North Dakota Action by Unanimous Written Consent of the Shareholders of (Name of Company)

Description

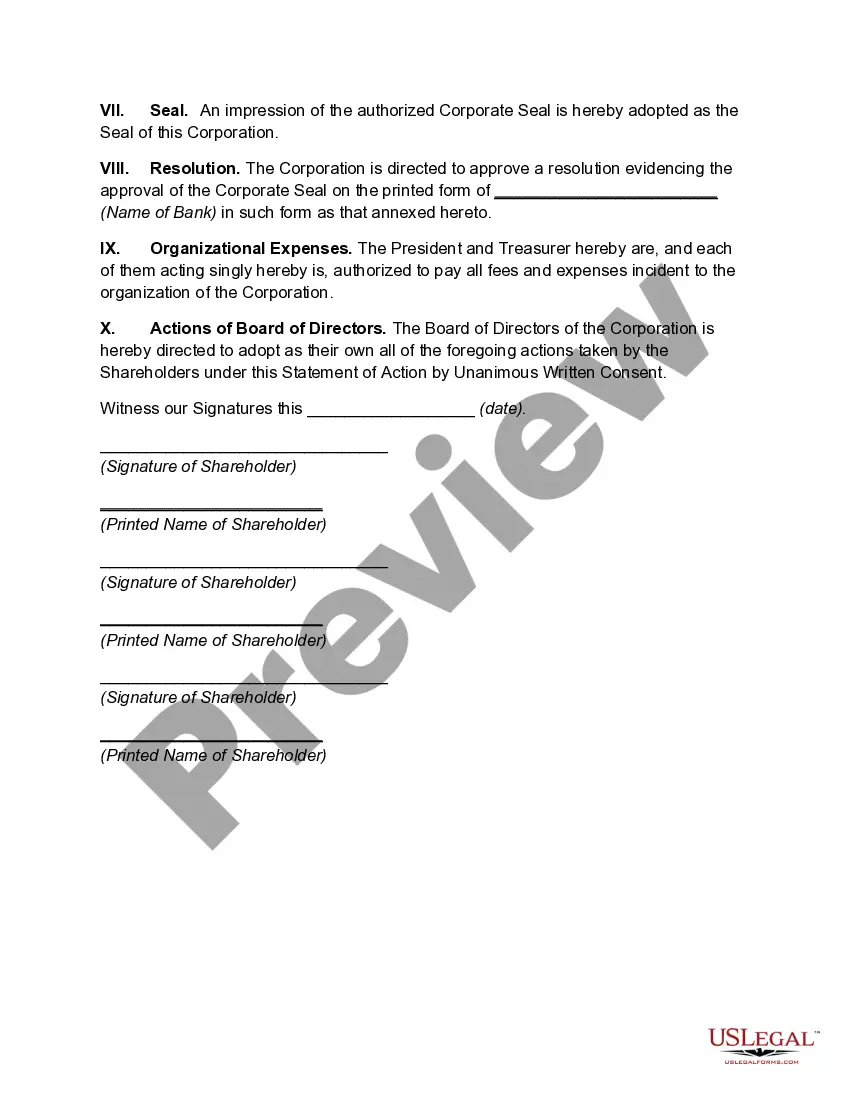

How to fill out Action By Unanimous Written Consent Of The Shareholders Of (Name Of Company)?

If you require to complete, acquire, or print sanctioned document templates, utilize US Legal Forms, the leading collection of legal forms, which are accessible online.

Take advantage of the website's user-friendly and convenient search feature to locate the documents you need.

Various templates for business and individual purposes are categorized by type and state, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Buy now button. Select the payment plan you prefer and enter your credentials to sign up for an account.

- Utilize US Legal Forms to find the North Dakota Action by Unanimous Written Consent of the Shareholders of (Company Name) in just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and click the Obtain button to retrieve the North Dakota Action by Unanimous Written Consent of the Shareholders of (Company Name).

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form’s details. Remember to read the summary.

Form popularity

FAQ

Under the CBCA and the corporate statutes of the remaining provinces (i.e. Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Ontario and Prince Edward Island) only the names and addresses of directors are filed on incorporation; no officer or shareholder information needs to be disclosed.

3) Bylaws and Shareholder Matters:The percentage of shareholders required to approve a delineated action (if greater than a majority). The means by which a shareholder may provide a proxy to vote its shares. The means by which shareholders may vote by written consent rather than through a meeting.

A foundational principle of the U.S. securities laws is that public companies have an obligation to publicly disclose information to prospective investors and shareholders so that they may make informed investment and proxy voting decisions.

Therefore, the company, not its shareholders, has the right to sue for wrongs done to it; and (ii) absent the rule, a shareholder would always be able to sue for wrongs done to the corporation which indirectly cause harm to the shareholder.

In most circumstances, the shareholders' agreement should take priority, because the agreement is specifically designed to control the shareholders' relationship. Once a conflict is disclosed between the bylaws and shareholders' agreement, the bylaws should be amended to remove the conflict.

Public companies are able to request a list of their registered and NOBO shareholders as of a particular record date. Typically, shareholder list requests are made through an intermediary for a modest per account fee.

Shareholders Elect Directors Articles of incorporation normally specify that shareholders shall elect directors. In practice, what usually happens is that a slate of one or more proposed directors is drawn up by the board of directors, then voted on by shareholders at the annual meeting.

SEC regulations require publicly owned companies to disclose certain types of business and financial data on a regular basis to the SEC and to the company's stockholders.

§ 55-10-20. (b) A corporation's shareholders may amend or repeal the corporation's bylaws even though the bylaws may also be amended or repealed by its board of directors.

Federal regulations require the disclosure of all relevant financial information by publicly-listed companies. In addition to financial data, companies are required to reveal their analysis of their strengths, weaknesses, opportunities, and threats.