North Dakota Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

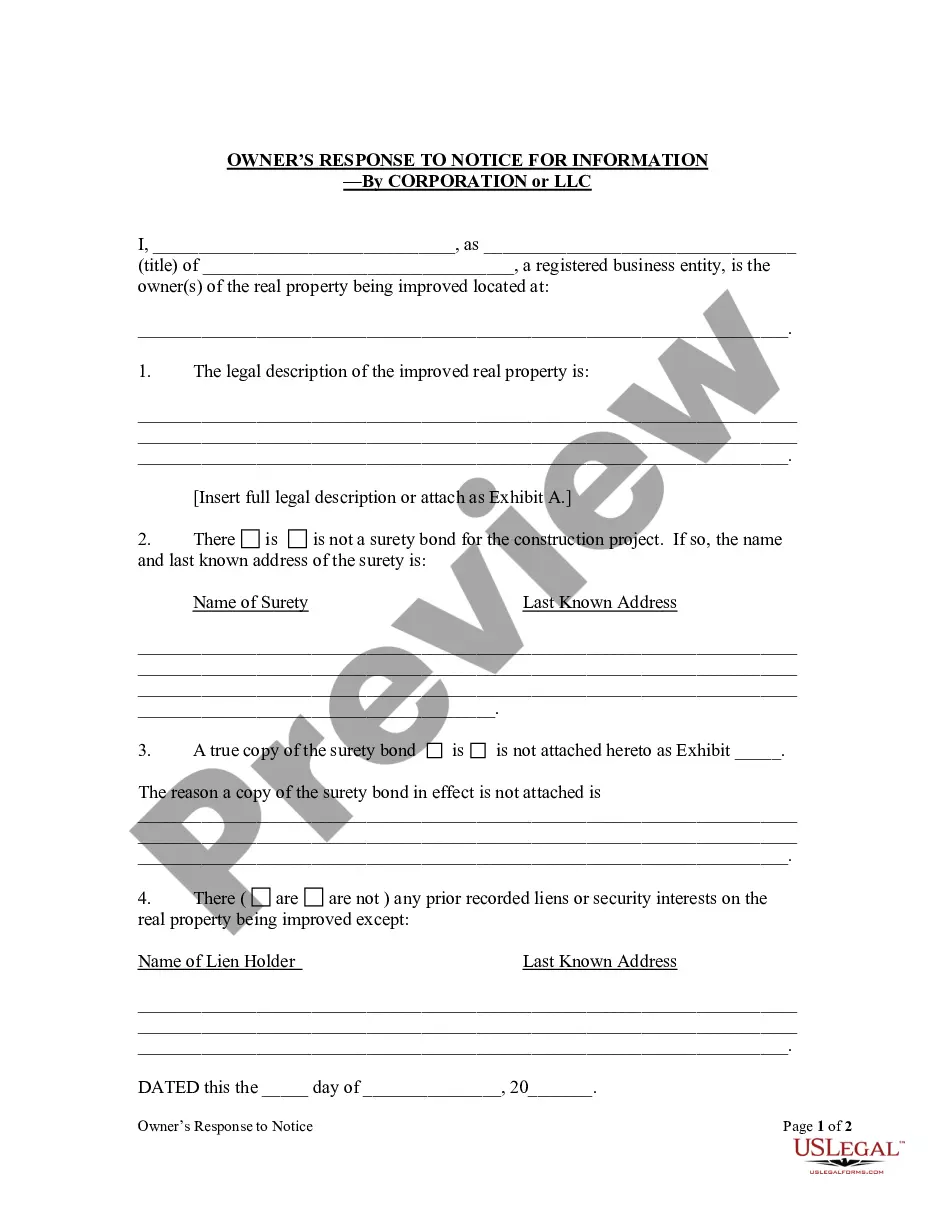

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

If you need to be thorough, acquire, or print approved document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's simple and user-friendly search to locate the documents you require. Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Leverage US Legal Forms to obtain the North Dakota Net Lease of Equipment (personal Property Net Lease) without Warranties from the Lessor and Option to Purchase with just a few clicks.

Every legal document template you acquire is yours permanently. You have access to all forms you downloaded within your account. Click the My documents section and choose a form to print or download again.

Stay competitive and download, and print the North Dakota Net Lease of Equipment (personal Property Net Lease) without Warranties from the Lessor and Option to Purchase using US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to find the North Dakota Net Lease of Equipment (personal Property Net Lease) without Warranties from the Lessor and Option to Purchase.

- You can also access forms you previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to examine the form’s content. Don’t forget to review the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other examples of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Select the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the North Dakota Net Lease of Equipment (personal Property Net Lease) without Warranties from the Lessor and Option to Purchase.

Form popularity

FAQ

In North Dakota, there are no statewide rent control laws, meaning landlords can raise rent as much as desired, provided they give proper notice as stipulated in the lease agreement. This flexibility allows landlords to adjust to market conditions while also requiring transparent communication with tenants. When navigating rental increases related to North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding your lease terms is essential. You may find useful templates and guidance on uslegalforms.

In North Dakota, a landlord generally cannot enter a rental property without providing notice, except in emergencies. This rule protects tenant privacy and ensures proper communication between parties. When dealing with the North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding entry rights helps maintain a respectful landlord-tenant relationship. Consult uslegalforms for assistance in clarifying your rights regarding entry.

A contract of lease is a legal document outlining the terms and conditions under which a property is rented. It details the responsibilities of both the landlord and tenant, ensuring clarity in the rental relationship. For those engaging in a North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, having a well-defined lease agreement is essential for a smooth transaction. Uslegalforms can help you create or review your lease to ensure compliance with state laws.

A holdover tenant in North Dakota refers to a tenant who remains in the rental property after the lease has expired without the landlord's consent. This situation can create complications for both parties, particularly regarding the enforcement of lease terms. If you're facing issues related to holdover tenants in the context of North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding your rights and obligations is crucial. Resources like uslegalforms can offer detailed guidance.

The Sunshine Law in North Dakota promotes transparency in government meetings, ensuring public access to information and decision-making processes. While it primarily focuses on governmental organizations, its emphasis on openness is a cornerstone of good governance. Understanding this principle can be beneficial when discussing the North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, as it encourages clear and transparent leasing agreements. Uslegalforms can guide you on relevant compliance aspects.

North Dakota has a balanced approach to tenant rights, focusing on both landlord and tenant responsibilities. While some may find the state less tenant-friendly compared to others, the regulations provide necessary protections. When dealing with North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding these laws helps both parties to navigate their rights effectively. Uslegalforms can provide insights into these dynamics.

A month to month lease agreement in North Dakota allows either party to terminate the lease with notice, facilitating flexibility for tenants and landlords alike. This arrangement is popular for those who may not want to commit to a long-term lease. It aligns well with the North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, providing a practical option for short-term equipment rental. Uslegalforms can assist you in drafting a compliant agreement.

In North Dakota, tenant laws are generally designed to protect both tenants and landlords. The laws specify rights and obligations for each party, ensuring fair treatment in rental agreements. North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase adheres to these regulations, offering clear terms that benefit all involved. You can find more detailed resources through platforms like uslegalforms to navigate these laws.

Exiting a lease in North Dakota typically requires following specific legal protocols outlined in your lease agreement. Keep in mind that breaking a lease can lead to penalties unless both parties mutually agree to the termination. For those involved in a North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding your rights and obligations can simplify this process.

net lease means the tenant is responsible for paying their base rent along with two major expenses: property taxes and insurance. This type of lease offers the landlord a reliable income stream while shifting significant costs to the tenant. If you are exploring a North Dakota Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, knowing the specifics of netnet leases helps ensure clarity in contractual obligations.