North Dakota Guaranty with Pledged Collateral

Description

How to fill out Guaranty With Pledged Collateral?

Have you ever been in a circumstance where you require documents for various business or personal activities almost daily.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of form templates, such as the North Dakota Guaranty with Pledged Collateral, which are designed to comply with federal and state regulations.

Once you find the right form, simply click Purchase now.

Choose the pricing plan you want, fill in the required information to create your account, and complete the purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the North Dakota Guaranty with Pledged Collateral template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and confirm it is for the correct city/region.

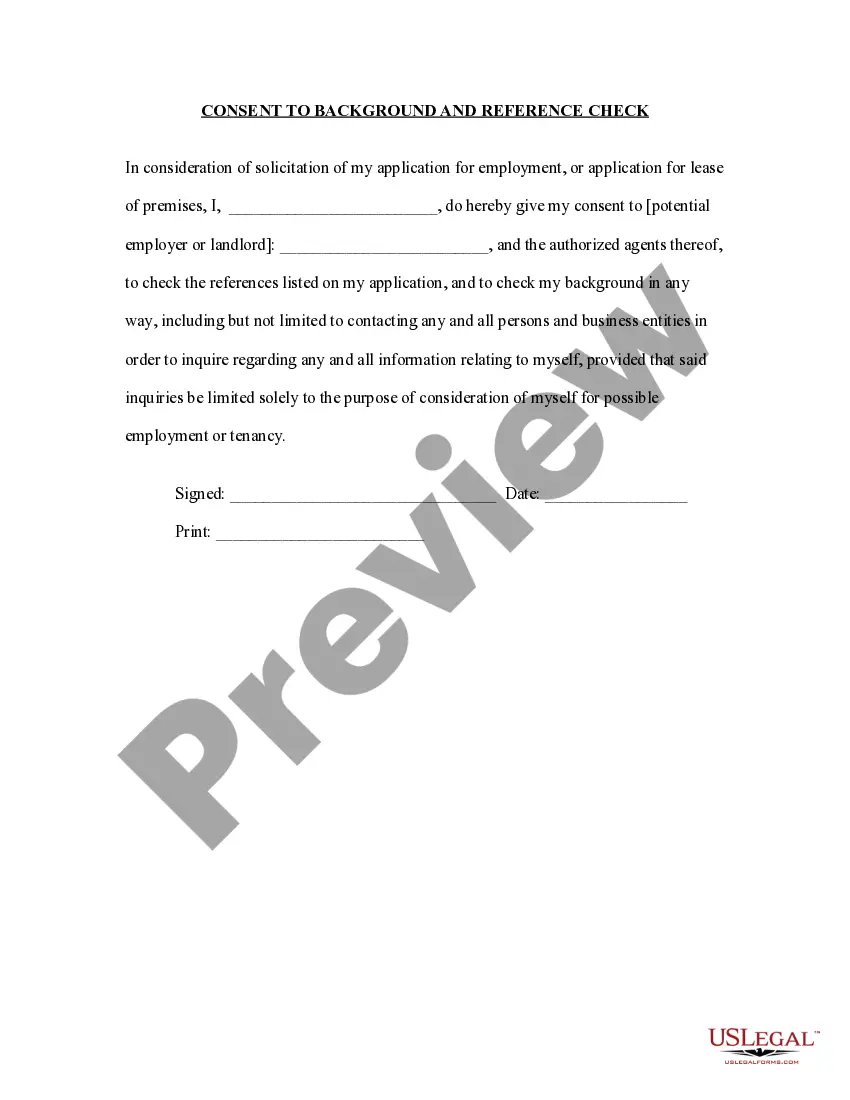

- Use the Preview button to review the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search box to find the form that suits your needs.

Form popularity

FAQ

Lenders are not required to take collateral for loans up to $25,000. For loans in excess of $350,000, the SBA requires that the lender collateralize the loan to the maximum extent possible up to the loan amount.

The SBA requires collateral as security on most SBA loans (when worthwhile assets are available).

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

What are the collateral requirements? Economic Injury Disaster Loans over $25,000 require collateral. SBA takes real estate as collateral when it is available.

Pledged collateral refers to assets that are used to secure a loan. The borrower pledges assets or property to the lender to guarantee or secure the loan.

The pledging of collateral by a financial institution is necessary to protect the Federal Government against risk of loss.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

Lenders are not required to take collateral for loans up to $25,000. For loans in excess of $350,000, the SBA requires that the lender collateralize the loan to the maximum extent possible up to the loan amount.

Collateral includes assets such as real estate and office or manufacturing equipment. Accounts receivable and inventory may be pledged as collateral. Collateral may also include personal assets and commonly, a second mortgage on a home.

Key Takeaways. A guarantor guarantees to pay a borrower's debt in the event that the borrower defaults on a loan obligation. The guarantor guarantees a loan by pledging their assets as collateral.