North Dakota Annuity as Consideration for Transfer of Securities

Description

How to fill out Annuity As Consideration For Transfer Of Securities?

Selecting the appropriate legal document layout can be a challenge.

Of course, there is a multitude of online templates accessible on the web, but how do you acquire the legal form you desire.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the North Dakota Annuity as Consideration for Transfer of Securities, which you can use for both business and personal purposes.

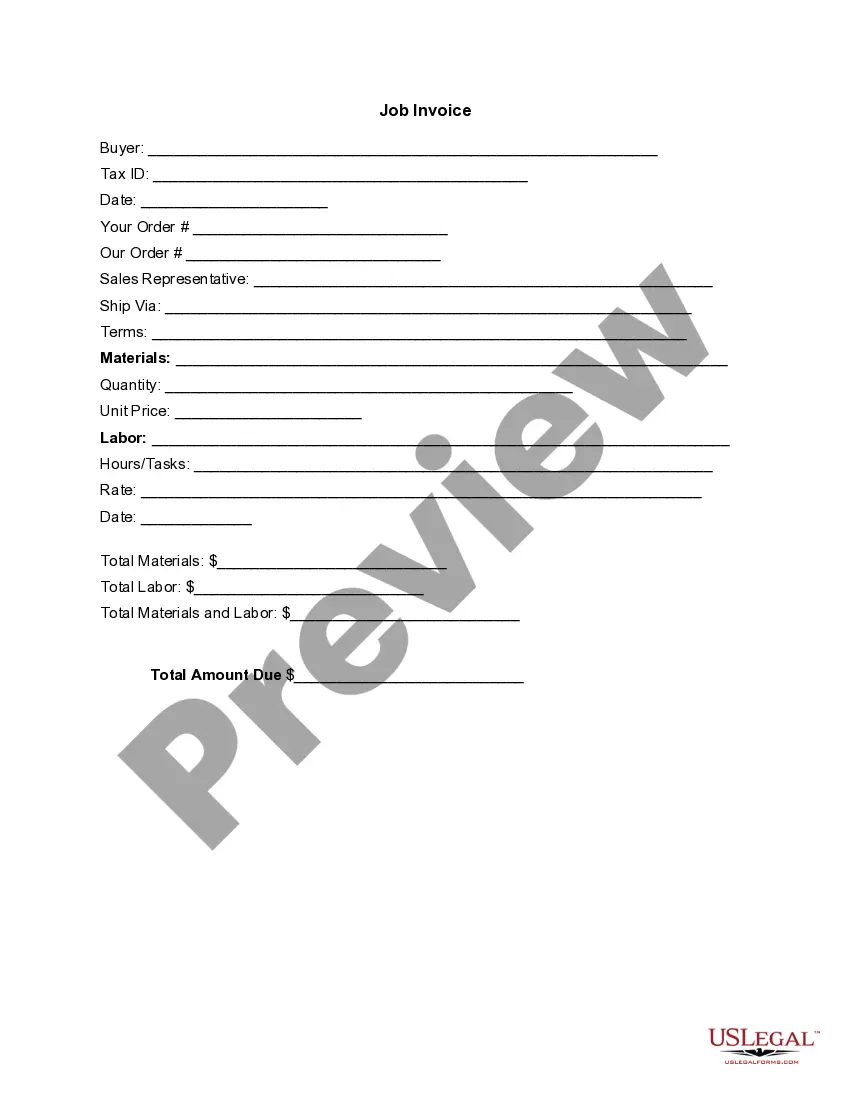

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your city/region. You can examine the form using the Review button and read the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate document. Once you are confident the form is suitable, click the Purchase Now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document layout to your device. Fill out, modify, print, and sign the received North Dakota Annuity as Consideration for Transfer of Securities. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download professionally crafted paperwork that adhere to state regulations.

- All of the forms are reviewed by experts and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to retrieve the North Dakota Annuity as Consideration for Transfer of Securities.

- Use your account to search for the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

A basic death benefit rider offered by a variable annuity guarantees that after your death, the insurance company will pay your heirs at least the amount of the money you put into the annuity prior to it being annuitized. If the policy has been annuitized, there is no death benefit.

The proceeds from an annuity death benefit are taxable when they are received by the beneficiary. In the case where the recipient is a surviving spouse, he or she can initiate certain measures to defer the payment or taxes on the amount received.

A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies. For life insurance policies, death benefits are not subject to income tax and named beneficiaries ordinarily receive the death benefit as a lump-sum payment.

Immediate annuity type structures cannot be transferred, so only deferred annuities like variable, fixed, or indexed can be moved. Annuities were designed to be transfer of risk solutions, so ask yourself what you want the money to do, and then find the best contractual guarantee to solve for that specific issue.

Payments will continue to you for as long as you live. But you or your beneficiary are guaranteed to get a least the amount you paid in. If you die before that amount is paid out, your beneficiary will get payments up to the amount that you initially paid for the annuity.

Like other investments, most annuities can be passed along to your heirs in the event of your death. However, it's important to remember that annuities are fundamentally a life insurance product, which alters how they're handled for taxation and inheritance purposes.

To give the annuity away, you simply contact the insurance company and state that you want to gift the ownership of the annuity policy to someone else or a trust. There are some tax implications to consider with this, though. Before you give an annuity away, you need to look at its status.

Annuities are a type of insurance contract that focuses on growing your assets and helping to provide a guaranteed income. Some contracts provide a death benefit for the annuity value that's not paid out during your lifetime.

Contact your annuity company and let your account manager know you want to change the owner of your contract. The annuity company will send you a change of ownership form. Fill out the change of ownership form for your annuity.

After an annuitant dies, insurance companies distribute any remaining payments to beneficiaries in a lump sum or stream of payments. It's important to include a beneficiary in the annuity contract terms so that the accumulated assets are not surrendered to a financial institution if the owner dies.