North Dakota Employee Lending Agreement

Description

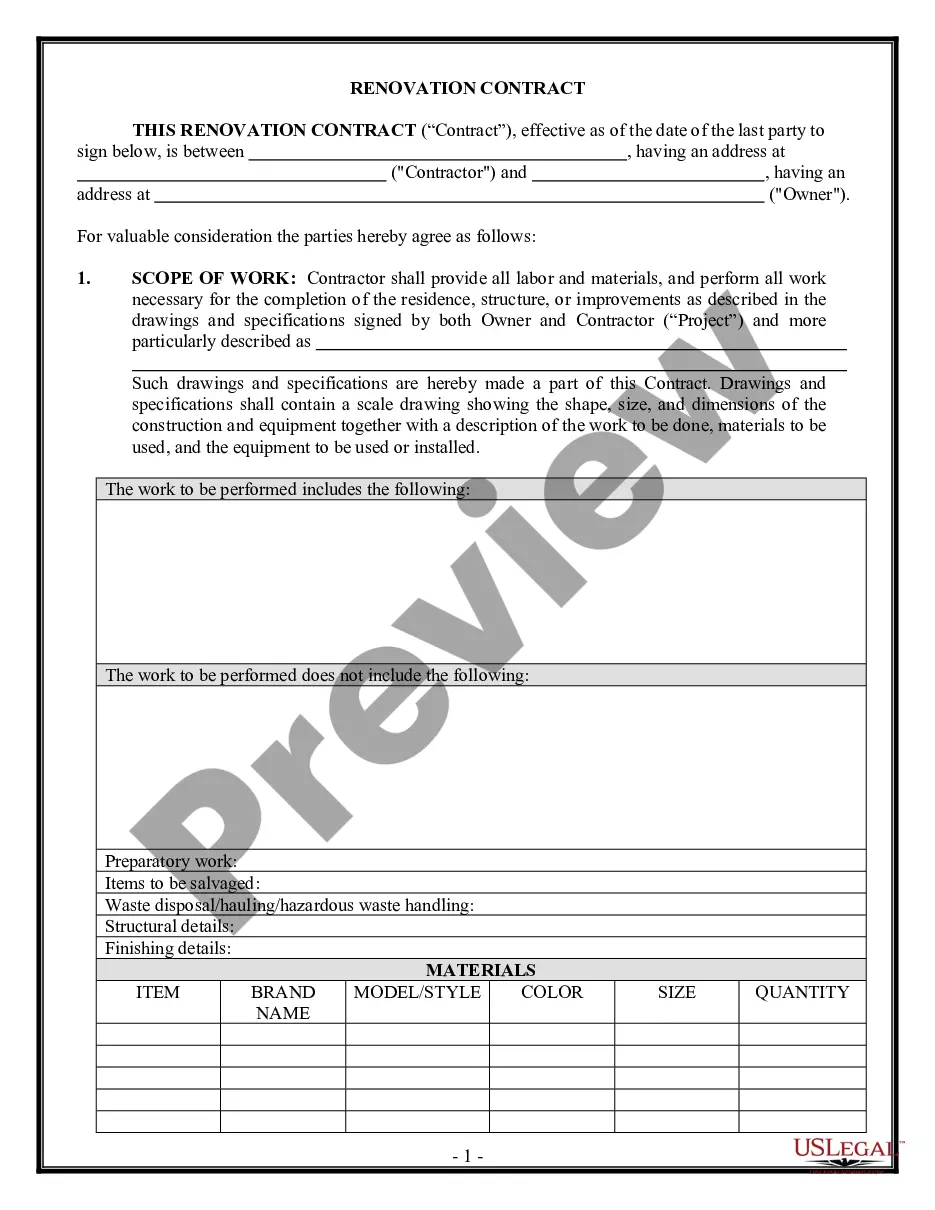

How to fill out Employee Lending Agreement?

If you require to finish, acquire, or print authentic document templates, utilize US Legal Forms, the most extensive selection of legitimate forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are categorized by types and states, or by keywords.

Step 4. After finding the form you need, click on the Acquire now button. Select your preferred pricing plan and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the North Dakota Employee Lending Agreement with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Acquire button to get the North Dakota Employee Lending Agreement.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read through the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to locate alternative versions of the legal document template.

Form popularity

FAQ

Yes, North Dakota is an employment at-will state, which means that employers can dismiss employees without cause, and employees can leave their jobs without reason. However, certain exceptions exist where contracts or agreements, like the North Dakota Employee Lending Agreement, may stipulate specific conditions. Understanding these nuances is vital for both parties to maintain a fair and respectful employment dynamic. It's beneficial to seek guidance from reliable sources when navigating these agreements.

Yes, there is a difference between state W-4s and federal Form W-4. Every employee in the U.S. will fill out a federal Form W-4, yet not every employee will fill out a state W-4. Your state tax withholdings and form requirements will vary depending on the state you reside in.

The W-4 is a federal document, and several states but not all accept the federal W-4. Below is a chart of states and what they accept. If the state has their own withholding form, then the federal W-4 is not allowed for state calculation of withholdings.

North Dakota Income Tax WithholdingNorth Dakota requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the State Tax Commissioner.

U.S. States that Require State Tax Withholding FormsAlabama.Arizona.Arkansas.California.Connecticut.District of Columbia.Georgia.Hawaii.More items...

North Dakota is an employment-at-will state (ND Cent. Code Sec. 34-03-01). Therefore, an employer may generally terminate an employment relationship at any time and for any reason, unless an agreement or law provides otherwise.

As of 2021, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

Do I Need to File? You must file an income tax return if you are a resident, part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in North Dakota.

Code § 34-14-09.2.) No federal or state law in North Dakota requires employers to pay out an employee's accrued vacation, sick leave, or other paid time off (PTO) at the termination of employment.

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold. For more information regarding income tax withholding, see: Guideline Income Tax Withholding & Information Returns. Income Tax Withholding Rates and Instructions.