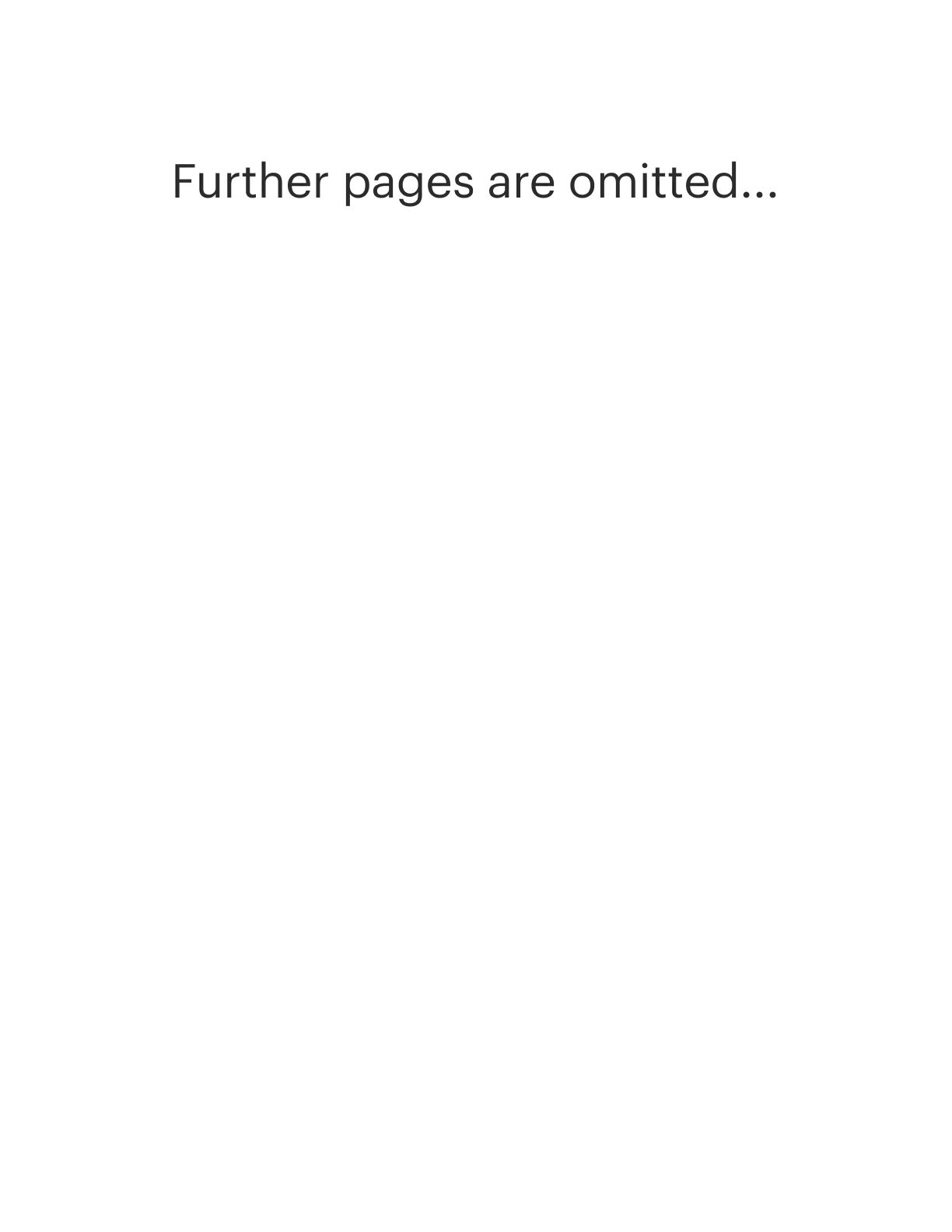

North Dakota Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.

Description

How to fill out Stock Option And Long Term Incentive Plan Of Golf Technology Holding, Inc.?

You may devote time on the web trying to find the legal papers web template which fits the state and federal specifications you will need. US Legal Forms gives 1000s of legal forms which are examined by experts. It is simple to download or produce the North Dakota Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. from our services.

If you currently have a US Legal Forms bank account, it is possible to log in and click on the Down load switch. Next, it is possible to total, change, produce, or indicator the North Dakota Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.. Every legal papers web template you buy is yours eternally. To acquire yet another version for any purchased type, go to the My Forms tab and click on the related switch.

If you work with the US Legal Forms website the first time, follow the easy instructions listed below:

- First, be sure that you have selected the right papers web template for that area/area of your choice. See the type description to ensure you have selected the proper type. If offered, make use of the Preview switch to search from the papers web template too.

- If you want to discover yet another model of the type, make use of the Search industry to obtain the web template that fits your needs and specifications.

- When you have identified the web template you would like, simply click Purchase now to move forward.

- Choose the prices prepare you would like, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You should use your bank card or PayPal bank account to purchase the legal type.

- Choose the formatting of the papers and download it to the system.

- Make modifications to the papers if required. You may total, change and indicator and produce North Dakota Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc..

Down load and produce 1000s of papers themes using the US Legal Forms web site, which offers the biggest assortment of legal forms. Use skilled and status-specific themes to take on your company or specific needs.

Form popularity

FAQ

Through LTIPs, a new long-term incentive can be granted to an employee every year, rather than a one-time incentive, similar to a holiday bonus.

ESOPs are qualified retirement plans and they are designed to accumulate funds for retirement. While LTIPS and ESPPs could be used to accumulate savings for retirement, they are frequently used to accumulate savings for other financial goals, such as college tuition or a vacation home.

Here's an example: You can purchase 1,000 shares of company stock at $20 a share with your vested ISO. Shares are trading for $40 in the market. If you already own 500 company shares, you can swap those shares (500 shares x $40 market price = $20,000) for the 1,000 new shares, rather than paying $20,000 in cash.

Stock options are another type of LTIP. After a set length of employment, workers may be able to purchase company stock at a discount while the employer pays the balance. The worker's seniority in the organization increases with the percentage of shares owned.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

A stock incentive plan, or employee stock purchase plan, is a form of compensation by a company for employees or contractors which can be used as an alternative to cash payment. It's designed to motivate employees by offering them the opportunity for future earnings through company stocks.

An example of a long-term incentive could be a cash plan, equity plan or share plan.

For employees, LTI can be a reward for outstanding performance and are a vehicle for capital accumulation. For shareholders, LTI are a vehicle that aligns employees with the performance of shares (for market-based equity vehicles) and the long-term vision of the company.

term incentive plan (LTIP) is a company policy that rewards employees for reaching specific goals that lead to increased shareholder value. In a typical LTIP, the employee, usually an executive, must fulfill various conditions or requirements.

These plans are discussed below: Premium Bonus Plan. Under premium bonus plans, the time taken to complete a job is fixed based on a careful time analysis. ... Profit-Sharing and Co-ownership. ... Group Incentives. ... Indirect Incentive Plans.