North Dakota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

Discovering the right lawful papers design can be quite a have difficulties. Naturally, there are tons of layouts available on the net, but how can you get the lawful kind you will need? Use the US Legal Forms website. The services delivers a huge number of layouts, including the North Dakota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, that you can use for organization and private requires. Each of the types are examined by specialists and fulfill state and federal specifications.

Should you be presently authorized, log in to the account and click on the Down load button to find the North Dakota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers. Make use of your account to look from the lawful types you have purchased previously. Go to the My Forms tab of your own account and obtain yet another copy of your papers you will need.

Should you be a new consumer of US Legal Forms, listed here are straightforward recommendations that you should follow:

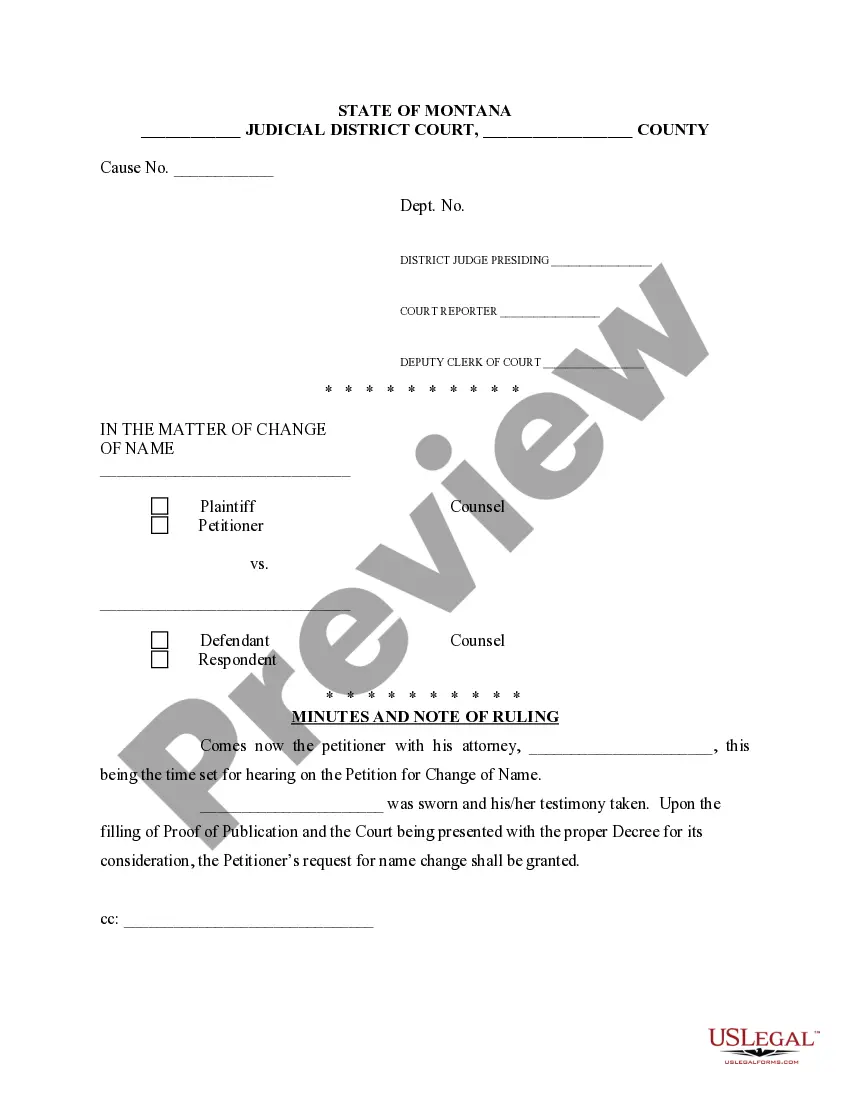

- Initially, be sure you have chosen the appropriate kind for your personal area/region. You are able to look through the shape making use of the Review button and look at the shape description to make sure it is the right one for you.

- If the kind is not going to fulfill your expectations, utilize the Seach industry to discover the appropriate kind.

- Once you are certain the shape is proper, click the Get now button to find the kind.

- Choose the rates prepare you need and enter in the essential information and facts. Make your account and purchase an order with your PayPal account or Visa or Mastercard.

- Opt for the file file format and acquire the lawful papers design to the gadget.

- Full, edit and printing and sign the attained North Dakota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers.

US Legal Forms may be the largest local library of lawful types where you can find different papers layouts. Use the company to acquire expertly-produced files that follow express specifications.

Form popularity

FAQ

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

Summary of ISO vs. NSO Differences Incentive Stock Options (ISOs)Non-Qualified Stock Options (NSOs)Eligible RecipientsEmployees onlyAny service provider (e.g. employees, advisors, consultants, directors)Tax at GrantNo tax eventNo tax event10 more rows