.

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.