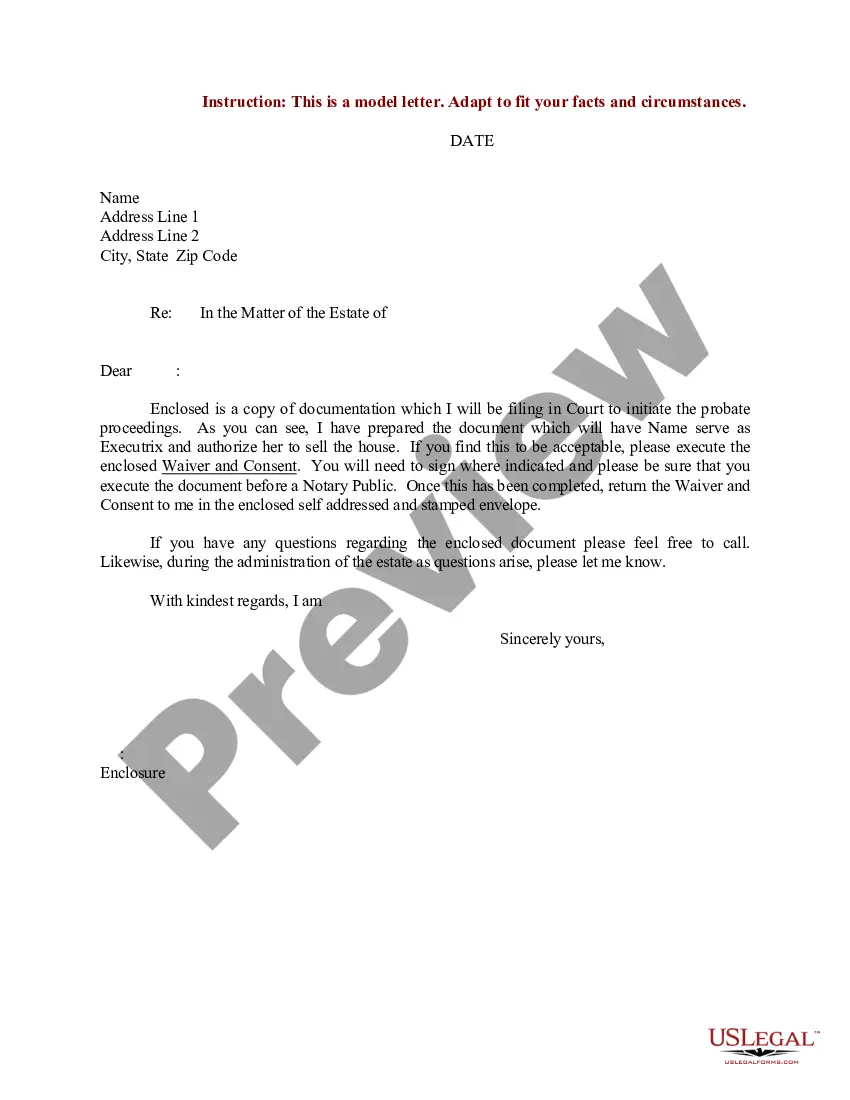

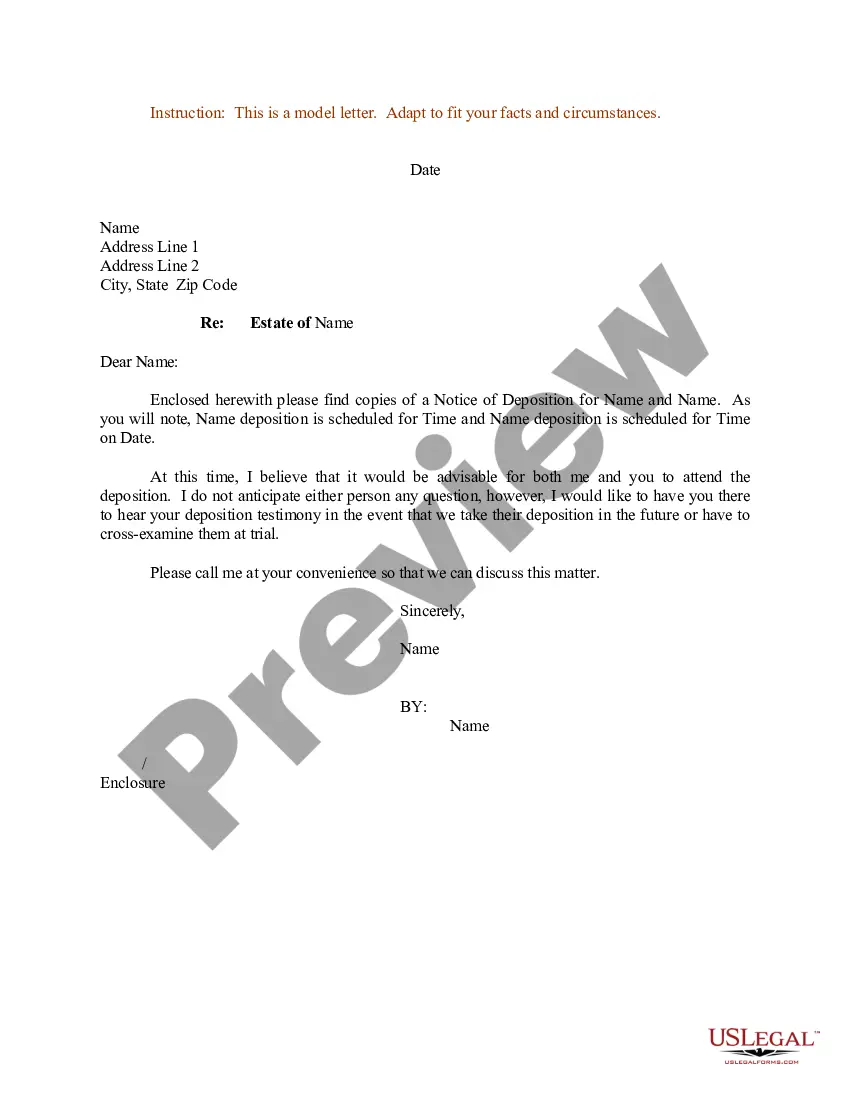

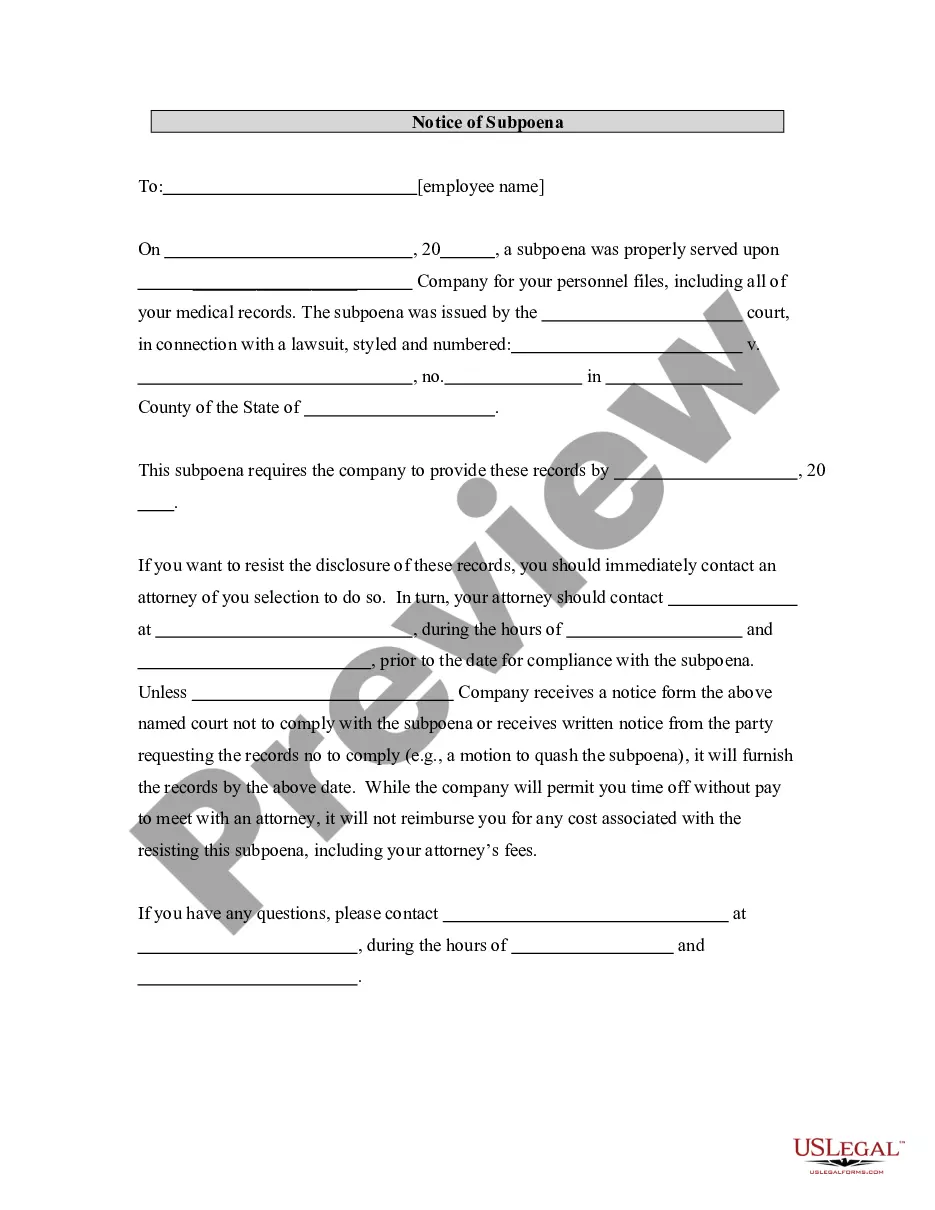

North Dakota Sample Letter for Estate - Correspondence from Attorney

Description

How to fill out Sample Letter For Estate - Correspondence From Attorney?

Choosing the best legal papers template might be a battle. Naturally, there are a lot of themes available on the Internet, but how can you get the legal type you need? Take advantage of the US Legal Forms internet site. The assistance delivers a huge number of themes, including the North Dakota Sample Letter for Estate - Correspondence from Attorney, which can be used for business and private requirements. All the varieties are checked by pros and satisfy state and federal requirements.

When you are currently authorized, log in for your accounts and click the Obtain option to have the North Dakota Sample Letter for Estate - Correspondence from Attorney. Use your accounts to check through the legal varieties you may have acquired in the past. Visit the My Forms tab of the accounts and obtain another version of the papers you need.

When you are a fresh end user of US Legal Forms, here are basic recommendations so that you can adhere to:

- Initial, make sure you have chosen the proper type for your city/area. You may look over the form utilizing the Preview option and browse the form information to make certain this is the right one for you.

- When the type will not satisfy your needs, utilize the Seach field to discover the proper type.

- Once you are certain that the form is proper, click the Buy now option to have the type.

- Choose the costs prepare you desire and enter the needed details. Build your accounts and purchase the transaction using your PayPal accounts or bank card.

- Opt for the data file format and download the legal papers template for your device.

- Complete, edit and print out and sign the obtained North Dakota Sample Letter for Estate - Correspondence from Attorney.

US Legal Forms is definitely the largest catalogue of legal varieties where you can see a variety of papers themes. Take advantage of the service to download professionally-produced files that adhere to status requirements.

Form popularity

FAQ

The surviving spouse who is a devisee of the decedent has the highest priority for consideration as the personal representative in informal probate proceedings.

A personal representative is under a duty to settle and distribute the estate of the decedent in ance with the terms of any probated and effective will and this title, and as expeditiously and efficiently as is consistent with the best interests of the estate.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

Probate is almost always required in North Dakota. If you have a larger estate, you must go through probate, especially if real estate is involved. Other deciding factors for requiring probate include: A poorly written will.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

If you have a larger estate, you must go through probate, especially if real estate is involved. Other deciding factors for requiring probate include: A poorly written will. Debates over the proper heir.

Probate Avoidance Joint Tenancy with Right of Survivorship. Adding another person to your assets as a joint owner or "joint tenant with rights of survivorship" will allow your property to pass to them upon your death without going through probate. ... Beneficiary Designations. ... Revocable Living Trust.

Trusts: If the deceased had a trust, you will not need to go through probate. Trusts are created to allow the deceased's family and friends to inherit without having to go through the long and expensive probate process.