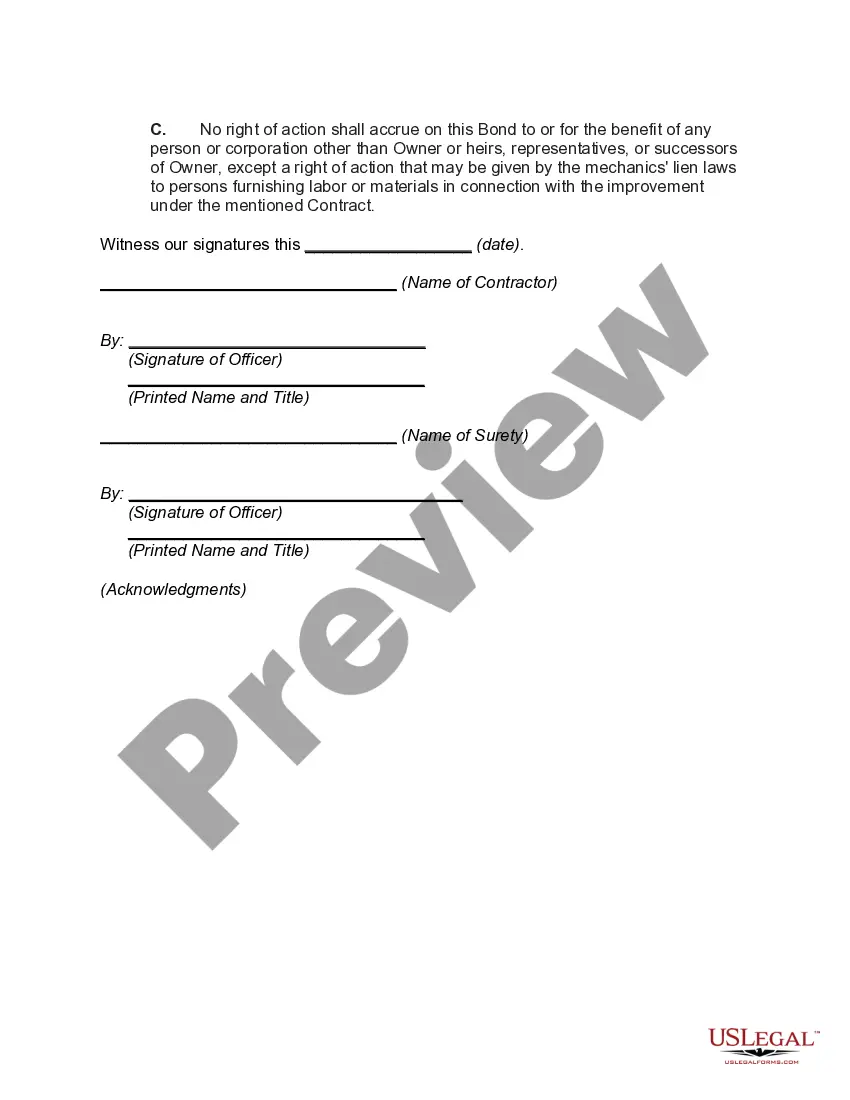

North Dakota Contractor's Performance Bond with Limitation of Right of Action

Description

How to fill out Contractor's Performance Bond With Limitation Of Right Of Action?

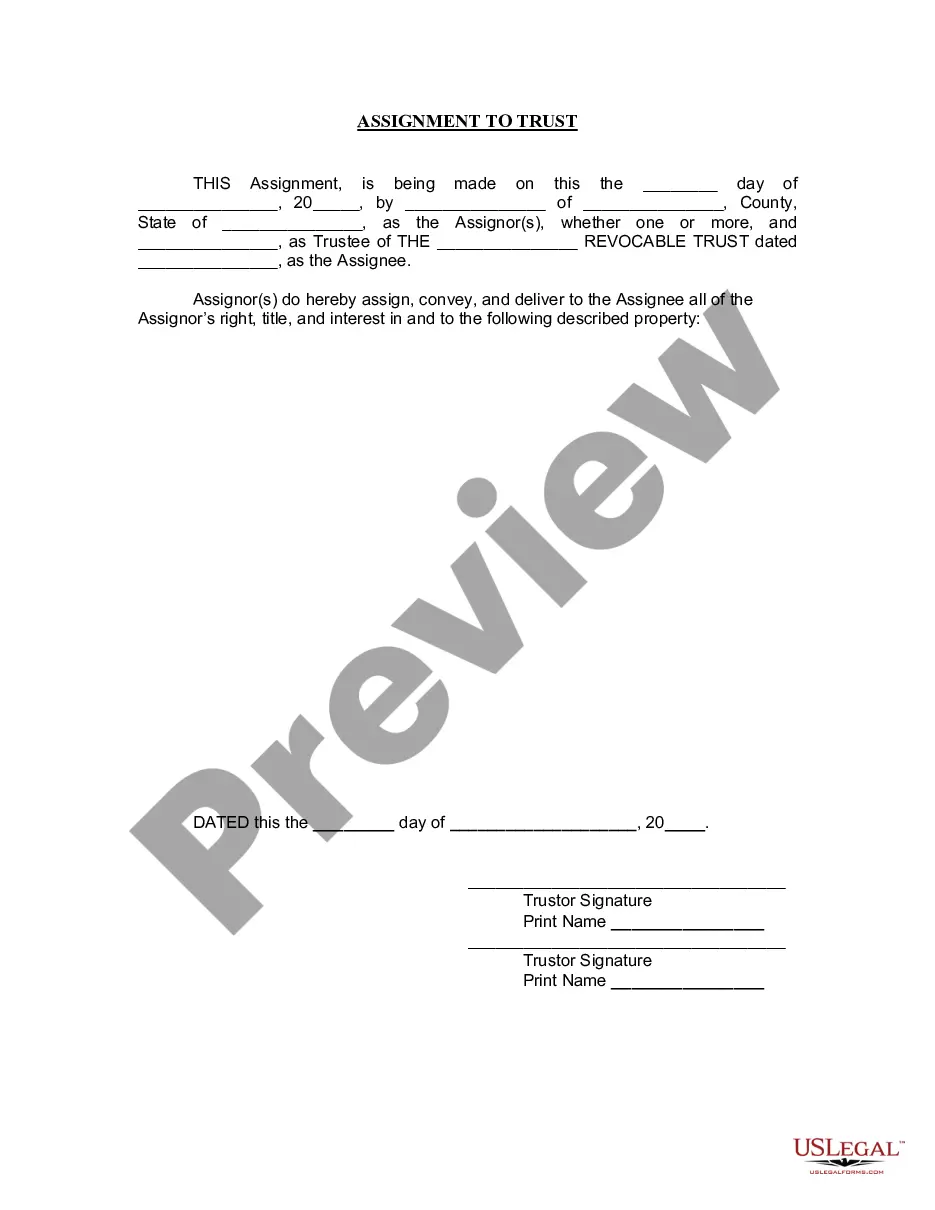

Choosing the right legal papers format might be a have a problem. Naturally, there are plenty of themes accessible on the Internet, but how do you find the legal kind you need? Take advantage of the US Legal Forms internet site. The assistance offers a huge number of themes, such as the North Dakota Contractor's Performance Bond with Limitation of Right of Action, which you can use for enterprise and private requires. Each of the kinds are examined by experts and meet up with federal and state requirements.

Should you be already registered, log in to your bank account and click the Acquire key to have the North Dakota Contractor's Performance Bond with Limitation of Right of Action. Utilize your bank account to check through the legal kinds you possess acquired earlier. Go to the My Forms tab of your respective bank account and obtain one more duplicate of the papers you need.

Should you be a fresh customer of US Legal Forms, allow me to share basic guidelines that you can comply with:

- First, be sure you have chosen the right kind for your personal metropolis/county. You can check out the shape making use of the Preview key and study the shape information to make certain this is basically the right one for you.

- If the kind is not going to meet up with your requirements, make use of the Seach discipline to get the correct kind.

- When you are certain the shape would work, click on the Purchase now key to have the kind.

- Choose the rates plan you desire and type in the needed information. Design your bank account and pay money for the order using your PayPal bank account or Visa or Mastercard.

- Select the submit file format and obtain the legal papers format to your system.

- Full, edit and printing and signal the obtained North Dakota Contractor's Performance Bond with Limitation of Right of Action.

US Legal Forms may be the most significant library of legal kinds where you will find a variety of papers themes. Take advantage of the service to obtain expertly-made papers that comply with status requirements.

Form popularity

FAQ

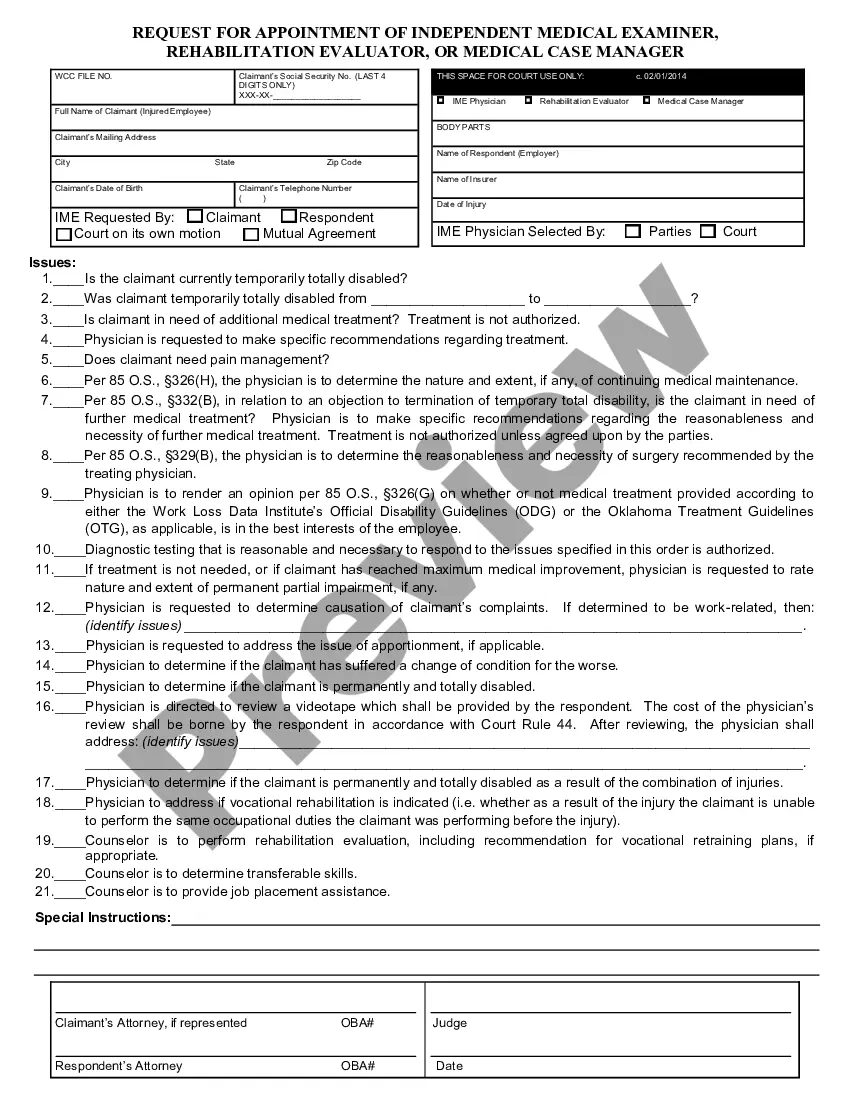

Performance bonds are a subset of contract bonds and guarantee that a contractor will fulfill the terms of the contract. If they fail to do so, the Surety company is responsible for completing the contract obligations, either by securing a new contractor to complete the job or by financial compensation.

A performance bond issued by a financial institution guarantees the fulfillment of a contract. If the U.S. exporter fails to "perform" as agreed, the buyer is compensated. A bid bond - often required in a bid selection process - guarantees the foreign buyer that the U.S. exporter will execute the contract if selected.

If the surety does not voluntarily pay the claim, a lawsuit must be filed against the payment bond surety as follows: (a) if the public entity files a notice of completion or cessation notice, thirty (30) days six plus (6) months after the notice is filed or (b) if neither a notice of completion or cessation is filed, ...

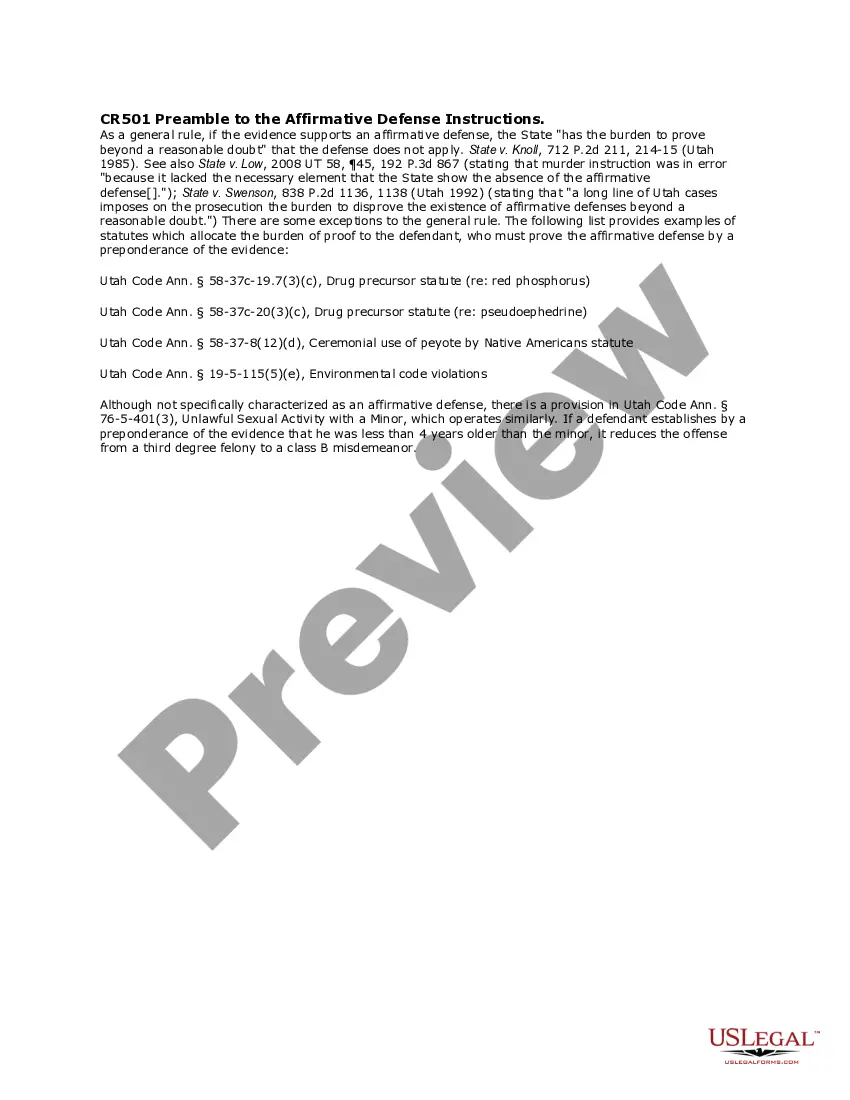

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

Performance bonds, which are secured by a contractor before the beginning of a project, provide a guarantee to the project owner that contract obligations will be fulfilled. If the contractor fails to complete work ing to the contract terms, the property owner may be financially compensated.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities. Another difference is the party responsible for paying the bond premium.

Distinction in Practice If accessoriness is evident, it is a surety bond. In the absence of accessoriness, a guarantee has been agreed. In contrast to a surety, the guarantor may not raise any objections or defenses based on another debt obligation.

Surety bonds also come with the following cons for contractors: A bonded contractor must pay for the bond and will also be responsible for paying valid bond claims. A lapse in a bond can result in a license suspension or the invalidation of a contract. Required renewals can add ongoing expenses.